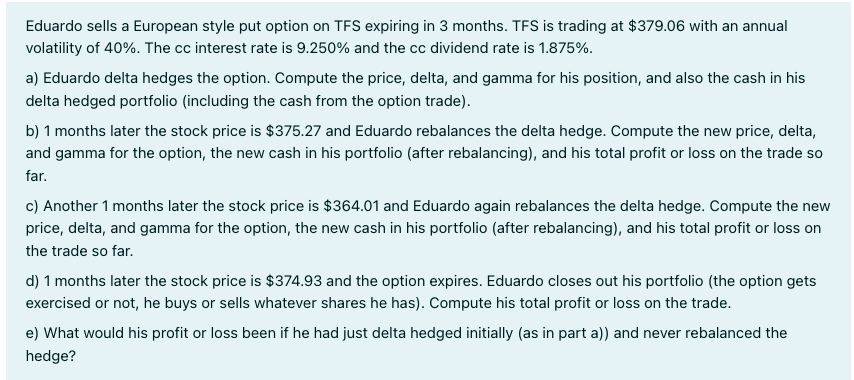

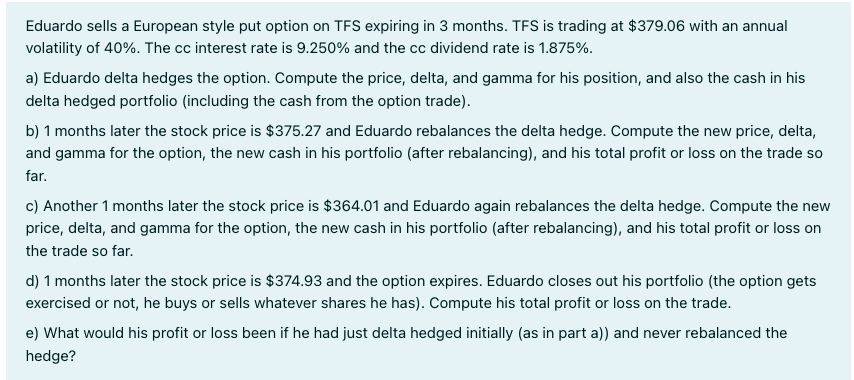

Eduardo sells a European style put option on TFS expiring in 3 months. TFS is trading at $379.06 with an annual volatility of 40%. The cc interest rate is 9.250% and the cc dividend rate is 1.875%. a) Eduardo delta hedges the option. Compute the price, delta, and gamma for his position, and also the cash in his delta hedged portfolio (including the cash from the option trade). b) 1 months later the stock price is $375.27 and Eduardo rebalances the delta hedge. Compute the new price, delta, and gamma for the option, the new cash in his portfolio (after rebalancing), and his total profit or loss on the trade so far. c) Another 1 months later the stock price is $364.01 and Eduardo again rebalances the delta hedge. Compute the new price, delta, and gamma for the option, the new cash in his portfolio (after rebalancing), and his total profit or loss on the trade so far. d) 1 months later the stock price is $374.93 and the option expires. Eduardo closes out his portfolio (the option gets exercised or not, he buys or sells whatever shares he has). Compute his total profit or loss on the trade. e) What would his profit or loss been if he had just delta hedged initially (as in part a)) and never rebalanced the hedge? Eduardo sells a European style put option on TFS expiring in 3 months. TFS is trading at $379.06 with an annual volatility of 40%. The cc interest rate is 9.250% and the cc dividend rate is 1.875%. a) Eduardo delta hedges the option. Compute the price, delta, and gamma for his position, and also the cash in his delta hedged portfolio (including the cash from the option trade). b) 1 months later the stock price is $375.27 and Eduardo rebalances the delta hedge. Compute the new price, delta, and gamma for the option, the new cash in his portfolio (after rebalancing), and his total profit or loss on the trade so far. c) Another 1 months later the stock price is $364.01 and Eduardo again rebalances the delta hedge. Compute the new price, delta, and gamma for the option, the new cash in his portfolio (after rebalancing), and his total profit or loss on the trade so far. d) 1 months later the stock price is $374.93 and the option expires. Eduardo closes out his portfolio (the option gets exercised or not, he buys or sells whatever shares he has). Compute his total profit or loss on the trade. e) What would his profit or loss been if he had just delta hedged initially (as in part a)) and never rebalanced the hedge