Answered step by step

Verified Expert Solution

Question

1 Approved Answer

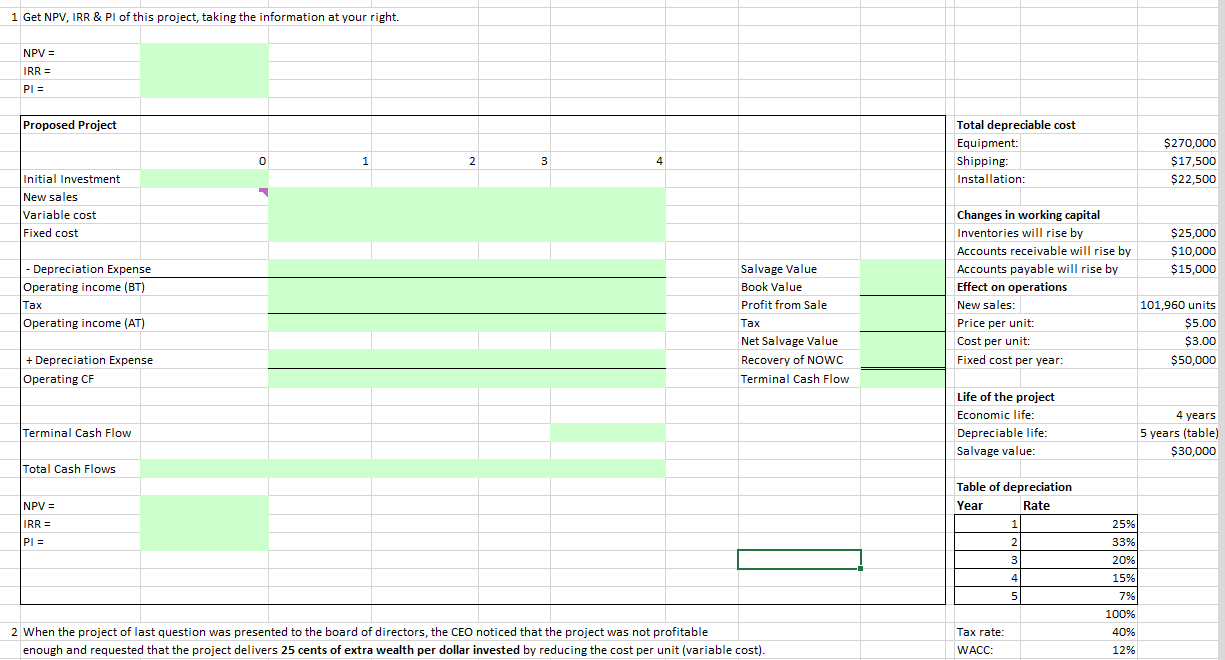

1 Get NPV, IRR & PI of this project, taking the information at your right. NPV=IRR=PI= 2 When the project of last question was presented

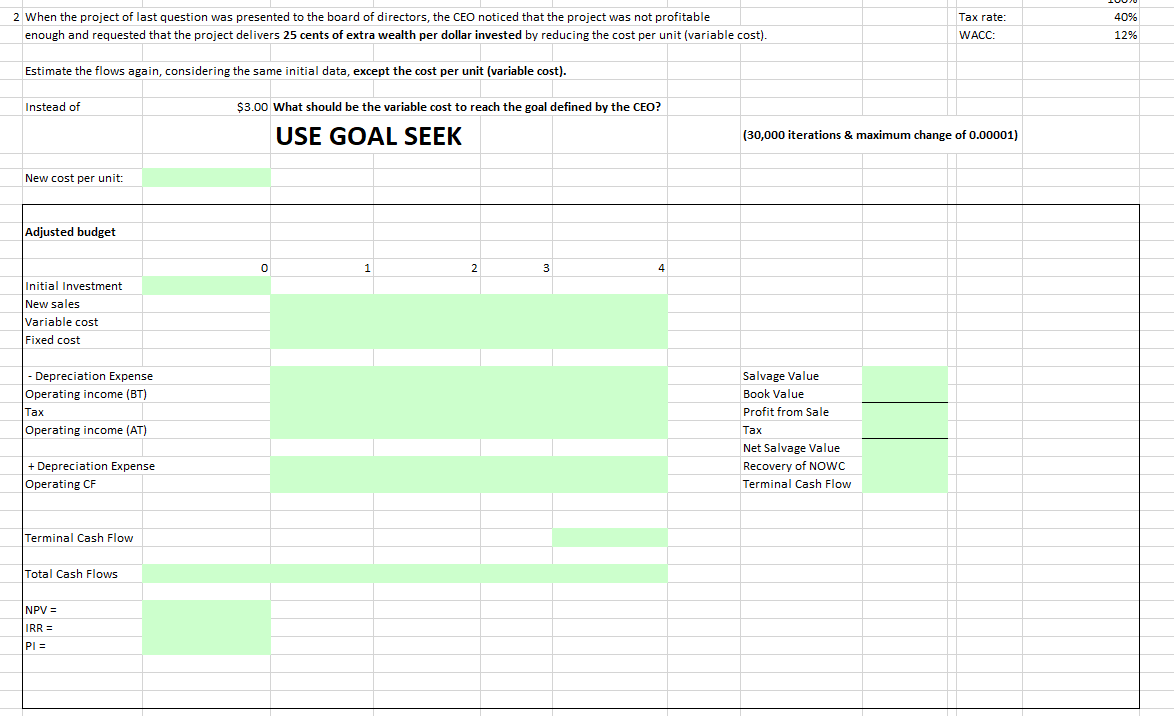

1 Get NPV, IRR \& PI of this project, taking the information at your right. NPV=IRR=PI= 2 When the project of last question was presented to the board of directors, the CEO noticed that the project was not profitable enough and requested that the project delivers 25 cents of extra wealth per dollar invested by reducing the cost per unit (variable cost). \begin{tabular}{|l|r|} \hline Tax rate: & 40% \\ \hline WACC: & 12% \\ \hline \end{tabular} Estimate the flows again, considering the same initial data, except the cost per unit (variable cost). Instead of $3.00 What should be the variable cost to reach the goal defined by the CEO? USE GOAL SEEK (30,000 iterations \& maximum change of 0.00001) New cost per unit: Adjusted budget Initial Investment 0 1 2 4 New sales Variable cost Fixed cost - Depreciation Expense Salvage Value Operating income (BT) Tax Operating income (AT) + Depreciation Expense Operating CF Terminal Cash Flow Total Cash Flows NPV = IRR= PI=

1 Get NPV, IRR \& PI of this project, taking the information at your right. NPV=IRR=PI= 2 When the project of last question was presented to the board of directors, the CEO noticed that the project was not profitable enough and requested that the project delivers 25 cents of extra wealth per dollar invested by reducing the cost per unit (variable cost). \begin{tabular}{|l|r|} \hline Tax rate: & 40% \\ \hline WACC: & 12% \\ \hline \end{tabular} Estimate the flows again, considering the same initial data, except the cost per unit (variable cost). Instead of $3.00 What should be the variable cost to reach the goal defined by the CEO? USE GOAL SEEK (30,000 iterations \& maximum change of 0.00001) New cost per unit: Adjusted budget Initial Investment 0 1 2 4 New sales Variable cost Fixed cost - Depreciation Expense Salvage Value Operating income (BT) Tax Operating income (AT) + Depreciation Expense Operating CF Terminal Cash Flow Total Cash Flows NPV = IRR= PI= Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started