Question

1. GIVEN THE FOLLOWING CASH TRANSACTIONS. IT IS YOUR RESPONSIBILITY TO PERFORM AN ECONOMIC ANALYSIS ON YOUR ASSIGNED ALTERNATIVE . ALTERNATE B INITIAL INVESTIMENT$ 550,000

1. GIVEN THE FOLLOWING CASH TRANSACTIONS. IT IS YOUR

RESPONSIBILITY TO PERFORM AN ECONOMIC ANALYSIS ON YOUR

ASSIGNED ALTERNATIVE.

ALTERNATE B

INITIAL INVESTIMENT $ 550,000

OPERATIONS AND $ 2,500/YR

MAINTENANCE

UPGRADES $ 1450/

EVERY 5 YEARS

INSURANCE $ 850/YR

REVENUE $ 30,000

INCREASE $10,000/YR

SALVAGE $ 180,000

USEFUL LIFE 12 YEARS

INTEREST ON COST 5%/YR

INTEREST ON REVENUE 1.5%/YR

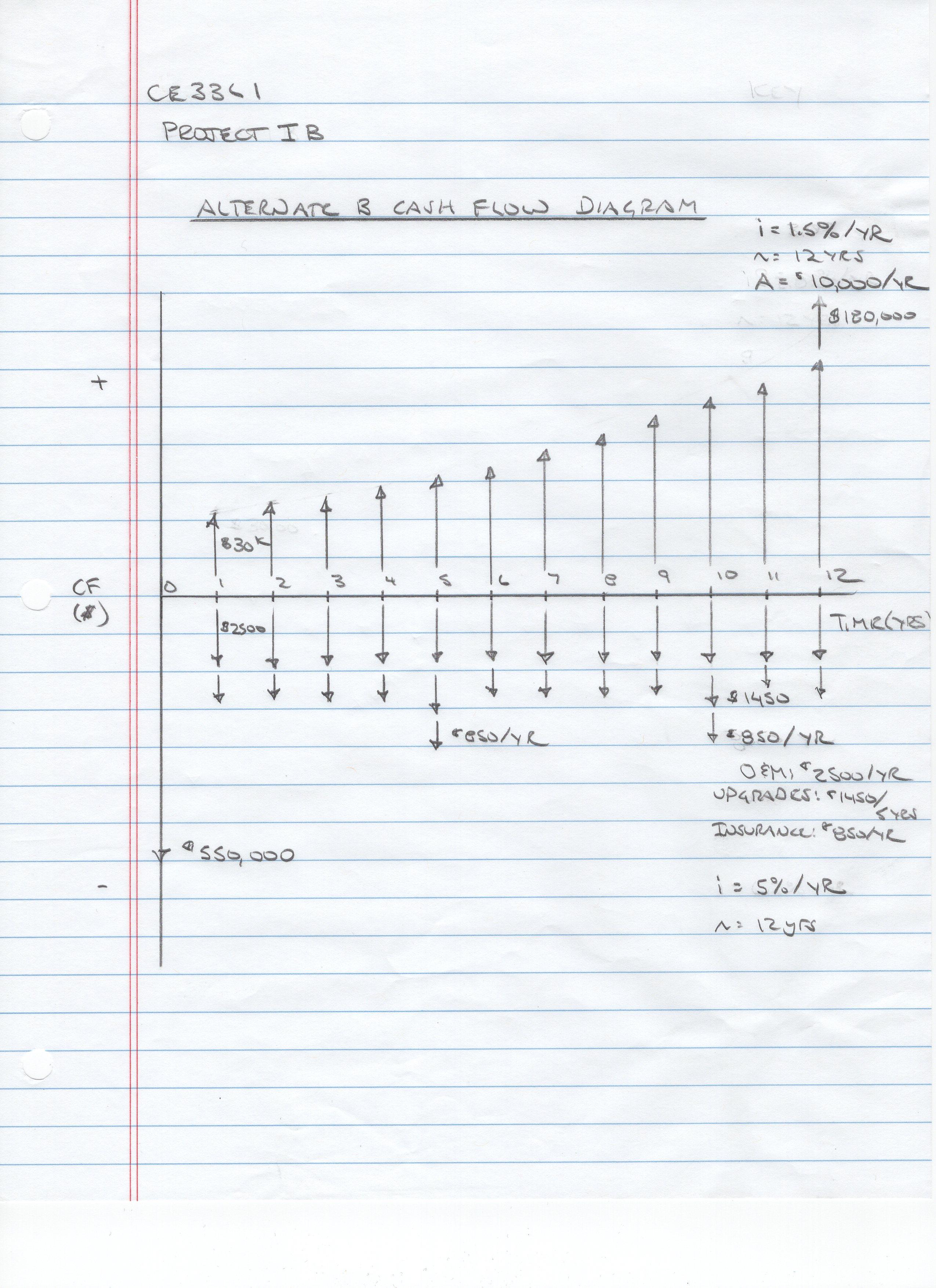

THE CASH FLOW DIAGRAM FOR ALTERNATE B IN GIVEN IN FIG. 1B.

