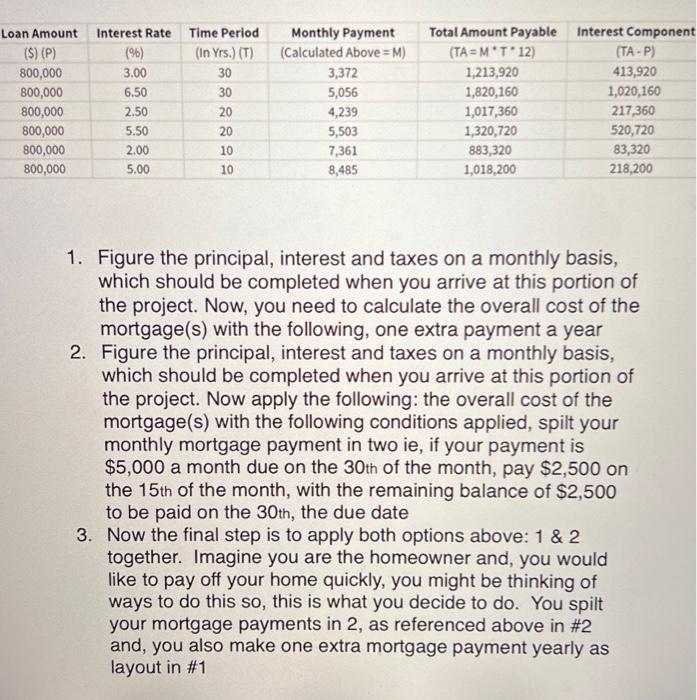

1. Figure the principal, interest and taxes on a monthly basis, which should be completed when you arrive at this portion of the project. Now, you need to calculate the overall cost of the mortgage(s) with the following, one extra payment a year 2. Figure the principal, interest and taxes on a monthly basis, which should be completed when you arrive at this portion of the project. Now apply the following: the overall cost of the mortgage(s) with the following conditions applied, spilt your monthly mortgage payment in two ie, if your payment is $5,000 a month due on the 30 th of the month, pay $2,500 on the 15 th of the month, with the remaining balance of $2,500 to be paid on the 30 th, the due date 3. Now the final step is to apply both options above: 1&2 together. Imagine you are the homeowner and, you would like to pay off your home quickly, you might be thinking of ways to do this so, this is what you decide to do. You spilt your mortgage payments in 2, as referenced above in \#2 and, you also make one extra mortgage payment yearly as layout in \#1 1. Figure the principal, interest and taxes on a monthly basis, which should be completed when you arrive at this portion of the project. Now, you need to calculate the overall cost of the mortgage(s) with the following, one extra payment a year 2. Figure the principal, interest and taxes on a monthly basis, which should be completed when you arrive at this portion of the project. Now apply the following: the overall cost of the mortgage(s) with the following conditions applied, spilt your monthly mortgage payment in two ie, if your payment is $5,000 a month due on the 30 th of the month, pay $2,500 on the 15 th of the month, with the remaining balance of $2,500 to be paid on the 30 th, the due date 3. Now the final step is to apply both options above: 1&2 together. Imagine you are the homeowner and, you would like to pay off your home quickly, you might be thinking of ways to do this so, this is what you decide to do. You spilt your mortgage payments in 2, as referenced above in \#2 and, you also make one extra mortgage payment yearly as layout in \#1