Answered step by step

Verified Expert Solution

Question

1 Approved Answer

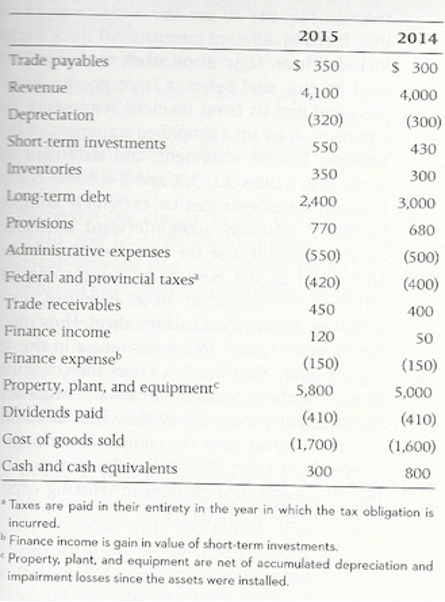

1) how to construct a cash flow statement? 2) cash flow from assets, cash flow to creditors, cash flow to shareholders? 2015 2014 $ 300

1) how to construct a cash flow statement?

2) cash flow from assets, cash flow to creditors, cash flow to shareholders?

2015 2014 $ 300 4,000 S 350 4,100 (320) 550 (300) 430 300 3,000 350 2,400 680 Trade payables Revenue Depreciation Short-term investments Inventories Long-term debt Provisions Administrative expenses Federal and provincial taxes? Trade receivables Finance income Finance expensel Property, plant, and equipment Dividends paid Cost of goods sold Cash and cash equivalents 770 (550) (420) (500) (400) 450 400 50 120 (150) 5,800 (410) (1,700) 300 (150) 5,000 (410) (1,600) 800 Taxes are paid in their entirety in the year in which the tax obligation is incurred. b Finance income is gain in value of short-term investments. Property, plant, and equipment are net of accumulated depreciation and impairment losses since the assets were installed. 2015 2014 $ 300 4,000 S 350 4,100 (320) 550 (300) 430 300 3,000 350 2,400 680 Trade payables Revenue Depreciation Short-term investments Inventories Long-term debt Provisions Administrative expenses Federal and provincial taxes? Trade receivables Finance income Finance expensel Property, plant, and equipment Dividends paid Cost of goods sold Cash and cash equivalents 770 (550) (420) (500) (400) 450 400 50 120 (150) 5,800 (410) (1,700) 300 (150) 5,000 (410) (1,600) 800 Taxes are paid in their entirety in the year in which the tax obligation is incurred. b Finance income is gain in value of short-term investments. Property, plant, and equipment are net of accumulated depreciation and impairment losses since the assets were installedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started