Answered step by step

Verified Expert Solution

Question

1 Approved Answer

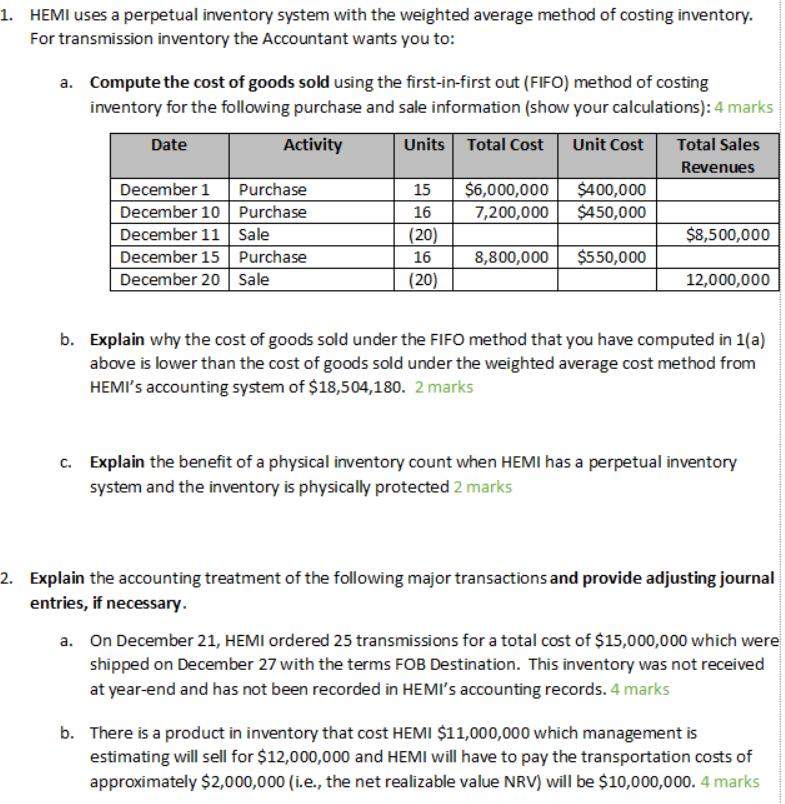

1. HEMI uses a perpetual inventory system with the weighted average method of costing inventory. For transmission inventory the Accountant wants you to: a.

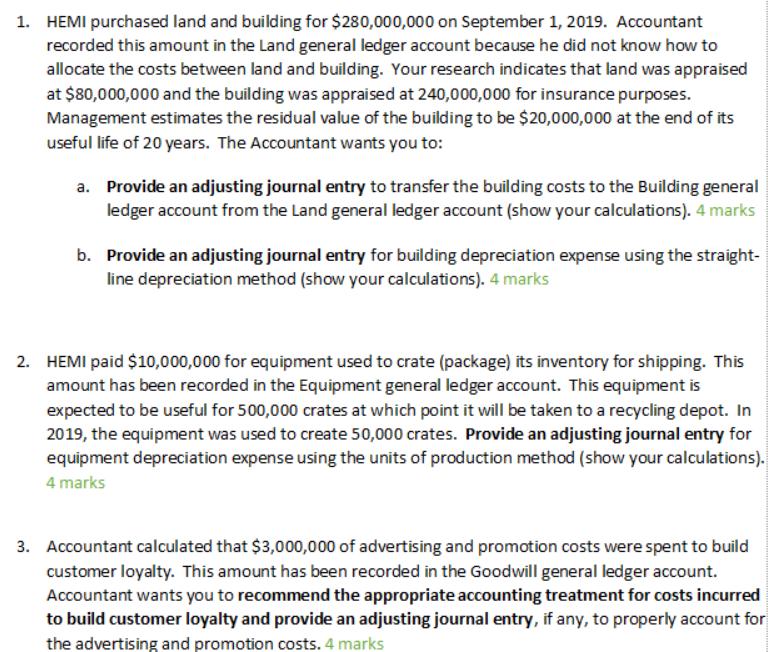

1. HEMI uses a perpetual inventory system with the weighted average method of costing inventory. For transmission inventory the Accountant wants you to: a. Compute the cost of goods sold using the first-in-first out (FIFO) method of costing inventory for the following purchase and sale information (show your calculations): 4 marks Date Activity Units Total Cost Unit Cost Total Sales Revenues $6,000,000 $400,000 $450,000 December 1 Purchase 15 December 10 Purchase December 11 Sale December 15 Purchase December 20 Sale 16 7,200,000 (20) $8,500,000 16 8,800,000 $550,000 (20) 12,000,000 b. Explain why the cost of goods sold under the FIFO method that you have computed in 1(a) above is lower than the cost of goods sold under the weighted average cost method from HEMI's accounting system of $18,504,180. 2 marks c. Explain the benefit of a physical inventory count when HEMI has a perpetual inventory system and the inventory is physically protected 2 marks 2. Explain the accounting treatment of the following major transactions and provide adjusting journal entries, if necessary. a. On December 21, HEMI ordered 25 transmissions for a total cost of $15,000,000 which were shipped on December 27 with the terms FOB Destination. This inventory was not received at year-end and has not been recorded in HEMI's accounting records. 4 marks b. There is a product in inventory that cost HEMI $11,000,000 which management is estimating will sell for $12,000,000 and HEMI will have to pay the transportation costs of approximately $2,000,000 (i.e., the net realizable value NRV) will be $10,000,000. 4 marks 1. HEMI purchased land and building for $280,000,000 on September 1, 2019. Accountant recorded this amount in the Land general ledger account because he did not know how to allocate the costs between land and building. Your research indicates that land was appraised at $80,000,000 and the building was appraised at 240,000,000 for insurance purposes. Management estimates the residual value of the building to be $20,000,000 at the end of its useful life of 20 years. The Accountant wants you to: a. Provide an adjusting journal entry to transfer the building costs to the Building general ledger account from the Land general ledger account (show your calculations). 4 marks b. Provide an adjusting journal entry for building depreciation expense using the straight- line depreciation method (show your calculations). 4 marks 2. HEMI paid $10,000,000 for equipment used to crate (package) its inventory for shipping. This amount has been recorded in the Equipment general ledger account. This equipment is expected to be useful for 500,000 crates at which point it will be taken to a recycling depot. In 2019, the equipment was used to create 50,000 crates. Provide an adjusting journal entry for equipment depreciation expense using the units of production method (show your calculations). 4 marks 3. Accountant calculated that $3,000,000 of advertising and promotion costs were spent to build customer loyalty. This amount has been recorded in the Goodwill general ledger account. Accountant wants you to recommend the appropriate accounting treatment for costs incurred to build customer loyalty and provide an adjusting journal entry, if any, to properly account for the advertising and promotion costs. 4 marks

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

2 A On December 21 HEMI only order 21 transmissions Therefore no accounting entry would be required However on December 27 the goods were shipped on F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started