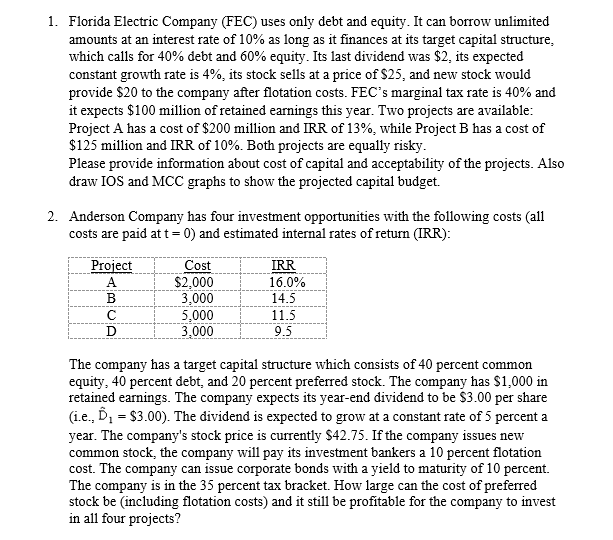

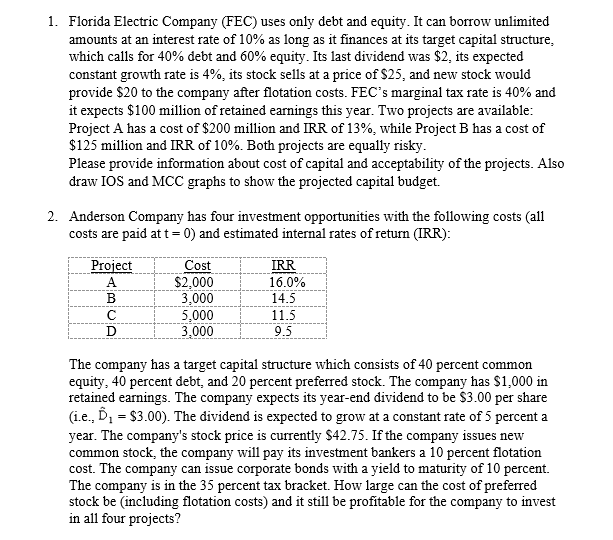

1. Florida Electric Company (FEC) uses only debt and equity. It can borrow unlimited amounts at an interest rate of 10% as long as it finances at its target capital structure, which calls for 40% debt and 60% equity. Its last dividend was $2, its expected constant growth rate is 4%, its stock sells at a price of $25, and new stock would provide $20 to the company after flotation costs. FEC's marginal tax rate is 40% and it expects $100 million of retained earnings this year. Two projects are available: Project A has a cost of $200 million and IRR of 13%, while Project B has a cost of $125 million and IRR of 10%. Both projects are equally risky. Please provide information about cost of capital and acceptability of the projects. Also draw IOS and MCC graphs to show the projected capital budget. 2. Anderson Company has four investment opportunities with the following costs (all costs are paid at t=0) and estimated internal rates of return (IRR): Project A B C D Cost $2,000 3,000 5,000 3,000 IRR 16.0% 14.5 11.5 9.5 The company has a target capital structure which consists of 40 percent common equity, 40 percent debt, and 20 percent preferred stock. The company has $1,000 in retained earnings. The company expects its year-end dividend to be $3.00 per share (i.e., D, = $3.00). The dividend is expected to grow at a constant rate of 5 percent a year. The company's stock price is currently $42.75. If the company issues new common stock, the company will pay its investment bankers a 10 percent flotation cost. The company can issue corporate bonds with a yield to maturity of 10 percent. The company is in the 35 percent tax bracket. How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects? 1. Florida Electric Company (FEC) uses only debt and equity. It can borrow unlimited amounts at an interest rate of 10% as long as it finances at its target capital structure, which calls for 40% debt and 60% equity. Its last dividend was $2, its expected constant growth rate is 4%, its stock sells at a price of $25, and new stock would provide $20 to the company after flotation costs. FEC's marginal tax rate is 40% and it expects $100 million of retained earnings this year. Two projects are available: Project A has a cost of $200 million and IRR of 13%, while Project B has a cost of $125 million and IRR of 10%. Both projects are equally risky. Please provide information about cost of capital and acceptability of the projects. Also draw IOS and MCC graphs to show the projected capital budget. 2. Anderson Company has four investment opportunities with the following costs (all costs are paid at t=0) and estimated internal rates of return (IRR): Project A B C D Cost $2,000 3,000 5,000 3,000 IRR 16.0% 14.5 11.5 9.5 The company has a target capital structure which consists of 40 percent common equity, 40 percent debt, and 20 percent preferred stock. The company has $1,000 in retained earnings. The company expects its year-end dividend to be $3.00 per share (i.e., D, = $3.00). The dividend is expected to grow at a constant rate of 5 percent a year. The company's stock price is currently $42.75. If the company issues new common stock, the company will pay its investment bankers a 10 percent flotation cost. The company can issue corporate bonds with a yield to maturity of 10 percent. The company is in the 35 percent tax bracket. How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects