Question

The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised) (4th Edition): Chapter 14, Case 13 The Adora and

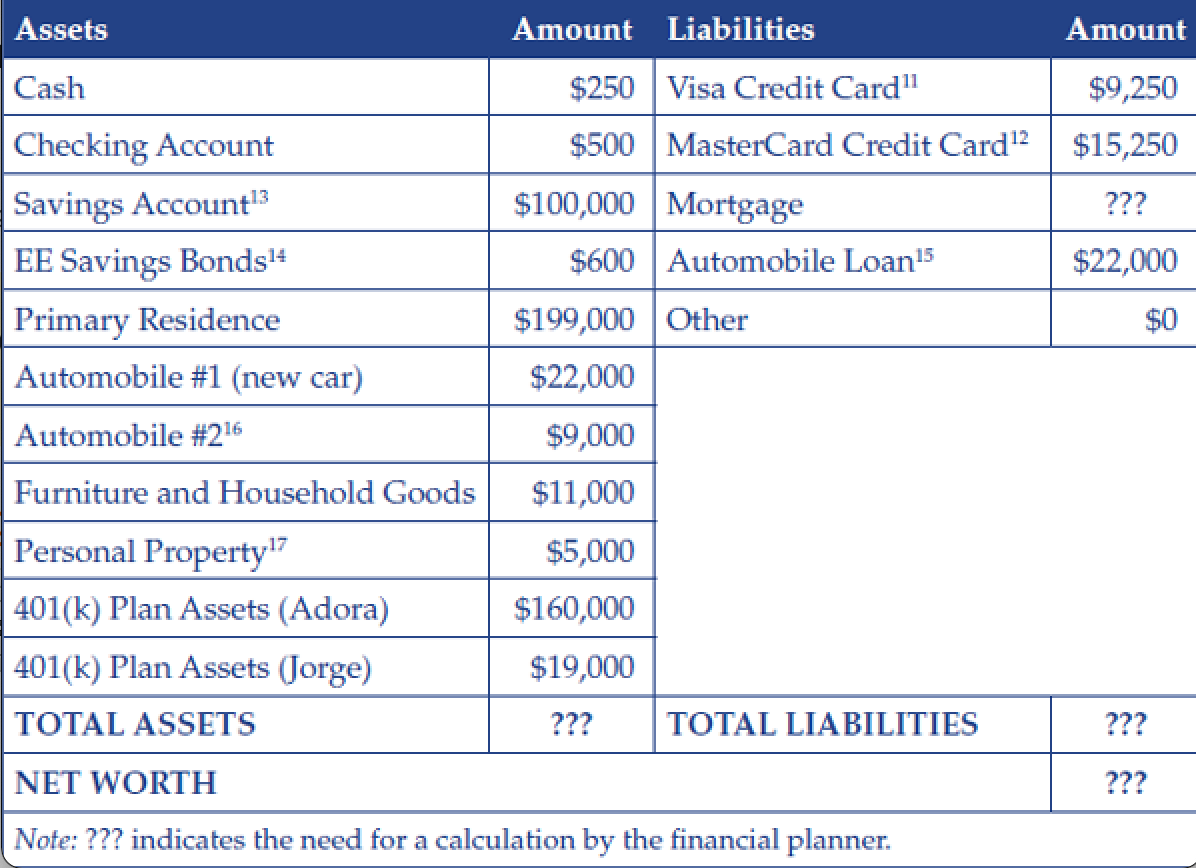

The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised) (4th Edition): Chapter 14, Case 13 The Adora and Jorge Tun Case Answers. Please help with calculating PITI and mortgage outstanding balance. Mortgage principle & Interest: 15,932 The house is insured for $141,000. The replacement value of the home equals the current market value Liability coverage is equal to $100,000. Deductible information: 1 percent deductible. Inflation has been averaging 3.40 percent annually; you feel this rate of inflation will continue into the future. Money market mutual funds and short-term certificates of deposit currently yield 2.25 percent. The thirty-year fixed rate mortgage interest rate is 7.00 percent. The twenty-year fixed rate mortgage interest rate is 6.25 percent. Closing costs for a refinanced mortgage are 2 percent of the amount borrowed. The current interest rate on home equity lines of credit is 7.25 percent. The typical draw period is ten years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started