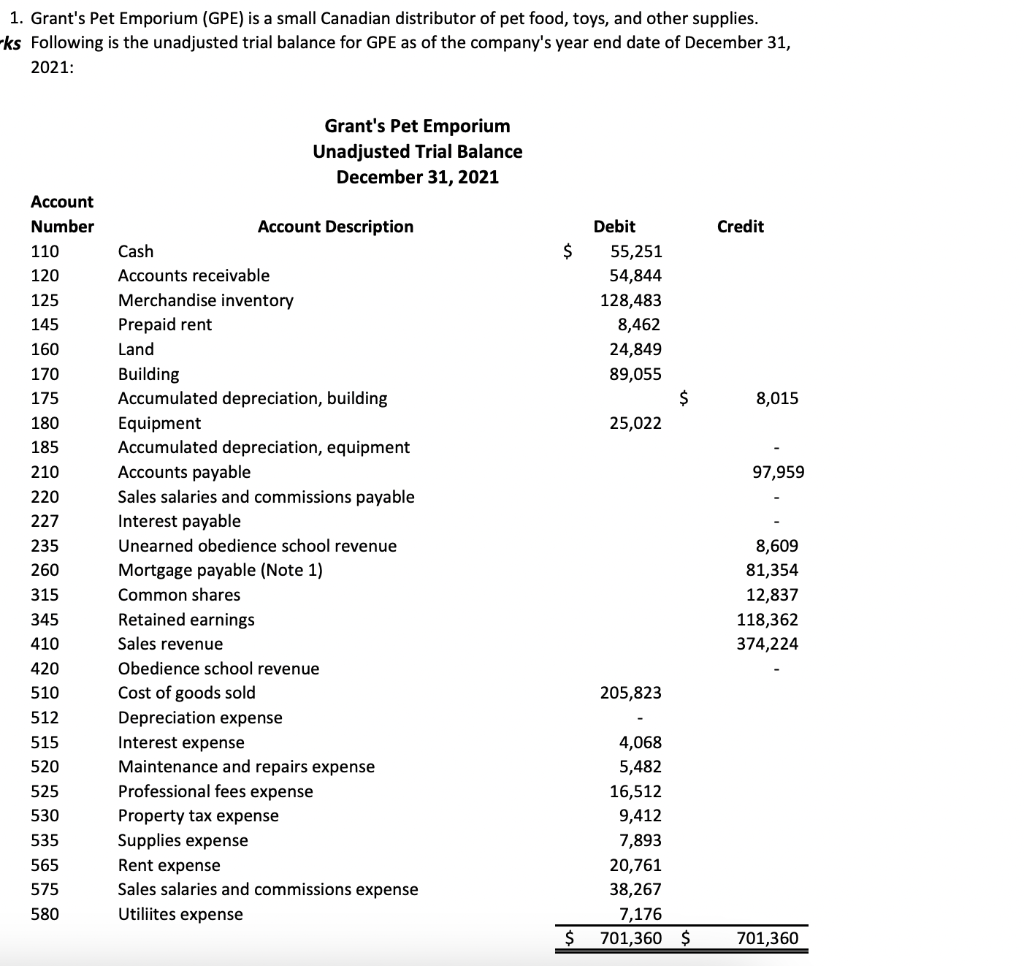

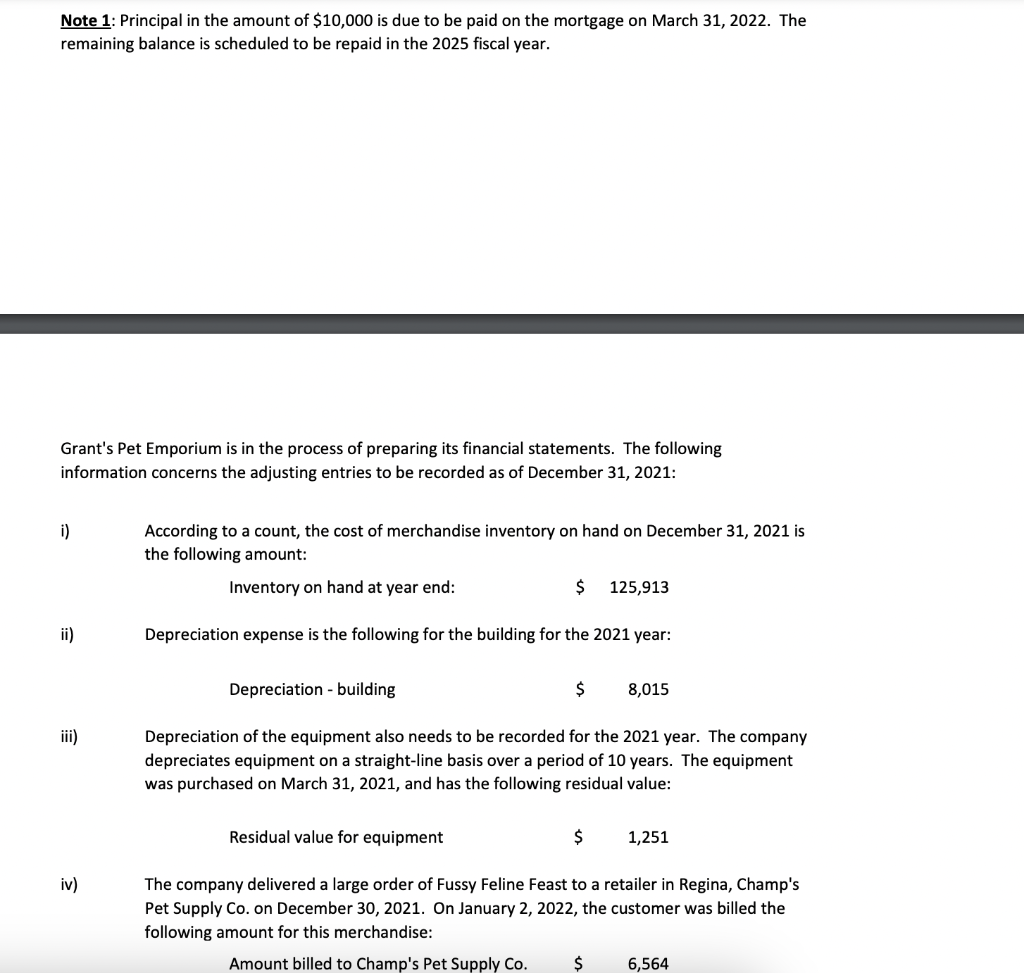

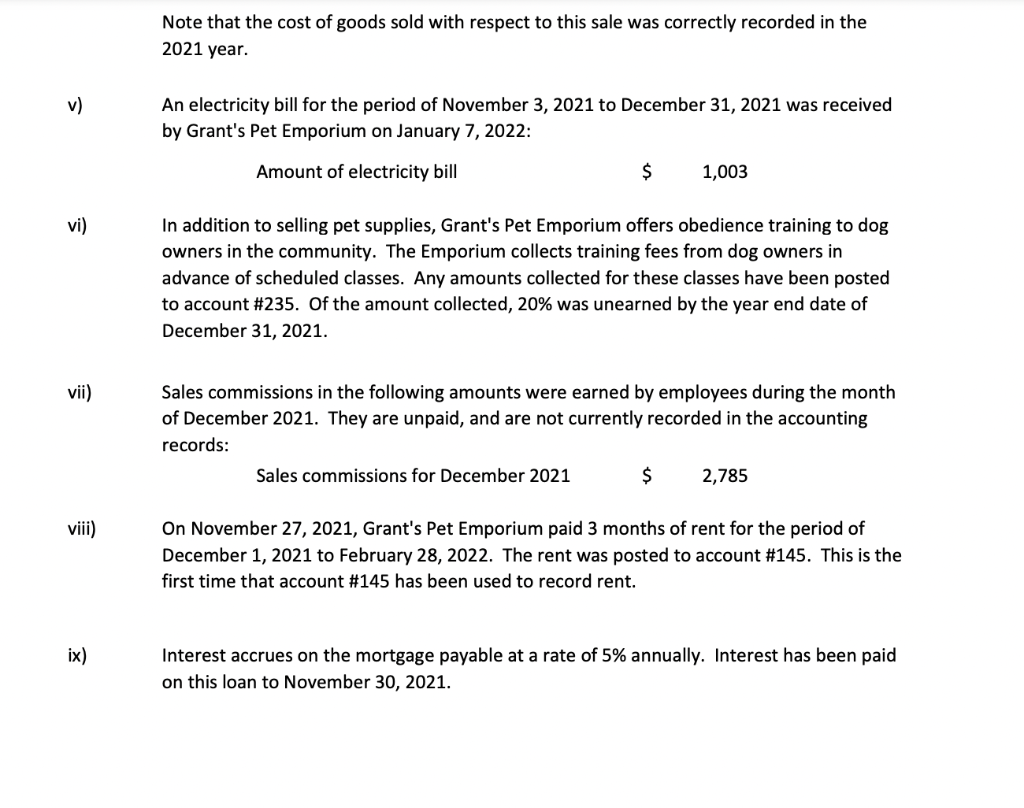

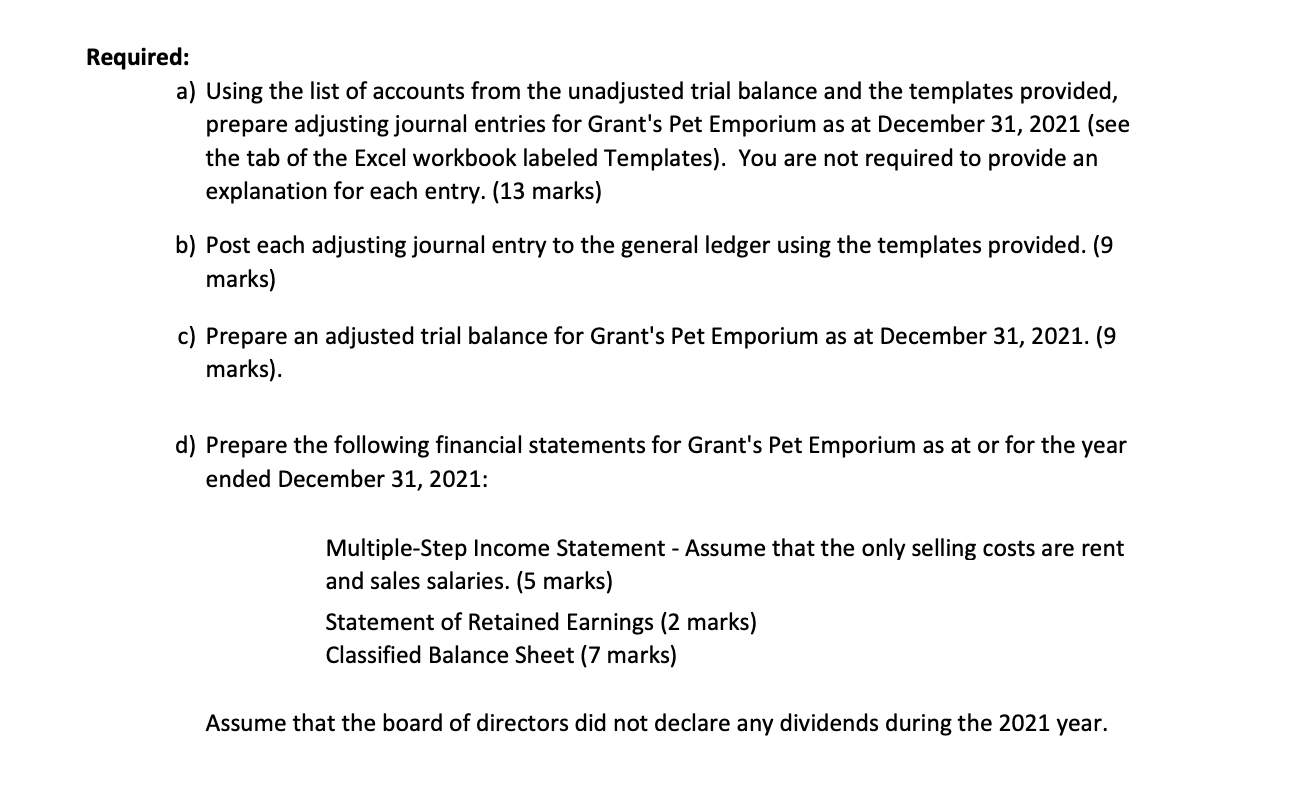

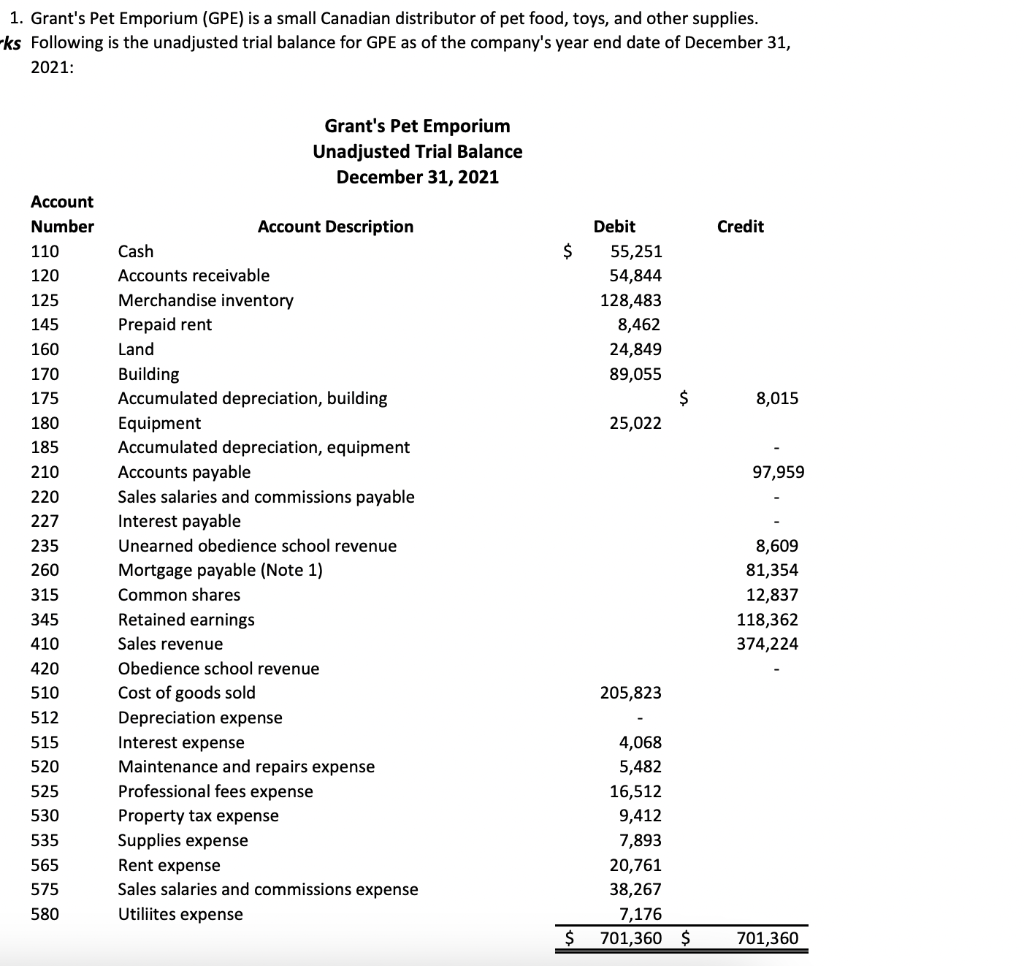

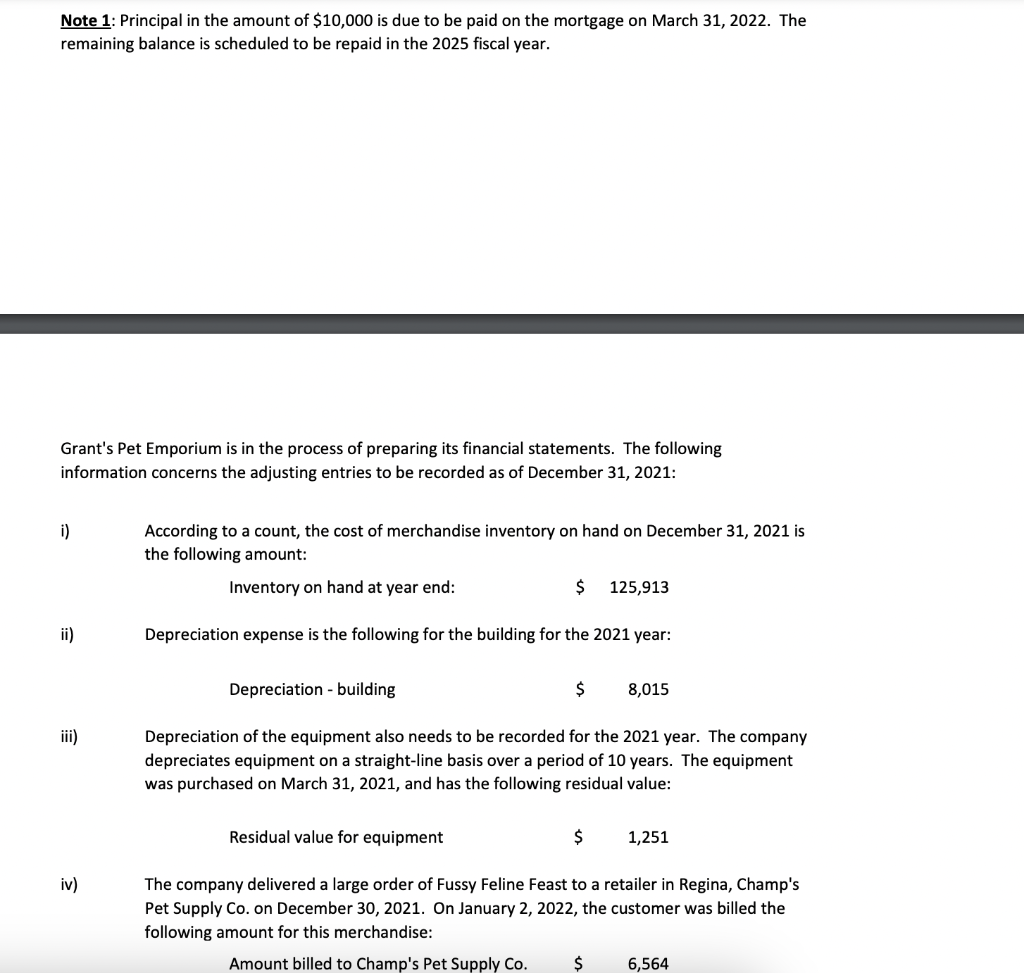

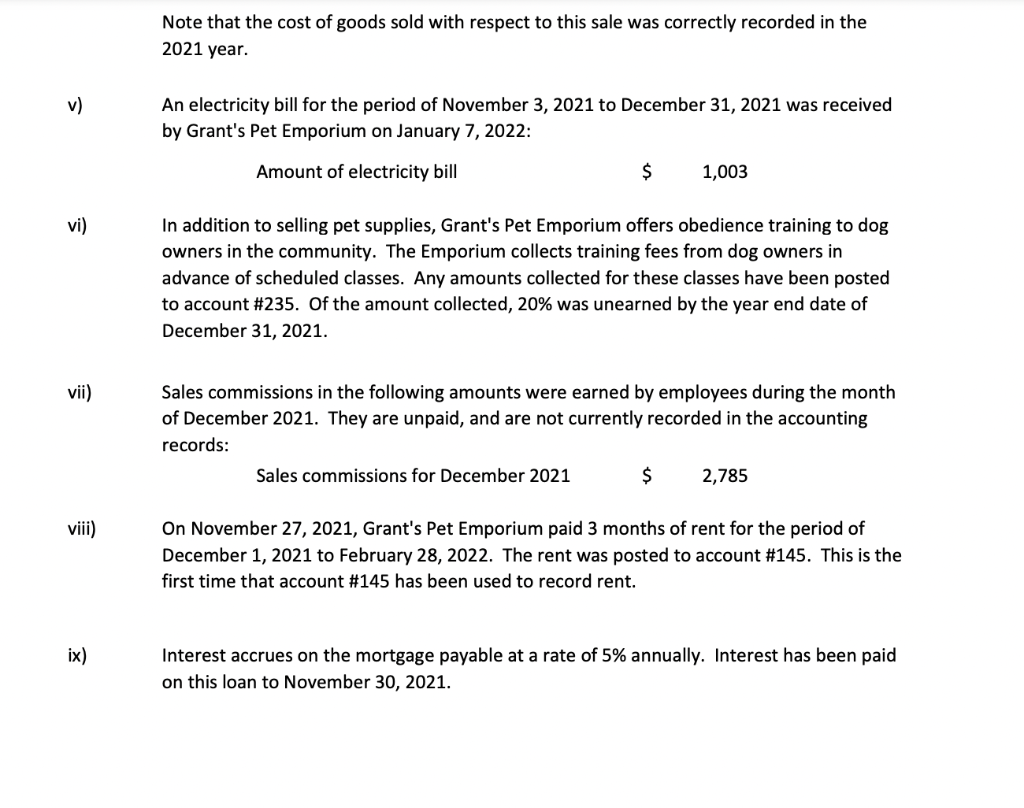

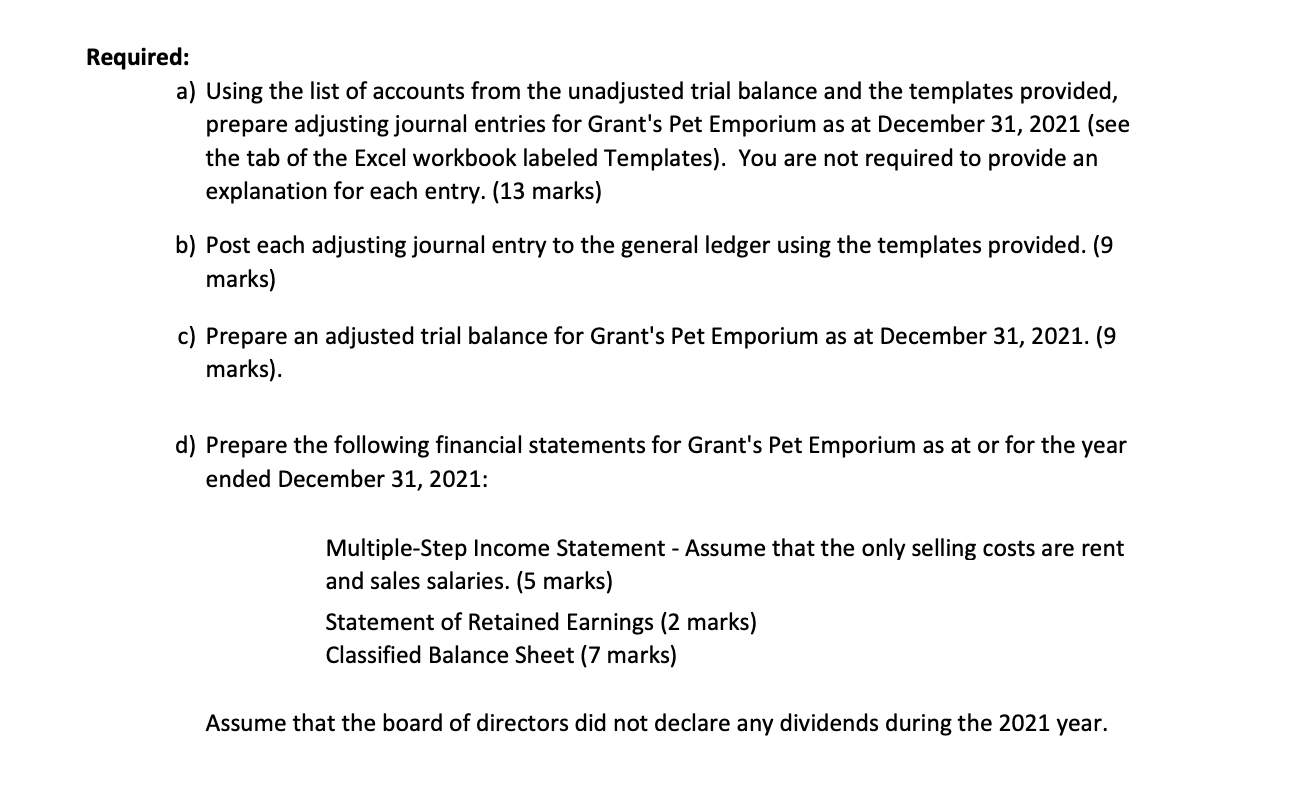

1. Grant's Pet Emporium (GPE) is a small Canadian distributor of pet food, toys, and other supplies. ks Following is the unadjusted trial balance for GPE as of the company's year end date of December 31, 2021: Grant's Pet Emporium I Inadinctod Trial Ralanco Note 1: Principal in the amount of $10,000 is due to be paid on the mortgage on March 31,2022 . The remaining balance is scheduled to be repaid in the 2025 fiscal year. Grant's Pet Emporium is in the process of preparing its financial statements. The following information concerns the adjusting entries to be recorded as of December 