Question

1. Generate a cost function for each decision alternative, where the dependent variable, Y, is lifetime cost and the independent variable, X, is lifetime miles

1. Generate a cost function for each decision alternative, where the dependent variable, Y, is lifetime cost

and the independent variable, X, is lifetime miles driven.

2. Calculate the breakeven price for gas (per gallon) between the gasoline-powered model and the hybrid

model.

3. Prepare a graph for lifetime cost (Y) for each of the two autos as a function of price per gallon of gas (X),

based on 60,000 lifetime miles for each auto. Use the following values of X (price per gallon of gas) to

generate each cost function: $2.75, $3.00, $3.25, $3.50, $3.75, $4.00, $4.25, $4.50, $4.75, and $5.00.

Properly label each graph, including the points of intersection. What can you conclude based on the

graph you prepared?

4. This decision problem is similar to the choice of cost structure (variable vs. fixed) discussed in the

chapter. Here, the issue is whether to pay an upfront premium (extra fixed cost) for the hybrid model in

exchange for lower variable costs over the life of the vehicle. In a typical CVP model, we are able, at

any output level (X), to calculate a measure of profit sensitivity, which we call the degree of operating

leverage (DOL). In the present context, which involves only costs for each vehicle over a 4-year period,

we cannot calculate DOL, but we might calculate an analogous measure: the ratio of percentage change

in lifetime cost to percentage change in miles. Refer to this as a pseudo-DOL. Calculate this pseudo

measure for each decision alternative, from a base of 60,000 lifetime miles. To calculate the percentage

change figures, use 62,000 miles. What information is conveyed in the two measures you calculated?

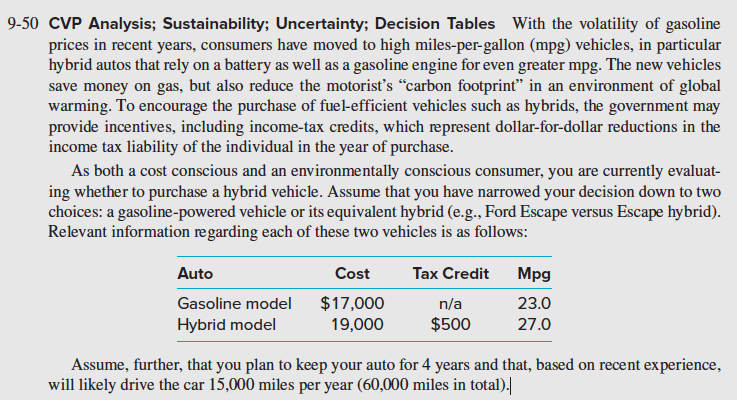

9-50 CVP Analysis; Sustainability; Uncertainty; Decision Tables With the volatility of gasoline prices in recent years, consumers have moved to high miles-per-gallon (mpg) vehicles, in particular hybrid autos that rely on a battery as well as a gasoline engine for even greater mpg. The new vehicles save money on gas, but also reduce the motorist's carbon footprint in an environment of global warming. To encourage the purchase of fuel-efficient vehicles such as hybrids, the government may provide incentives, including income-tax credits, which represent dollar-for-dollar reductions in the income tax liability of the individual in the year of purchase. As both a cost conscious and an environmentally conscious consumer, you are currently evaluat- ing whether to purchase a hybrid vehicle. Assume that you have narrowed your decision down to two choices: a gasoline-powered vehicle or its equivalent hybrid (e.g., Ford Escape versus Escape hybrid). Relevant information regarding each of these two vehicles is as follows: Auto Gasoline model Hybrid model Cost $17,000 19,000 Tax Credit n/a $500 Mpg 23.0 27.0 Assume, further, that you plan to keep your auto for 4 years and that, based on recent experience, will likely drive the car 15,000 miles per year (60,000 miles in total)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started