Question

1. If LIFO is used as a method for evaluating inventory, then the companys Income statement will show the cost of goods sold expense at

1. If LIFO is used as a method for evaluating inventory, then the companys Income statement will show the cost of goods sold expense at a value of: *

A) $16,500

B) $13,500

C) $15,513.3

D) $4,400

E) None of the above

2. If FIFO is used as a method for evaluating inventory, then the companys Income statement will show the cost of goods sold expense at a value of: *

A) $16,500

B) $13,500

C) $15,513.3

D) $1,400

E) None of the above

3. The companys average cost per unit is equal to: *

A) $11.9

B) $11

C) $13

D) $13.7

E) None of the above

4. When using LIFO method for evaluating inventory: *

A) COGS value is understated on the income statement.

B) The cost of inventory is matched with current selling prices.

C) Ending inventory on the Balance Sheet is understated

D) Both (B) & (C)

E) None of the above

5. If a company is experiencing continuously lower costs. Which cost flow assumption will result in less income tax expense for this company? *

A) FIFO Method, Because matching the latest/recent/higher costs against current sales results in less profit, less taxable income, and less income tax expense than LIFO or an average cost.

B) LIFO Method, Because matching the latest/recent/higher costs against current sales results in less profit, less taxable income, and less income tax expense than FIFO or an average cost.

C) Average Cost Method.

D) None of the above

6. Using the average cost method of evaluating inventory, the COGS would be: *

A) Higher than the COGS under the FIFO method.

B) Lower than the COGS under the LIFO method

C) Both (A) and (B)

D) None of the above

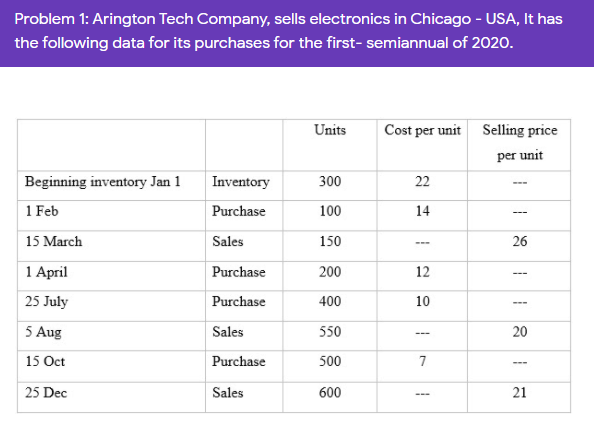

Problem 1: Arington Tech Company, sells electronics in Chicago - USA, It has the following data for its purchases for the first- semiannual of 2020. Units Cost per unit Selling price per unit 22 Inventory 300 --- Beginning inventory Jan 1 1 Feb 100 14 15 March 150 26 Purchase Sales Purchase Purchase 1 April 200 12 25 July 400 10 5 Aug Sales 550 20 15 Oct Purchase 500 7 25 Dec Sales 600 21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started