31,2021 : i) According to a count, the cost of merchandise inventory on hand on December 31,2021 is the following amount: Inventory on hand at year end: $125,913 ii) Depreciation expense is the following for the building for the 2021 year: Depreciation - building \$ 8,015 iii) Depreciation of the equipment also needs to be recorded for the 2021 year. The company depreciates equipment on a straight-line basis over a period of 10 years. The equipment was purchased on March 31, 2021, and has the following residual value: Residual value for equipment $1,251 iv) The company delivered a large order of Fussy Feline Feast to a retailer in Regina, Champ's Pet Supply Co. on December 30, 2021. On January 2, 2022, the customer was billed the following amount for this merchandise: Amount billed to Champ's Pet Supply Co. $6,564 Note that the cost of goods sold with respect to this sale was correctly recorded in the 2021 year. v) An electricity bill for the period of November 3, 2021 to December 31, 2021 was received by Grant's Pet Emporium on January 7, 2022: Amount of electricity bill $1,003 vi) In addition to selling pet supplies, Grant's Pet Emporium offers obedience training to dog owners in the community. The Emporium collects training fees from dog owners in advance of scheduled classes. Any amounts collected for these classes have been posted to account \#235. Of the amount collected, 20% was unearned by the year end date of December 31, 2021. vii) Sales commissions in the following amounts were earned by employees during the month of December 2021. They are unpaid, and are not currently recorded in the accounting records: Sales commissions for December 2021$2,785 viii) On November 27, 2021, Grant's Pet Emporium paid 3 months of rent for the period of December 1, 2021 to February 28, 2022. The rent was posted to account \#145. This