Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Fonterra is considering investing in a new processing plant. The plant will cost ( $ 5 mathrm{~m} ) to build and will depreciate fully

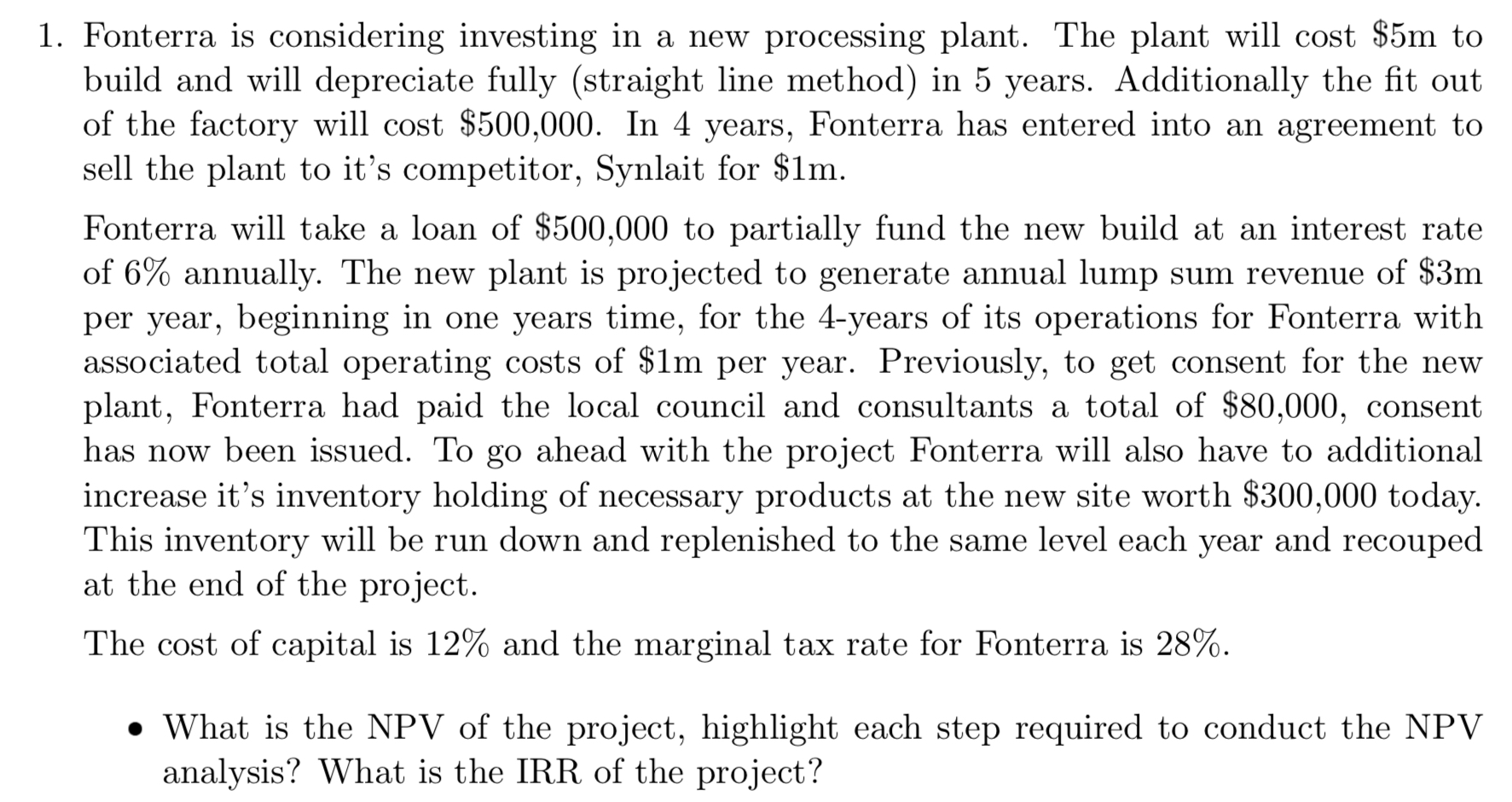

1. Fonterra is considering investing in a new processing plant. The plant will cost \\( \\$ 5 \\mathrm{~m} \\) to build and will depreciate fully (straight line method) in 5 years. Additionally the fit out of the factory will cost \\( \\$ 500,000 \\). In 4 years, Fonterra has entered into an agreement to sell the plant to it's competitor, Synlait for \\( \\$ 1 \\mathrm{~m} \\). Fonterra will take a loan of \\( \\$ 500,000 \\) to partially fund the new build at an interest rate of \6 annually. The new plant is projected to generate annual lump sum revenue of \\( \\$ 3 \\mathrm{~m} \\) per year, beginning in one years time, for the 4-years of its operations for Fonterra with associated total operating costs of \\( \\$ 1 \\mathrm{~m} \\) per year. Previously, to get consent for the new plant, Fonterra had paid the local council and consultants a total of \\( \\$ 80,000 \\), consent has now been issued. To go ahead with the project Fonterra will also have to additional increase it's inventory holding of necessary products at the new site worth \\( \\$ 300,000 \\) today. This inventory will be run down and replenished to the same level each year and recouped at the end of the project. The cost of capital is \12 and the marginal tax rate for Fonterra is \28. - What is the NPV of the project, highlight each step required to conduct the NPV analysis? What is the IRR of the project

1. Fonterra is considering investing in a new processing plant. The plant will cost \\( \\$ 5 \\mathrm{~m} \\) to build and will depreciate fully (straight line method) in 5 years. Additionally the fit out of the factory will cost \\( \\$ 500,000 \\). In 4 years, Fonterra has entered into an agreement to sell the plant to it's competitor, Synlait for \\( \\$ 1 \\mathrm{~m} \\). Fonterra will take a loan of \\( \\$ 500,000 \\) to partially fund the new build at an interest rate of \6 annually. The new plant is projected to generate annual lump sum revenue of \\( \\$ 3 \\mathrm{~m} \\) per year, beginning in one years time, for the 4-years of its operations for Fonterra with associated total operating costs of \\( \\$ 1 \\mathrm{~m} \\) per year. Previously, to get consent for the new plant, Fonterra had paid the local council and consultants a total of \\( \\$ 80,000 \\), consent has now been issued. To go ahead with the project Fonterra will also have to additional increase it's inventory holding of necessary products at the new site worth \\( \\$ 300,000 \\) today. This inventory will be run down and replenished to the same level each year and recouped at the end of the project. The cost of capital is \12 and the marginal tax rate for Fonterra is \28. - What is the NPV of the project, highlight each step required to conduct the NPV analysis? What is the IRR of the project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started