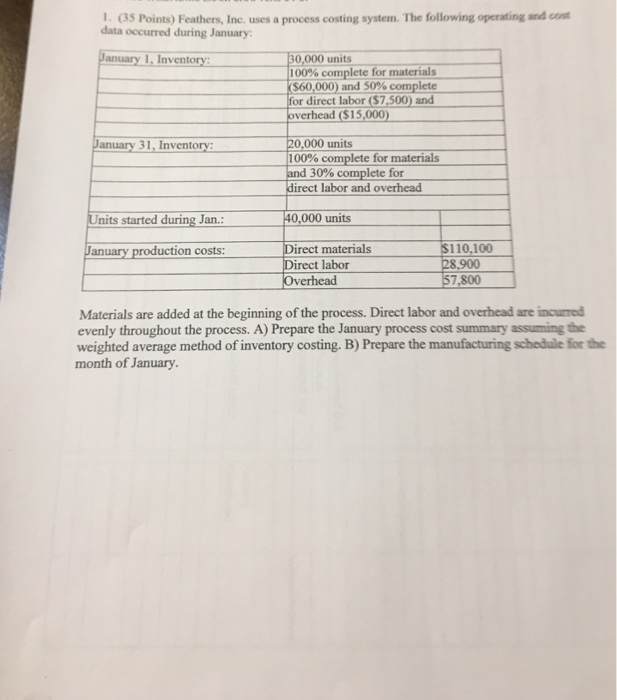

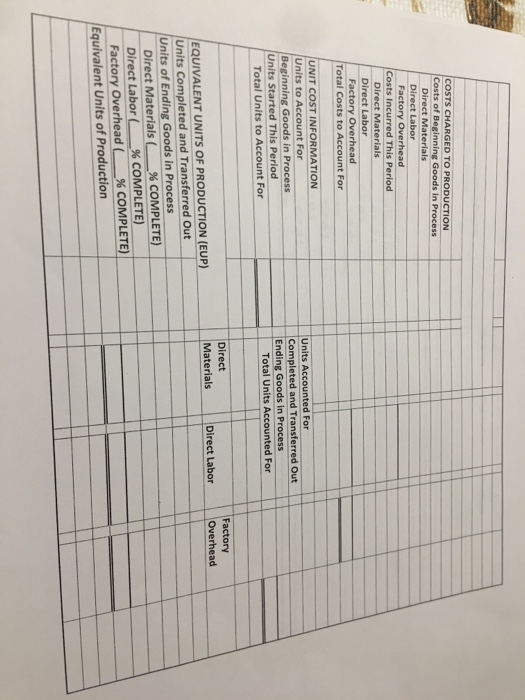

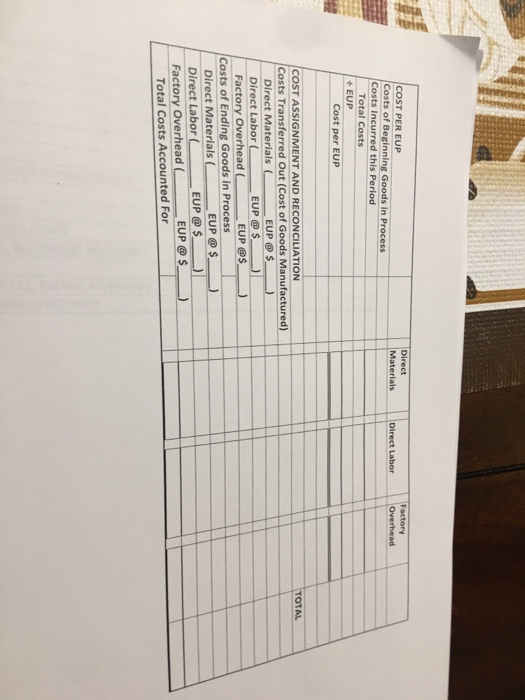

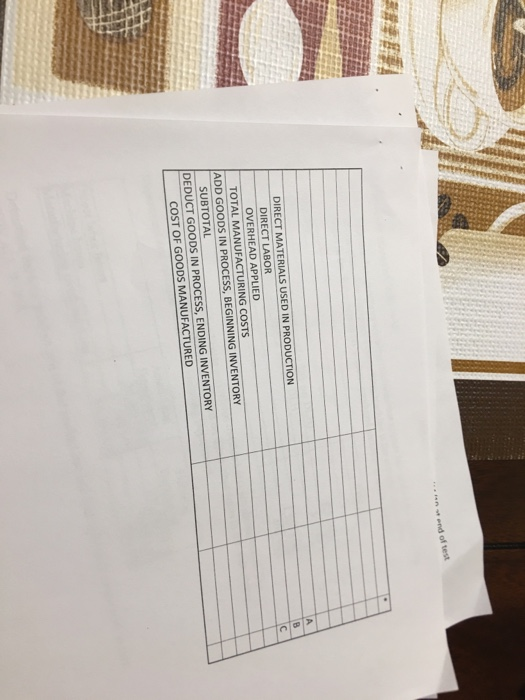

1. G5 Points) Feathers, Inc. uses a process costing system. The following operating and cont data occurred during January January 1, Inventory 30,000 units 100% complete for materials ($60,000) and 50% complete or direct labor ($7.500) and verhead ($15,000) 0,000 units 100% complete for materials nd 30% complete for irect labor and overhead anuary 31, Inventory Units started during Jan. 0,000 units irect materials irect labor verhead 110,100 8,900 800 January production costs: Materials are added at the beginning of the process. Direct labor and overhead are incurred evenly throughout the process. A) Prepare the January process cost summary assuming the weighted average method of inventory costing. B) Prepare the manufacturing schedule for the month of January. COSTS CHARGED TO PRODUCTION Costs of Beginning Goods in Process Direct Materlals Direct Labor Factory Overhead Costs Incurred This Period Direct Materials Direct Labor Factory Overhead Total Costs to Account For UNIT COST INFORMATION Units to Account For Beginning Goods in Process Units Accounted For Completed and Transferred Out Units Started This Period Ending Goods in Process Total Units to Account For Total Units Accounted For Direct Materials Factory Overhead Direct Labor EQUIVALENT UNITS OF PRODUCTION (EUP) Units Completed and Transferred Out Units of Ending Goods in Process Direct Materials L-%COMPLETE) Direct Labor ( 96 COMPLETE) Factory Overhead( % COMPLETE) Equivalent Units of Production COST PER EUP Costs of Beginning Goods in Process Costs Incurred this Period Materials Direct Labor Overhead Total Costs EUP Cost per EUP COST ASSIGNMENT AND RECONCILIATION OTAL Costs Transferred Out (Cost of Goods Manufactured) Direct Labor ( -EUP @ $ Costs of Ending Goods in Process @ $ Direct Materials( EUP @._) Factory Overhead L--. EUP @s_) Direct Materials ( )1 EUP @ $ EUP s ) Direct Labor FactoryOverhead ( EUP@$ Total Costs Accounted For end of test DIRECT MATERIALS USED IN PRODUCTION DIRECT LABOR OVERHEAD APPLIED TOTAL MANUFACTURING COSTS ADD GOODS IN PROCESS, BEGINNING INVENTORY SUBTOTAL DEDUCT GOODS IN PROCESS, ENDING INVENTORY