Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How are earnings per common share calculated? Net earnings/average common shares outstanding 2. Of the following items, identify those found on a statement of

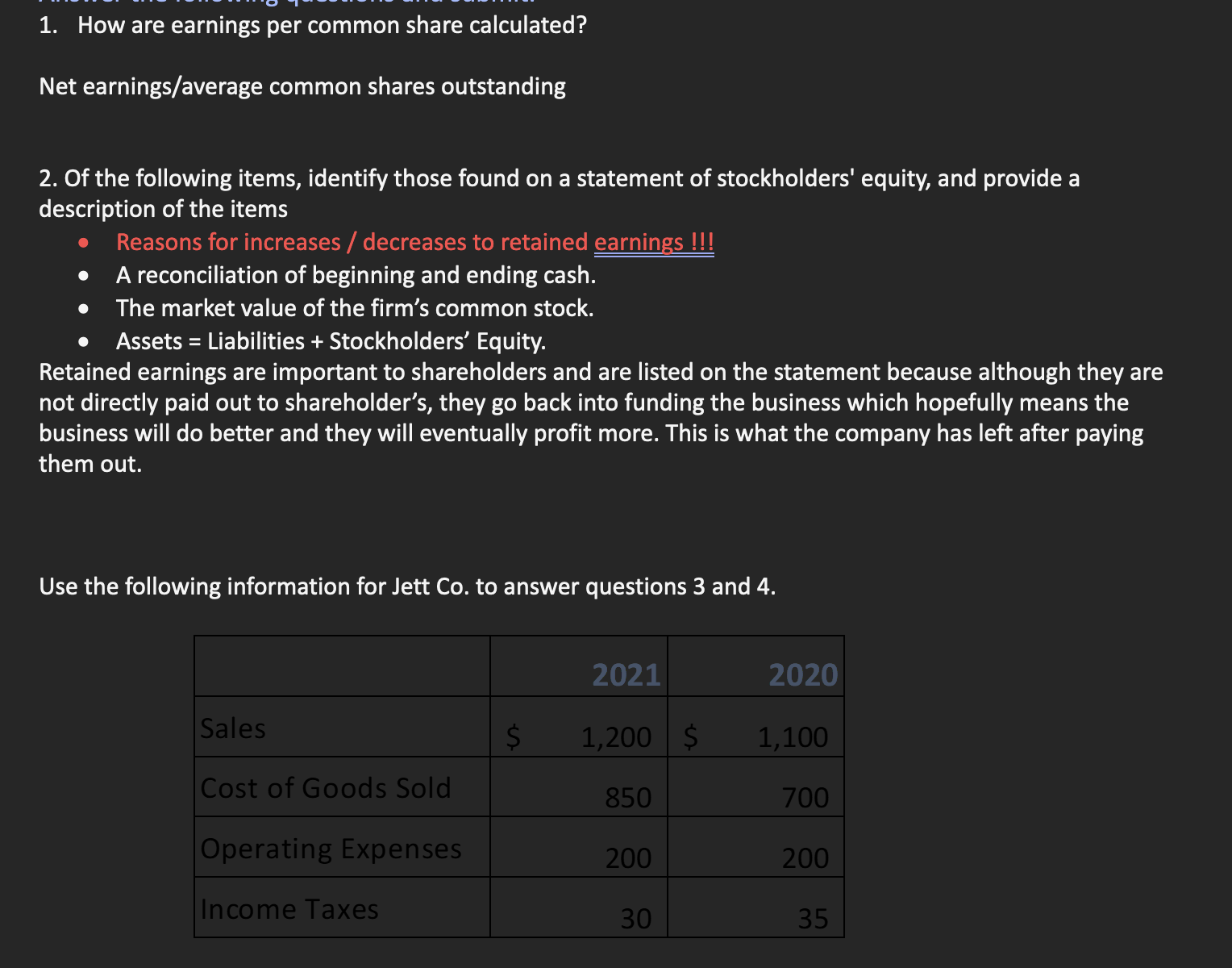

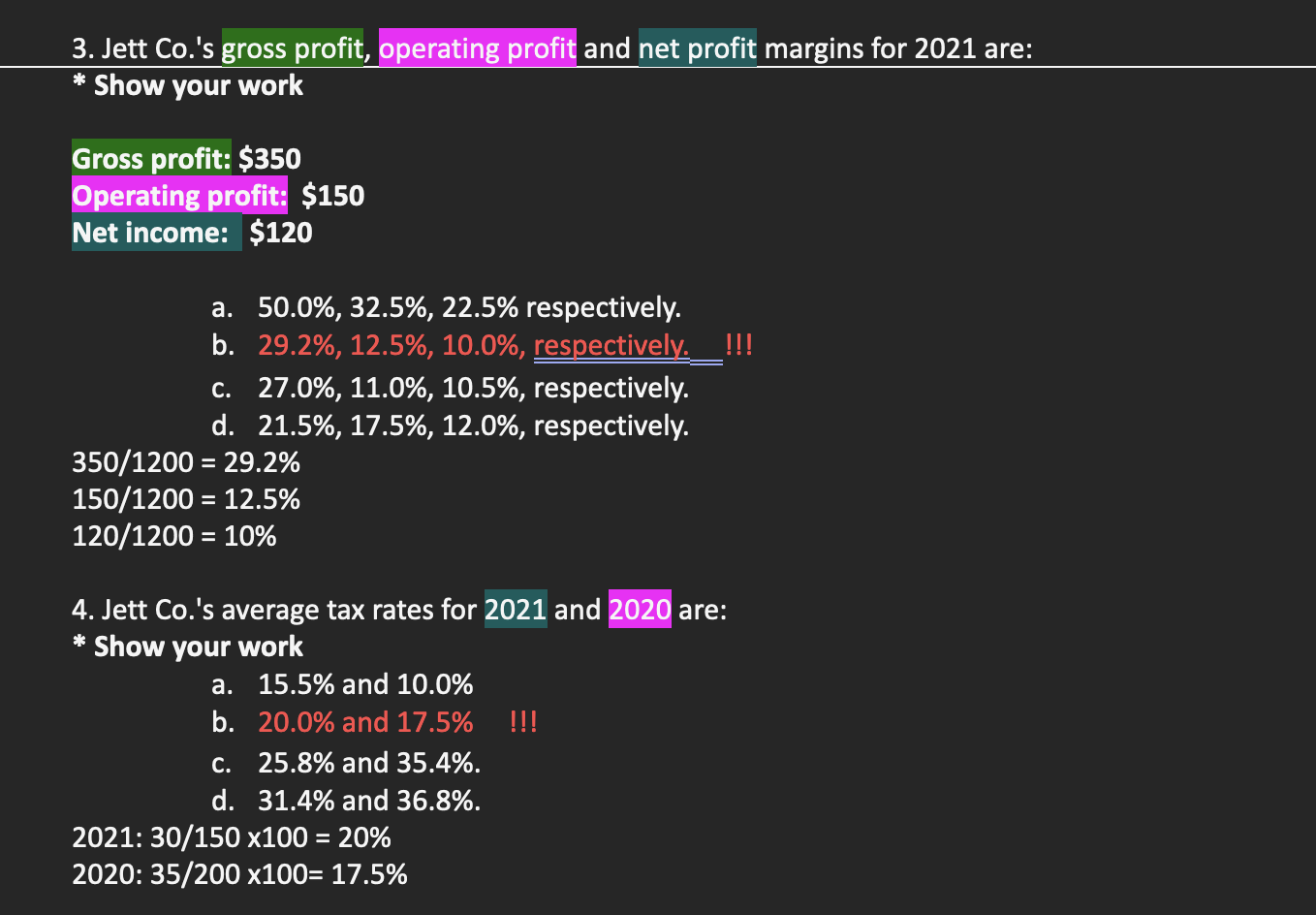

1. How are earnings per common share calculated? Net earnings/average common shares outstanding 2. Of the following items, identify those found on a statement of stockholders' equity, and provide a description of the items - Reasons for increases / decreases to retained earnings !!! - A reconciliation of beginning and ending cash. - The market value of the firm's common stock. - Assets = Liabilities + Stockholders' Equity. Retained earnings are important to shareholders and are listed on the statement because although they are not directly paid out to shareholder's, they go back into funding the business which hopefully means the business will do better and they will eventually profit more. This is what the company has left after paying them out. Use the following information for Jett Co. to answer questions 3 and 4. * Show your work Gross profit: $350 Operating profit: $150 Net income: \$120 a. 50.0%,32.5%,22.5% respectively. b. 29.2%,12.5%,10.0%, respectively. !!! c. 27.0%,11.0%,10.5%, respectively. d. 21.5%,17.5%,12.0%, respectively. 350/1200=29.2%150/1200=12.5%120/1200=10% 4. Jett Co.'s average tax rates for 2021 and 2020 are: * Show your work a. 15.5% and 10.0% b. 20.0% and 17.5% !!! c. 25.8% and 35.4%. d. 31.4% and 36.8%. 2021:30/150100=20% 2020: 35/200100=17.5% 1. How are earnings per common share calculated? Net earnings/average common shares outstanding 2. Of the following items, identify those found on a statement of stockholders' equity, and provide a description of the items - Reasons for increases / decreases to retained earnings !!! - A reconciliation of beginning and ending cash. - The market value of the firm's common stock. - Assets = Liabilities + Stockholders' Equity. Retained earnings are important to shareholders and are listed on the statement because although they are not directly paid out to shareholder's, they go back into funding the business which hopefully means the business will do better and they will eventually profit more. This is what the company has left after paying them out. Use the following information for Jett Co. to answer questions 3 and 4. * Show your work Gross profit: $350 Operating profit: $150 Net income: \$120 a. 50.0%,32.5%,22.5% respectively. b. 29.2%,12.5%,10.0%, respectively. !!! c. 27.0%,11.0%,10.5%, respectively. d. 21.5%,17.5%,12.0%, respectively. 350/1200=29.2%150/1200=12.5%120/1200=10% 4. Jett Co.'s average tax rates for 2021 and 2020 are: * Show your work a. 15.5% and 10.0% b. 20.0% and 17.5% !!! c. 25.8% and 35.4%. d. 31.4% and 36.8%. 2021:30/150100=20% 2020: 35/200100=17.5%

1. How are earnings per common share calculated? Net earnings/average common shares outstanding 2. Of the following items, identify those found on a statement of stockholders' equity, and provide a description of the items - Reasons for increases / decreases to retained earnings !!! - A reconciliation of beginning and ending cash. - The market value of the firm's common stock. - Assets = Liabilities + Stockholders' Equity. Retained earnings are important to shareholders and are listed on the statement because although they are not directly paid out to shareholder's, they go back into funding the business which hopefully means the business will do better and they will eventually profit more. This is what the company has left after paying them out. Use the following information for Jett Co. to answer questions 3 and 4. * Show your work Gross profit: $350 Operating profit: $150 Net income: \$120 a. 50.0%,32.5%,22.5% respectively. b. 29.2%,12.5%,10.0%, respectively. !!! c. 27.0%,11.0%,10.5%, respectively. d. 21.5%,17.5%,12.0%, respectively. 