Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) If Easton deposits $19,750 in a bank account that pays interest of 3.75%, compounded annually, how much will Easton have in the account

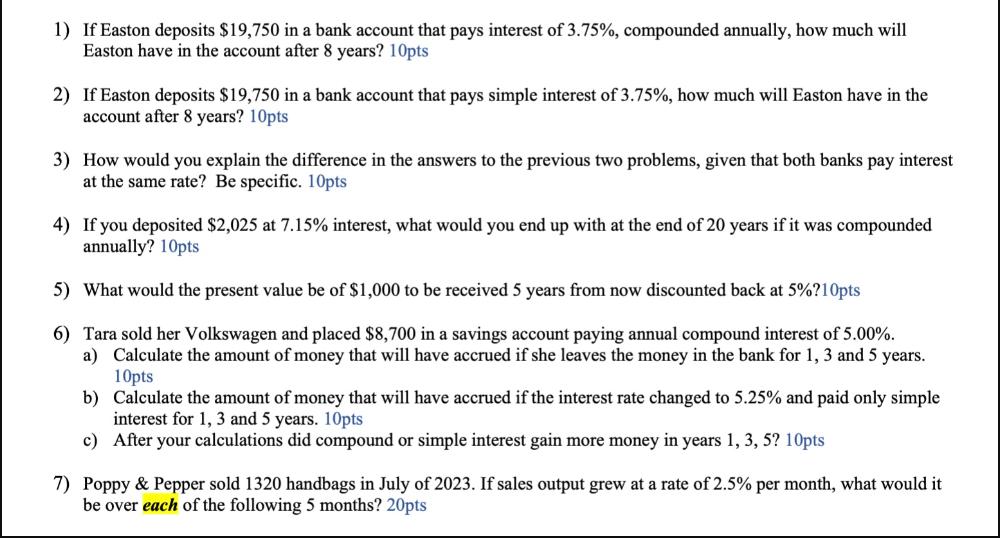

1) If Easton deposits $19,750 in a bank account that pays interest of 3.75%, compounded annually, how much will Easton have in the account after 8 years? 10pts 2) If Easton deposits $19,750 in a bank account that pays simple interest of 3.75%, how much will Easton have in the account after 8 years? 10pts 3) How would you explain the difference in the answers to the previous two problems, given that both banks pay interest at the same rate? Be specific. 10pts 4) If you deposited $2,025 at 7.15% interest, what would you end up with at the end of 20 years if it was compounded annually? 10pts 5) What would the present value be of $1,000 to be received 5 years from now discounted back at 5%?10pts 6) Tara sold her Volkswagen and placed $8,700 in a savings account paying annual compound interest of 5.00%. a) Calculate the amount of money that will have accrued if she leaves the money in the bank for 1, 3 and 5 years. 10pts b) Calculate the amount of money that will have accrued if the interest rate changed to 5.25% and paid only simple interest for 1, 3 and 5 years. 10pts c) After your calculations did compound or simple interest gain more money in years 1, 3, 5? 10pts 7) Poppy & Pepper sold 1320 handbags in July of 2023. If sales output grew at a rate of 2.5% per month, what would it be over each of the following 5 months? 20pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started