Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. For each taxation year, determine the following: (a) Net income (loss) for tax purposes; (b) Taxable income; (c) Federal and provincial tax payable.

- 1. For each taxation year, determine the following:

- (a) Net income (loss) for tax purposes;

- (b) Taxable income;

- (c) Federal and provincial tax payable.

2. Explain to David the tax implications for his transactions, what he can claim for tax purposes and what he ca not claim.

3. Explain to David if he should file corporate tax return for the 2020 taxation year.

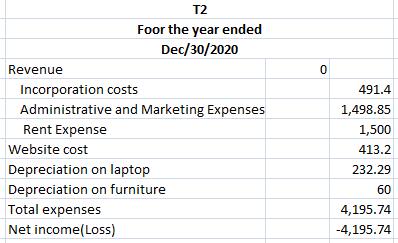

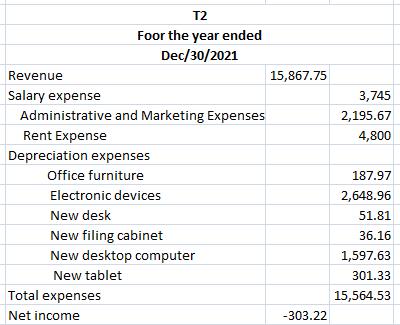

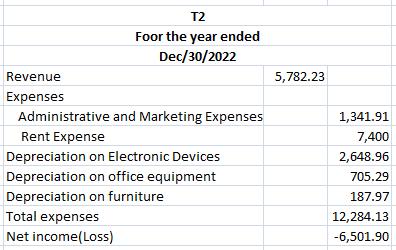

4. Prepare T2 for each taxation year.

Revenue Incorporation costs Administrative and Marketing Expenses Rent Expense Website cost T2 Foor the year ended Dec/30/2020 Depreciation on laptop Depreciation on furniture Total expenses Net income (Loss) 0 491.4 1,498.85 1,500 413.2 232.29 60 4,195.74 -4,195.74

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 a To determine the net income loss for tax purposes for each taxation year we need to consider the following information b To determine the taxable income for each taxation year we need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started