Question

1. First City Bank pays 6 percent simple interest on its savings account balances, whereas Second City Bank pays 6 percent interest compounded annually. If

| 1. First City Bank pays 6 percent simple interest on its savings account balances, whereas Second City Bank pays 6 percent interest compounded annually. |

| If you made a $72,000 deposit in each bank, how much more money would you earn from your Second City Bank account at the end of 10 years?

2.

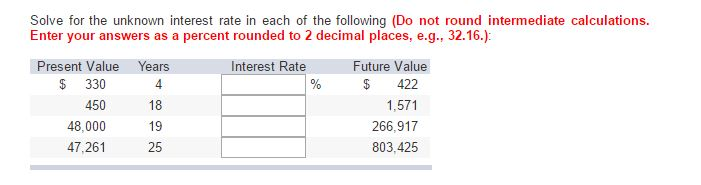

3.

|

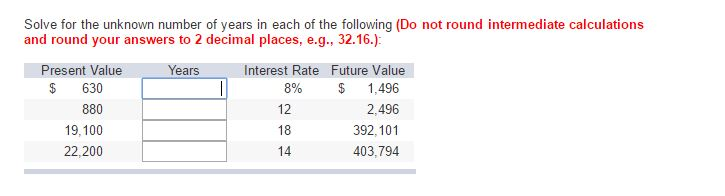

4.

| Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2003, an auction house sold a sculpture at auction for a price of $10,211,500. Unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. |

| What was his annual rate of return on this sculpture? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started