Question

1. Find the Annuity Calculator at www.bankrate.com to answer the following questions. Suppose you have $800,000 when you retire and want to withdraw an equal

1.Find theAnnuity Calculatorat www.bankrate.com to answer the following questions. Suppose you have $800,000 when you retire and want to withdraw an equal amount each monthbeginning immediatelyfor the next 25 years.

How much can you withdraw each month if you earn 5%?

How much can you withdraw each month if you earn 7%?

2.Find theCompound Savings Calculatorat www.dinkytown.net to answer the following questions.Assume you will not make any additional contributions and interest is compounded annually.

If you currently have $20,000 and invest this money at 7%, how much will you have in 20 years?

How much will you have in 20 years if you earn 10%?(2 points)

3.Find the Loan Calculator at www.bankrate.com to answer the following questions. First find the APR quoted on the website for a 15-year fixed rate mortgage. Please use the rate listed underA better rate is waiting Todays mortgage rates. You want to buy a home for $180,000 with a $30,000 down payment on a 15-year mortgage with monthly payments at the APR quoted on the site.

What is the monthly payment (principal and interest only)?

What percentage of your first months payment is principal?

What percentage of your last months payment is principal?

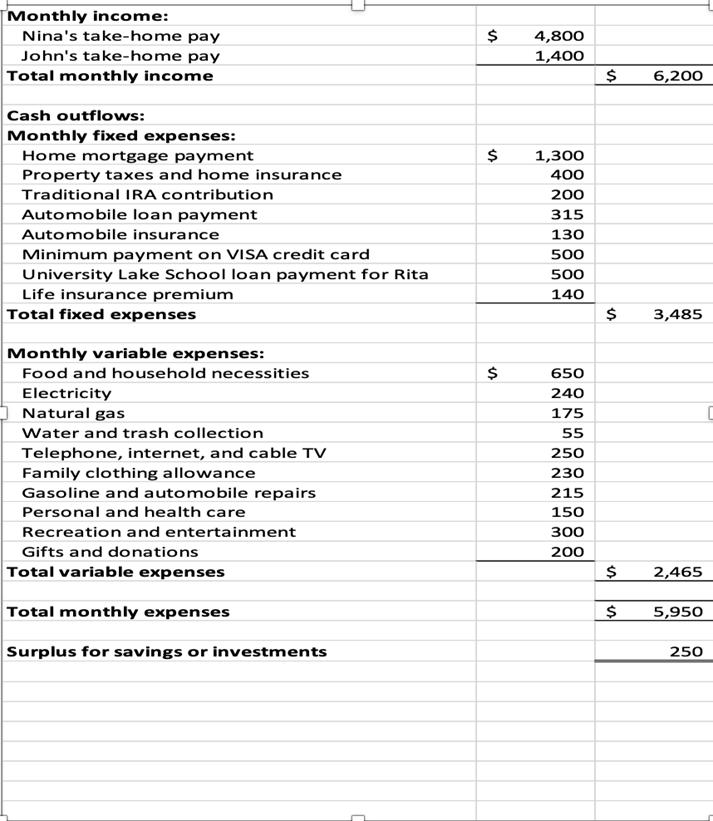

Monthly income: Nina's take-home pay $ 4,800 John's take-home pay 1,400 Total monthly income $ 6,200 Cash outflows: Monthly fixed expenses: Home mortgage payment $ 1,300 Property taxes and home insurance 400 Traditional IRA contribution 200 Automobile loan payment 315 Automobile insurance 130 Minimum payment on VISA credit card 500 University Lake School loan payment for Rita 500 Life insurance premium 140 Total fixed expenses $ 3,485 Monthly variable expenses: Food and household necessities Electricity Natural gas Water and trash collection Telephone, internet, and cable TV Family clothing allowance Gasoline and automobile repairs Personal and health care Recreation and entertainment Gifts and donations Total variable expenses Total monthly expenses $ 650 240 175 55 250 230 215 150 300 200 $ 2,465 $ 5,950 Surplus for savings or investments 250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started