Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Firm A is considering a project that will require $28,000 in initial working capital and $87,000 in fixed assets. The project is expected to

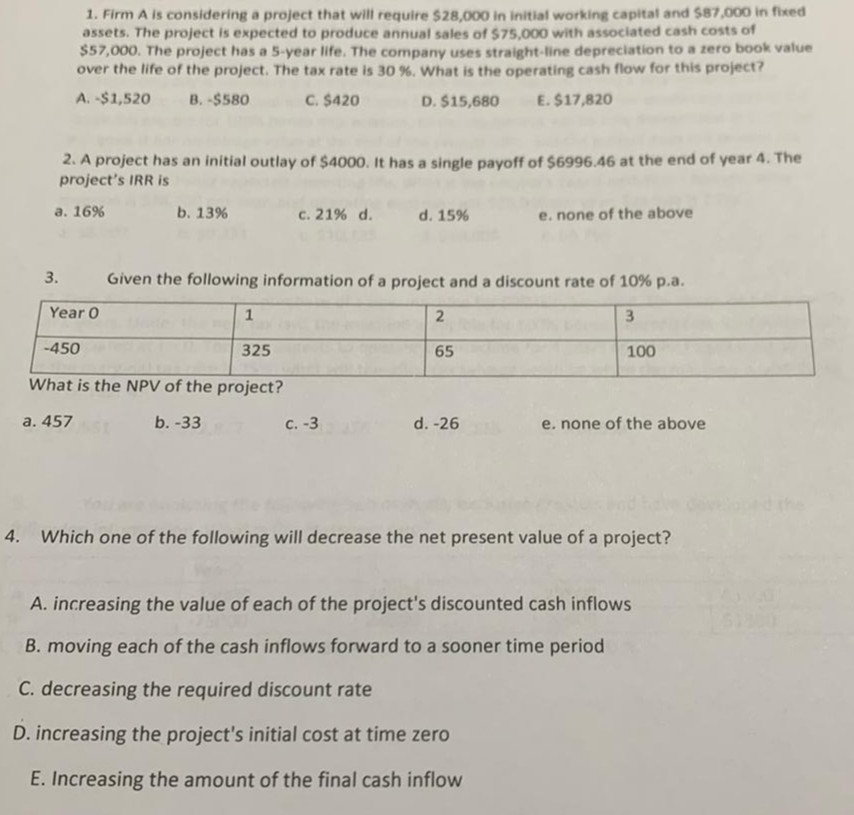

1. Firm A is considering a project that will require $28,000 in initial working capital and $87,000 in fixed assets. The project is expected to produce annual sales of $75,000 with associated cash costs of $57,000. The project has a 5-year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 30 %. What is the operating cash flow for this project? A.-$1,520 B.-$580 C. $420 E.$17,820 D.$15,680 2. A project has an initial outlay of $4000. It has a single payoff of $6996.46 at the end of year 4. The project's IRR is c. 21 % d. . 16% b. 13% d. 15% e. none of the above 3. Given the following information of a project and a discount rate of 10 % p.a. Year O 2 -450 325 65 100 What is the NPV of the project? a. 457 . -3 b. -33 d. -26 e. none of the above 4. Which one of the following will decrease the net present value of a project? A. increasing the value of each of the project's discounted cash inflows B. moving each of the cash inflows forward to a sooner time period C. decreasing the required discount rate D. increasing the project's initial cost at time zero E. Increasing the amount of the final cash inflow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started