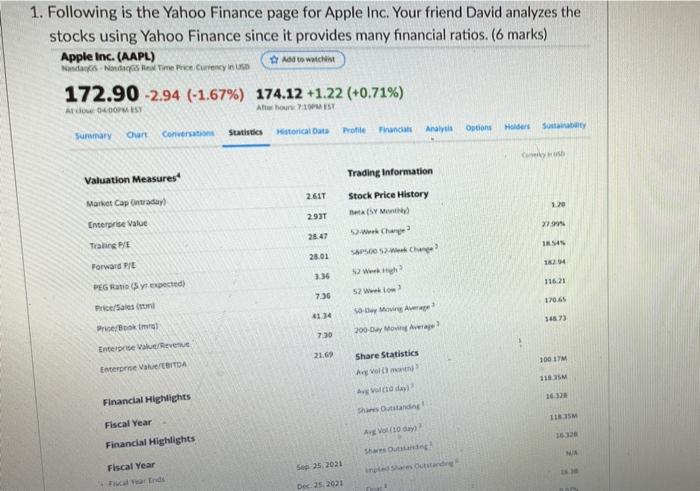

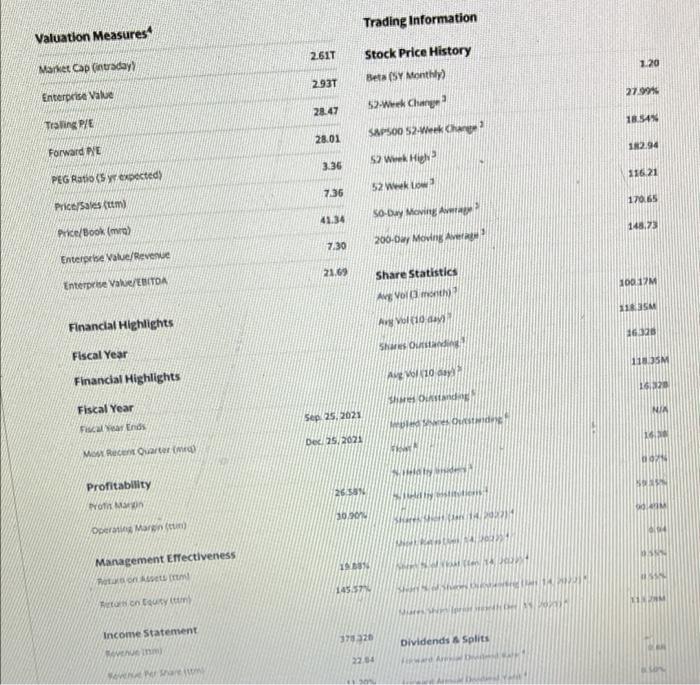

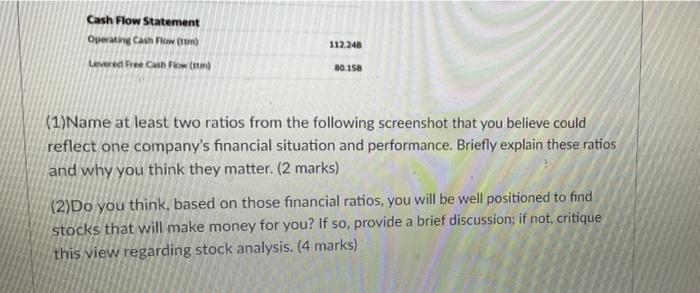

1. Following is the Yahoo Finance page for Apple Inc. Your friend David analyzes the stocks using Yahoo Finance since it provides many financial ratios. (6 marks) Apple Inc. (AAPL) Add to watch Nadie Currency in USD 172.90 -2.94 (-1.67%) 174.12 +1.22 (+0.71%) Ar 04 OPISY Athon IS Sub Convert Statistics Historical Data Profile Francia O Holders Analysis Summary on 2611 1.20 Valuation Measures Market Cap Ontrada Enterprise Value Traming PE 2.931 Trading Information Stock Price History Bet (SYM Change SAPSCO S. Change 27994 IR SAY 28.01 1024 Forward Pit 36 116 21 PERSy gected) 7:36 170.65 PriceSales um Say Movie A 6114 345.73 Prie/ 7.30 200-Day Map Literie Valuevenue 2169 100 M Enterree ValueTDA Share Statistics Angola 118 to di Sharestand! 1115 Financial Highlights Fiscal Year Financial Highlights Aro (10) 16 Share Out Fiscal Year Sep 25 2021 Outstanding Dec 25 2021 Trading Information Valuation Measures 2611 1.20 Market Cap (intraday) 2931 27.99% Enterprise Value 28.47 Stock Price History Beta (SY Monthly) S2-Week Change SAPSOO 52-Week Chu 5 Week High 1854 Traling P/E 28.01 12.94 Forward PYE 3.36 116.21 PEG Ratio (y expected 736 52 wwkow 170.65 Price Sales (tm) SO-Day Moving A 43.34 148.73 Price/Book (ro) 200-Day Moving 7.30 Enterprise Value/Revenue 21.69 Enterprise Value/EBITDA Share Statistics Avg Vollmonth 100.17M SM Financial Highlights Avyvola 16:32 Shares Fiscal Year 11035M Financial Highlights Aug 10 ) 1620 SO Fiscal Year NIK Sep 25, 2021 de Ostwie Far Ends Dec 15, 2021 MR Quarter Profitability Won 26 10.30 314 Open Marin (tu) 4 IND Management Effectiveness tot WSW ON 145.5 on tutti VI WER Income Statement 373 320 Dividends & Splits 22:54 WOWE Cash Flow Statement Operating Cash Flow (1) Levered Free Cash Flow (1) 112.248 80150 (1)Name at least two ratios from the following screenshot that you believe could reflect one company's financial situation and performance. Briefly explain these ratios and why you think they matter. (2 marks) (2)Do you think, based on those financial ratios, you will be well positioned to find stocks that will make money for you? If so, provide a brief discussion; if not, critique this view regarding stock analysis. (4 marks)