Answered step by step

Verified Expert Solution

Question

1 Approved Answer

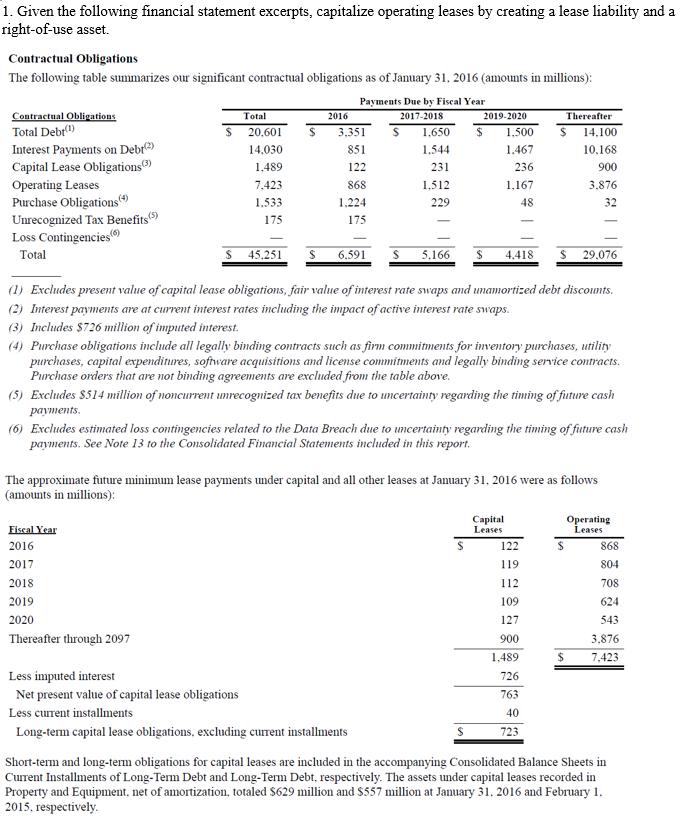

1. Given the following financial statement excerpts, capitalize operating leases by creating a lease liability and a right-of-use asset. Contractual Obligations The following table

1. Given the following financial statement excerpts, capitalize operating leases by creating a lease liability and a right-of-use asset. Contractual Obligations The following table summarizes our significant contractual obligations as of January 31, 2016 (amounts in millions): Payments Due by Fiscal Year 2017-2018 Contractual Obligations Total Debt() Interest Payments on Debr(2) Capital Lease Obligations (3) Operating Leases Purchase Obligations (4) Unrecognized Tax Benefits (5) Loss Contingencies) Total $ Total 20,601 14,030 1,489 7.423 1.533 175 $ 2016 Fiscal Year 2016 2017 2018 2019 2020 Thereafter through 2097 3,351 851 122 868 1,224 175 $ 45.251 S 6.591 S 1.650 1,544 231 1,512 229 2019-2020 $ 5.166 $ Less imputed interest Net present value of capital lease obligations Less current installments Long-term capital lease obligations, excluding current installments Thereafter 1.500 $ 14.100 1.467 10,168 236 900 1,167 48 (1) Excludes present value of capital lease obligations, fair value of interest rate swaps and unamortized debt discounts. (2) Interest payments are at current interest rates including the impact of active interest rate swaps. (3) Includes $726 million of imputed interest. 4,418 (4) Purchase obligations include all legally binding contracts such as firm commitments for inventory purchases, utility purchases, capital expenditures, software acquisitions and license commitments and legally binding service contracts. Purchase orders that are not binding agreements are excluded from the table above. $ (5) Excludes $514 million of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of future cash payments. (6) Excludes estimated loss contingencies related to the Data Breach due to uncertainty regarding the timing of future cash payments. See Note 13 to the Consolidated Financial Statements included in this report. The approximate future minimum lease payments under capital and all other leases at January 31, 2016 were as follows (amounts in millions): Capital Leases 3.876 32 29.076 122 119 112 109 127 900 1,489 726 763 40 723 $ Operating Leases 868 804 708 624 543 3.876 7.423 Short-term and long-term obligations for capital leases are included in the accompanying Consolidated Balance Sheets in Current Installments of Long-Term Debt and Long-Term Debt, respectively. The assets under capital leases recorded in Property and Equipment, net of amortization, totaled $629 million and $557 million at January 31, 2016 and February 1. 2015. respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 of 2 To capitalize operating leases and create a lease liability and a rightofuse asset you will need to calculate the present value of the future lease payments and record them on your financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started