is the first time that account \#145 has been used to record rent. ix) Interest accrues on the mortgage payable at a rate of 5% annually. Interest has been paid on this loan to November 30, 2021. quired: a) Using the list of accounts from the unadjusted trial balance and the templates provided, prepare adjusting journal entries for Grant's Pet Emporium as at December 31, 2021 (see the tab of the Excel workbook labeled Templates). You are not required to provide an explanation for each entry. (13 marks) b) Post each adjusting journal entry to the general ledger using the templates provided. (9 marks) c) Prepare an adjusted trial balance for Grant's Pet Emporium as at December 31, 2021. (9 marks). d) Prepare the following financial statements for Grant's Pet Emporium as at or for the year ended December 31, 2021: Multiple-Step Income Statement - Assume that the only selling costs are rent and sales salaries. (5 marks) Statement of Retained Earnings ( 2 marks) Classified Balance Sheet (7 marks) Assume that the board of directors did not declare any dividends during the 2021 year. 1. Grant's Pet Emporium (GPE) is a small Canadian distributor of pet food, toys, and other supplies. ks Following is the unadjusted trial balance for GPE as of the company's year end date of December 31, 2021: Grant's Pet Emporium I Inadinctod Trial Ralanco Note 1: Principal in the amount of $10,000 is due to be paid on the mortgage on March 31,2022 . The remaining balance is scheduled to be repaid in the 2025 fiscal year. Grant's Pet Emporium is in the process of preparing its financial statements. The following information concerns the adjusting entries to be recorded as of December 31,2021 : i) According to a count, the cost of merchandise inventory on hand on December 31,2021 is the following amount: Inventory on hand at year end: $125,913 