Answered step by step

Verified Expert Solution

Question

1 Approved Answer

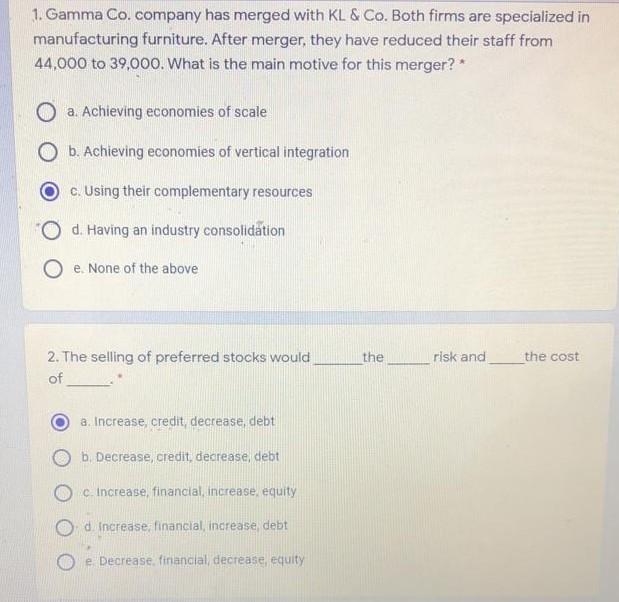

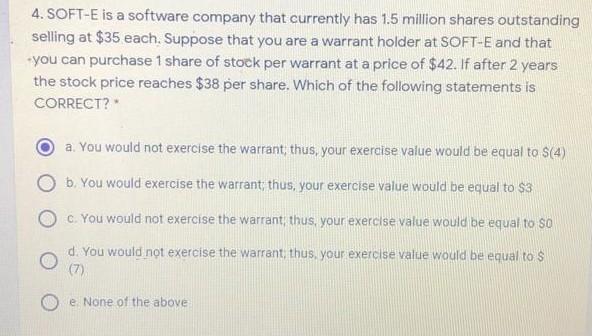

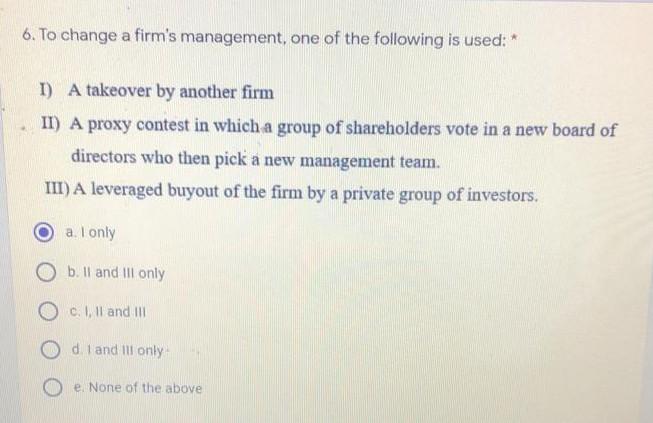

1. Gamma Co. company has merged with KL & Co. Both firms are specialized in manufacturing furniture. After merger, they have reduced their staff from