350/1200=29.2%150/1200=12.5%120/1200=10% 4. Jett Co.'s average tax rates for 2021 and 2020 are: * Show your work a. 15.5% and 10.0% b. 20.0% and 17.5% !!! c. 25.8% and 35.4%. d. 31.4% and 36.8%. 2021:30/150100=20% 2020: 35/200100=17.5% 1. How are earnings per common share calculated? Net earnings/average common shares outstanding 2. Of the following items, identify those found on a statement of stockholders' equity, and provide a description of the items - Reasons for increases / decreases to retained earnings !!! - A reconciliation of beginning and ending cash. - The market value of the firm's common stock. - Assets = Liabilities + Stockholders' Equity. Retained earnings are important to shareholders and are listed on the statement because although they are not directly paid out to shareholder's, they go back into funding the business which hopefully means the business will do better and they will eventually profit more. This is what the company has left after paying them out. Use the following information for Jett Co. to answer questions 3 and 4. * Show your work Gross profit: $350 Operating profit: $150 Net income: \$120 a. 50.0%,32.5%,22.5% respectively. b. 29.2%,12.5%,10.0%, respectively. !!! c. 27.0%,11.0%,10.5%, respectively. d. 21.5%,17.5%,12.0%, respectively. 350/1200=29.2%150/1200=12.5%120/1200=10% 4. Jett Co.'s average tax rates for 2021 and 2020 are: * Show your work a. 15.5% and 10.0% b. 20.0% and 17.5% !!! c. 25.8% and 35.4%. d. 31.4% and 36.8%. 2021:30/150100=20% 2020: 35/200100=17.5% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started