ii) Depreciation expense is the following for the building for the 2021 year: Depreciation - building \$ 8,015 iii) Depreciation of the equipment also needs to be recorded for the 2021 year. The company depreciates equipment on a straight-line basis over a period of 10 years. The equipment was purchased on March 31, 2021, and has the following residual value: Residual value for equipment $1,251 iv) The company delivered a large order of Fussy Feline Feast to a retailer in Regina, Champ's Pet Supply Co. on December 30, 2021. On January 2, 2022, the customer was billed the following amount for this merchandise: Amount billed to Champ's Pet Supply Co. $6,564 Note that the cost of goods sold with respect to this sale was correctly recorded in the 2021 year. v) An electricity bill for the period of November 3, 2021 to December 31, 2021 was received by Grant's Pet Emporium on January 7, 2022: Amount of electricity bill $1,003 vi) In addition to selling pet supplies, Grant's Pet Emporium offers obedience training to dog owners in the community. The Emporium collects training fees from dog owners in advance of scheduled classes. Any amounts collected for these classes have been posted to account \#235. Of the amount collected, 20% was unearned by the year end date of December 31, 2021. vii) Sales commissions in the following amounts were earned by employees during the month of December 2021. They are unpaid, and are not currently recorded in the accounting records: Sales commissions for December 2021$2,785 viii) On November 27, 2021, Grant's Pet Emporium paid 3 months of rent for the period of December 1, 2021 to February 28, 2022. The rent was posted to account \#145. This is the first time that account \#145 has been used to record rent. ix) Interest accrues on the mortgage payable at a rate of 5% annually. Interest has been paid on this loan to November 30, 2021. quired: a) Using the list of accounts from the unadjusted trial balance and the templates provided, prepare adjusting journal entries for Grant's Pet Emporium as at December 31, 2021 (see the tab of the Excel workbook labeled Templates). You are not required to provide an explanation for each entry. (13 marks) b) Post each adjusting journal entry to the general ledger using the templates provided. (9 marks) c) Prepare an adjusted trial balance for Grant's Pet Emporium as at December 31, 2021. (9 marks). d) Prepare the following financial statements for Grant's Pet Emporium as at or for the year ended December 31, 2021: Multiple-Step Income Statement - Assume that the only selling costs are rent and sales salaries. (5 marks) Statement of Retained Earnings ( 2 marks) Classified Balance Sheet (7 marks) Assume that the board of directors did not declare any dividends during the 2021 year