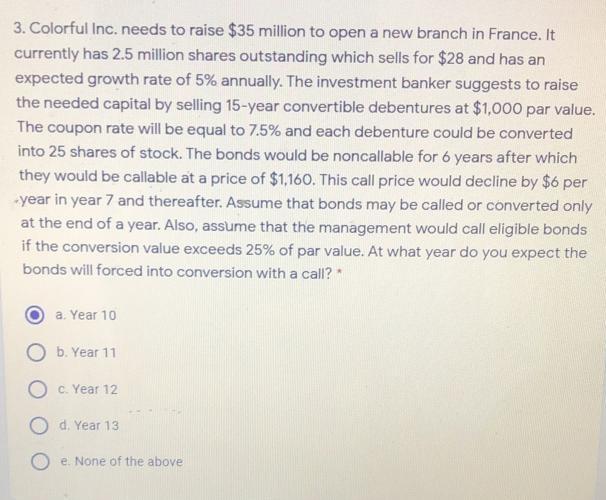

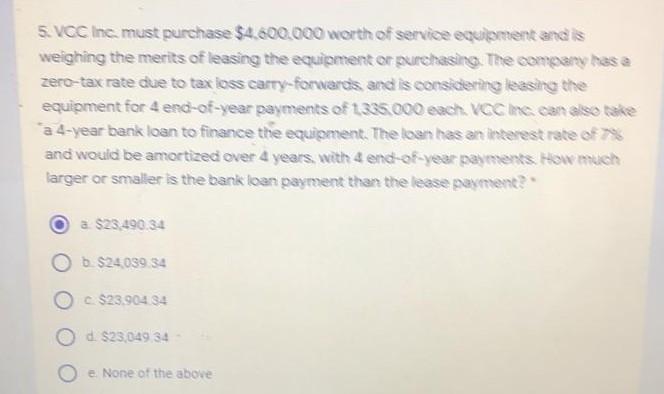

1. Gamma Co. company has merged with KL & Co. Both firms are specialized in manufacturing furniture. After merger, they have reduced their staff from 44,000 to 39,000. What is the main motive for this merger?* a. Achieving economies of scale O b. Achieving economies of vertical integration c. Using their complementary resources O d. Having an consolidation O e None of the above the risk and the cost 2. The selling of preferred stocks would of a. Increase, credit decrease, debt b Decrease, credit, decrease, debt c Increase, financial increase equity d. Increase financial increase, debt e Decrease financial decrease, equity 4. SOFT-E is a software company that currently has 1.5 million shares outstanding selling at $35 each. Suppose that you are a warrant holder at SOFT-E and that -you can purchase 1 share of stock per warrant at a price of $42. If after 2 years the stock price reaches $38 per share. Which of the following statements is CORRECT? a. You would not exercise the warrant, thus, your exercise value would be equal to $(4) b. You would exercise the warrant; thus, your exercise value would be equal to $3 O c. You would not exercise the warrant thus, your exercise value would be equal to 50 d. You would not exercise the warrant, thus your exercise value would be equal to $ (7) e None of the above 6. To change a firm's management, one of the following is used: I) A takeover by another firm II) A proxy contest in which a group of shareholders vote in a new board of directors who then pick a new management team. III) A leveraged buyout of the firm by a private group of investors. a. I only O b. ll and Ill only O c.. and I d. I and Ill only e. None of the above 3. Colorful Inc. needs to raise $35 million to open a new branch in France. It currently has 2.5 million shares outstanding which sells for $28 and has an expected growth rate of 5% annually. The investment banker suggests to raise the needed capital by selling 15-year convertible debentures at $1,000 par value. The coupon rate will be equal to 7.5% and each debenture could be converted into 25 shares of stock. The bonds would be noncallable for 6 years after which they would be callable at a price of $1,160. This call price would decline by $6 per -year in year 7 and thereafter. Assume that bonds may be called or converted only at the end of a year. Also, assume that the management would call eligible bonds if the conversion value exceeds 25% of par value. At what year do you expect the bonds will forced into conversion with a call? a Year 10 O b. Year 11 c. Year 12 O d. Year 13 e. None of the above 5. VCC Inc, must purchase $4.600,000 worth of service equipment and is weighing the merits of leasing the equipment or purchasing. The company has a zero-tax rate due to tax loss carry-forwares and is considering leasing the equipment for 4 end-of-year payments of 1335.000 each, VCC he can also take a 4-year bank loan to finance the equipment. The loan has an interest rate of and would be amortized over 4 years, with 4 end-of-year payments. How much larger or smaller is the bank loan payment than the lease payment? a $23.490.34 b $24.039 34 O c $23.904 34 Od $23,049 34 e None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started