ANSWER THE FOLLOWING QUESTIONS AND FILL-IN THE BLANK SPACES

-2-

CE 3361 NAME:____________________

PROJECT IB

SHOW ALL WORK AND CALCULATIONS

(10) 1. WHAT IS THE ALTERNATE B PAYMENT PERIOD: ___________________

2. IF THE QUARTERLY INTEREST RATE ON THE INVESTMENT IS 4.5%

COMPOUINDED QUARTERLY, CALCULATE THE EFFECTIVE

ANNUAL INTEREST RATE?

(20)

3. DETERMINE THE PRESENT WORTH OF ALTERNATE B.

i = 5%/YR

COST n = 12 YEARS

ELEMENT n P/F P/A PRESENT SOURCE

WORTH

-$550,000 0 - - $

-$ 1,450 5 - $ 1,136 TABLE 10

-$ 1,450 10 0.6139 - $ TABLE 10

-$ 2,500 - $

-$ 850 8.8633 - $ 7,534

PRESENT WORTH COST - $

i = 1.5%/YR

REVENUE n = 12 YEARS

ELEMENT n P/F P/A P/G PRESENT SOURCE

WORTH

$ 30,000 12 - 10.9075 - $ 327,225

$ 10,000 12 - $ TABLE 6

$180,000 0.8364 - $ 150,552

PRESENT WORTH REVENUE $

NET PRESENT WORTH: ____________

-3-

CE 3361 NAME:____________________

PROJECT IB

BE YEE NEAT

SHOW ALL WORK AND CALCULATIONS

4. DETERMINE THE ANNUAL WORTH OF ALTERNATE B.

i = ____YR

COST n = ____ YEARS

ELEMENT PRESENT n A/P ANNUAL SOURCE

WORTH WORTH

-$550,000 -$550,000 - $

-$ 1,450 12 - $ 128 TABLE 10

-$ 1,450 -$ 890 0.11283 - $

-$ 2,500 - $

-$ 850 - $ 850

ANNUAL WORTH COST - $

i = ____YR

REVENUE n = ____ YEARS

ELEMENT PRESENT n A/P ANNUAL SOURCE

WORTH WORTH

$ 30,000 $ 327,225 $ 30,000

$ 10,000 12 $ TABLE 6

$180,000 $ 150,552 0.09168 $

ANNUALWORTH REVENUE $

NET ANNUAL WORTH: $___________

CALCULATIONS:

-4-

CE 3361 NAME:____________________

PROJECT IB

BE YEE NEAT

SHOW ALL WORK AND CALCULATIONS

4. DETERMINE THE FUTURE WORTH OF ALTERNATE B.

i = ____YR

COST n = ____ YEARS

ELEMENT PRESENT n F/P FUTURE SOURCE

WORTH WORTH

-$550,000 -$550,000 1.7959 - $

-$ 1,450 12 - $ 2,040 TABLE 10

-$ 1,450 -$ 890 - $ 1,598

-$ 2,500 - $

-$ 850 - $ 850

FUTURE WORTH COST - $

i = ____YR

REVENUE n = ____ YEARS

ELEMENT PRESENT n A/P ANNUAL SOURCE

WORTH WORTH

$ 30,000 $ 327,225 $

$ 10,000 12 $ 694,131 TABLE 6

$180,000 $ 150,552 1.1956 $

FUTURE WORTH REVENUE $

NET FUTURE WORTH: $___________

5A. IS THE CAPITALIZED COST

SHORT TERM LONG TERM

HALF TERM MID TERM

5B. CALCULATE THE CAPITALIZED COST

CCT = AWC/i CCT =

CCT = - $ 62,057 - $ CCT =

|

-5-

CE 3361 NAME:____________________

PROJECT IB

SHOW ALL WORK AND CALCULATIONS

6. AT AN INTEREST RATE OF 1.5% ON THE NET CASH FLOW, CALCULATE

THE PAYBACK PERIOD FOR ALTERNATE B:

i = 1.5%

0 = - PW + Σ AW NCF

PW = -$

AW NCF

AW REVENUE AW COST

$ 30,000

-

- -$ 850

Σ AW NCF:__________________

P/A = ______________

P/A = ______________

YEAR P/A ∆ SOURCE

11 10.0711 TABLE 6

9.2222

1 0.8224

nP = __________YRS

nP = __________YRS

NAME _____________________________________

SIGNATURE:_______________________________

BY SIGNING THIS PAGE, I CERTIFY THAT I HAVE NOT GIVEN

OR RECEIVED HELP FROM ANY OTHER PERSON

FIG. 1B. CASH FLOW DIAGRAM FOR ALTERNATE B PROJECT IB STUDENTS

|

O + CF CE3341 0 ALTERNATE B CASH FLOW DIAGRAM A 830k 82500 2 asso,000 3 S 6 &resolyR 7 CO 9 to i=1.5%/YR 2= 12YRS A = $10,000/12 $180,000 A 12 TIME(YES) $1450 850/42 O&M: $2500/yR UPGRADES! P1450/ INSURANCE: "EsoAR ^=1242 1 = 5%/YR

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information here are the answers to the questions 1 The payment period for Alternate B is 12 years given in the problem statement 2 To calculate the effective annual interest rate E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started