Answered step by step

Verified Expert Solution

Question

1 Approved Answer

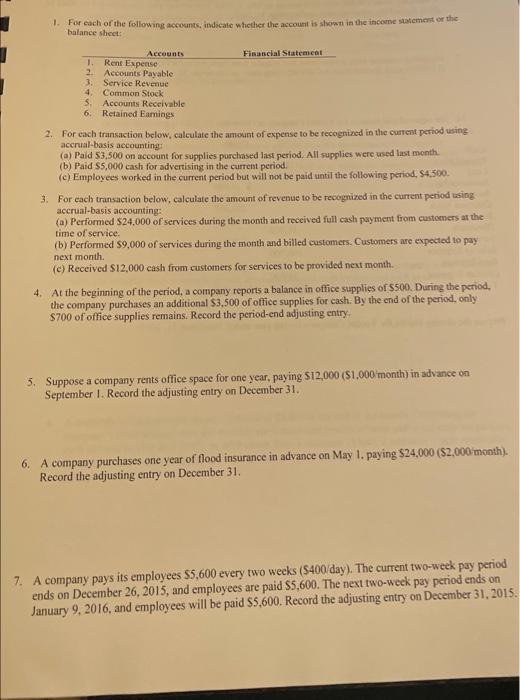

1. For each of the following accounts, indicate whether the account is shown in the income statement or the balance sheet: Accounts Rent Expense 1.

1. For each of the following accounts, indicate whether the account is shown in the income statement or the balance sheet: Accounts Rent Expense 1. 2. Accounts Payable 3. Service Revenue 4. Common Stock 5. 6. Retained Earnings Accounts Receivable Financial Statement 2. For each transaction below, calculate the amount of expense to be recognized in the current period using accrual-basis accounting: (a) Paid $3,500 on account for supplies purchased last period. All supplies were used last month. (b) Paid $5,000 cash for advertising in the current period. (c) Employees worked in the current period but will not be paid until the following period, $4,500. 3. For each transaction below, calculate the amount of revenue to be recognized in the current period using accrual-basis accounting: (a) Performed $24,000 of services during the month and received full cash payment from customers at the time of service. (b) Performed $9,000 of services during the month and billed customers. Customers are expected to pay next month. (c) Received $12,000 cash from customers for services to be provided next month. 4. At the beginning of the period, a company reports a balance in office supplies of $500. During the period, the company purchases an additional $3,500 of office supplies for cash. By the end of the period, only $700 of office supplies remains. Record the period-end adjusting entry. 5. Suppose a company rents office space for one year, paying $12,000 ($1,000/month) in advance on September 1. Record the adjusting entry on December 31. 6. A company purchases one year of flood insurance in advance on May 1, paying $24,000 ($2,000/month). Record the adjusting entry on December 31. 7. A company pays its employees $5,600 every two weeks ($400/day). The current two-week pay period ends on December 26, 2015, and employees are paid $5,600. The next two-week pay period ends on January 9, 2016, and employees will be paid $5,600. Record the adjusting entry on December 31, 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started