Question

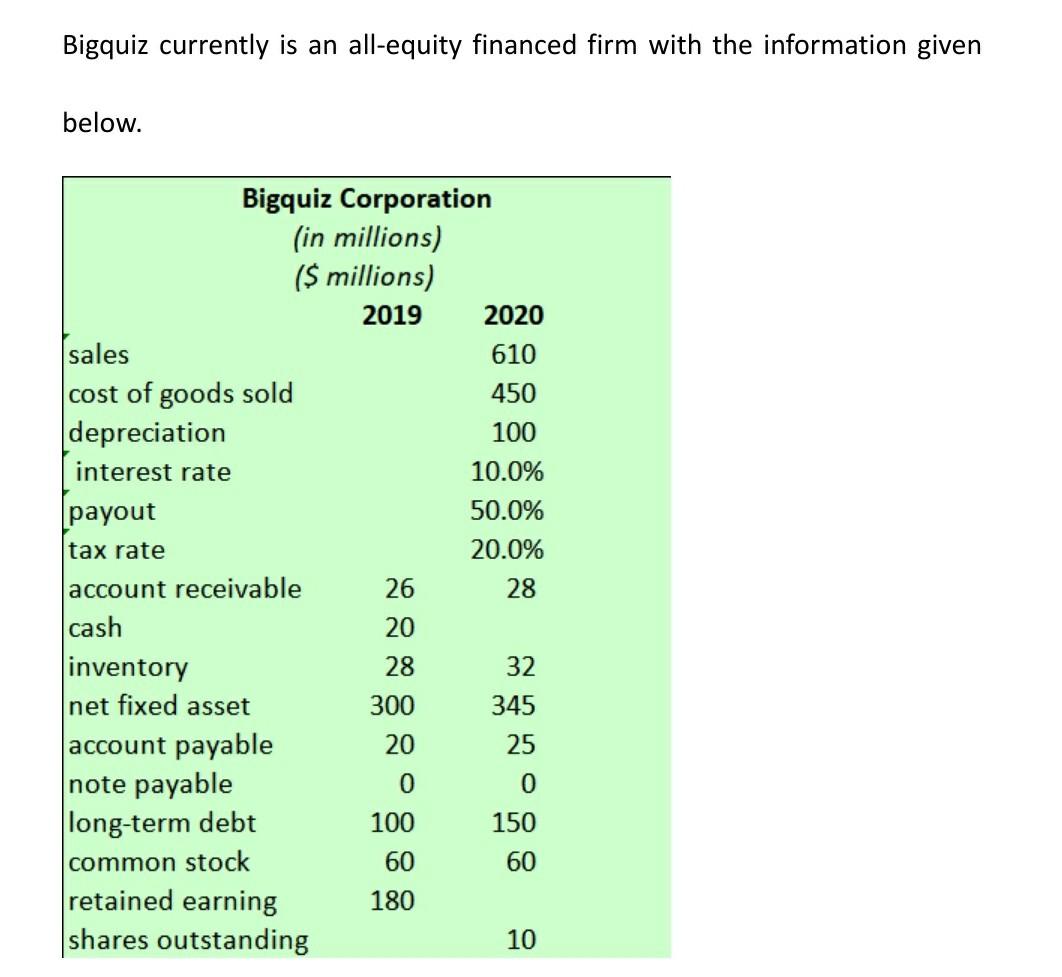

1. How much is the cash and retained earning in 2020? B) Apply DuPont identity on ROE, how much is the operating contribution and how

1. How much is the cash and retained earning in 2020?

B) Apply DuPont identity on ROE, how much is the operating contribution and how much is the financing contribution.

D) If the firm targets a 30% growth rate in the next 3 years, but the firm doesnt want to issue new equity, what will be the firms leverage ratio by the end of year 3? (suppose net profit margin, asset turnover ratio, payout ratio remain constant over the period).

2. Here are some addtional information. The companys beta is 1.5, risk free rate is 2% and market risk premium is 6%, what is WACC under market value based capital structure? (Hint, only long-term debt is interst bearing, and is considered as debt capital).

3. Bigquiz Inc. is considering whether to introduce a new machine. The projected unit sales are 150, 225, and 175 units per year for the next three years, respectively. Price is $1 million per unit, variable cost is $0.5 million per unit, and fixed costs are 15 million per year. The equipment costs 150 million today and can be sold three years later at a market value of 10 million. The machine will be depreciated on a three-year MACRS schedule (33.3%, 44.44%, 14.8%, 7.4%). The machine also requires an initial working capital of 10 million, and in each year working capital is estimated as 10% of the total sales. All working capital will be recovered by the end of the projects life. Tax rate is 20%. (Use WACC in Problem 2 as discount rate).

4. Bigquiz is experiencing rapid growth. Dividends are expected to grow at 15% per year during the next three years. After that period, dividend will grow at 4% forever. Using two stage dividend discount model, how much is the stock price today? Comparing to market price, do you suggest to buy or sell the stock?

5. BigQuiz is considering to issue 50 million long-term debt to buy back its existing stocks. How many shares can be bought? Suppose the new debt has the same interest rate as the existing debt, how much will be EPS before and after the stock repurchase? List three reasons that firms may prefer stock repurchase to cash dividend. List another three reasons that firms may prefer cash dividend.

Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10 Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started