Question

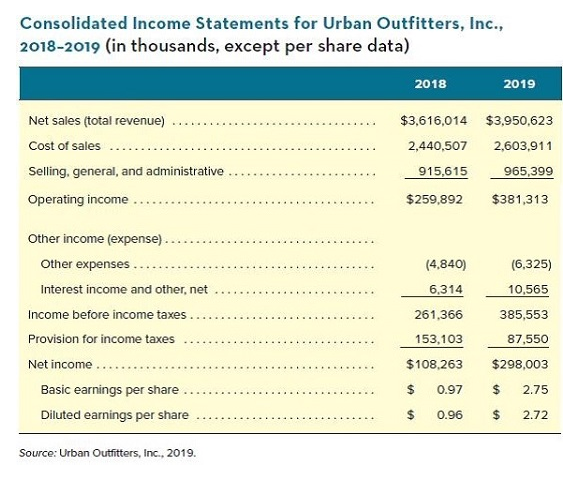

1. From 2018 to 2019, Urban Outfitters' gross profit margins showed a(n): a. favorable decrease. b. unfavorable increase. c. unfavorable decrease. d. favorable increase. e.

1. From 2018 to 2019, Urban Outfitters' gross profit margins showed a(n):

a. favorable decrease.

b. unfavorable increase.

c. unfavorable decrease.

d. favorable increase.

e. neither a favorable nor an unfavorable increase or decrease.

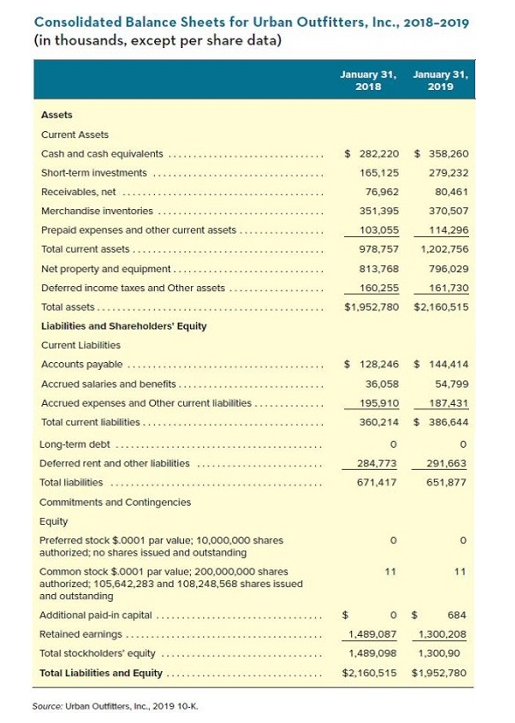

2. From 2018 to 2019, Urban Outfitters' return on shareholder equity showed a(n):

a. unfavorable decrease.

b. favorable decrease.

c. neither a favorable nor an unfavorable increase or decrease.

d. unfavorable increase.

e. favorable increase.

3. From 2018 to 2019, Urban Outfitters' return on assets showed a(n):

a. favorable increase.

b. unfavorable decrease.

c. unfavorable increase.

d. favorable decrease.

e. neither a favorable nor an unfavorable increase or decrease.

4. From 2018 to 2019, Urban Outfitters' debt-to-equity ratio showed a(n):

a. neither a favorable nor an unfavorable increase or decrease.

b. favorable decrease.

c. unfavorable decrease.

d. unfavorable increase.

e. favorable increase.

5. From 2018 to 2019, Urban Outfitters' inventory turnover ratios showed a(n):

a. favorable decrease.

b. unfavorable decrease.

c. favorable increase.

d. neither a favorable nor an unfavorable increase or decrease.

e. unfavorable increase.

6. From 2018 to 2019, Urban Outfitters' average collection period showed a(n):

a. unfavorable increase.

b. unfavorable decrease.

c. favorable decrease.

d. favorable increase.

e. neither a favorable nor an unfavorable increase or decrease.

Consolidated Income Statements for Urban Outfitters, Inc., 2018_3n10 (in thnusands oxcent ner charo datal Consolidated Balance Sheets for Urban Outfitters, Inc., 2018-2019 (in thousands, except per share data) Assets Current Assets Cash and cash equivalents Short-term imvestments Receivables, net Merchandise inventories Prepaid expenses and other current assets Total current assets. Net property and equipment . Deferred income taxes and Other assets Total assets Liabilities and Shareholders' Equity Current Llabilities Accrued salaries and benefits Accrued expenses and Other current liabilities Total current liablities. Long-term debt Deferred rent and other liabilities Total liabilities Commitments and Contingencies Equily Preferred stock $.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding Common stock $.0001 par value; 200,000,000 shares 11 authorized; 105,642,283 and 108,248,568 shares issued and outstanding Additional paid-in capital Retained earnings . Total stockholders' equity Total Liabilities and EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started