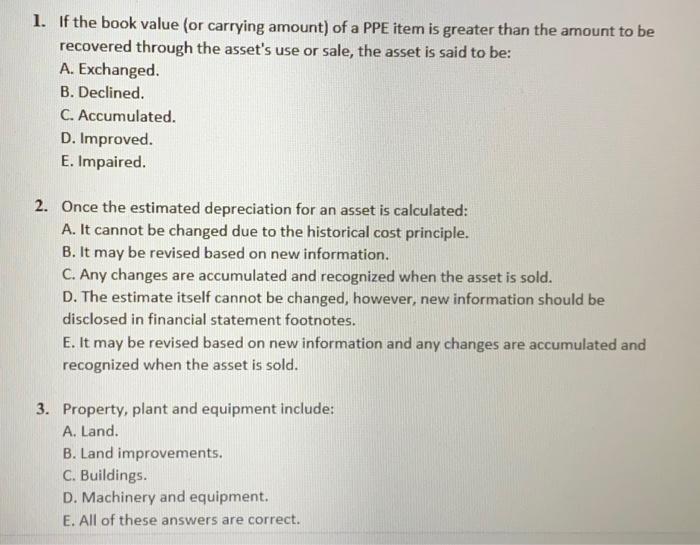

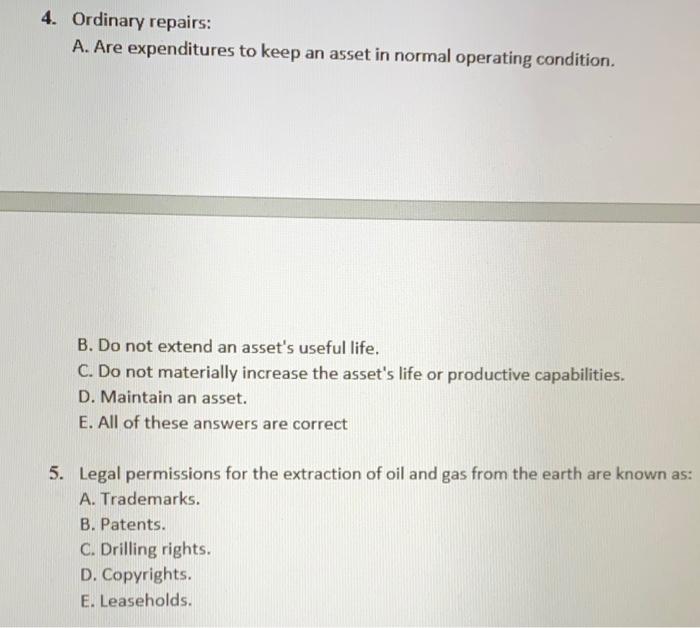

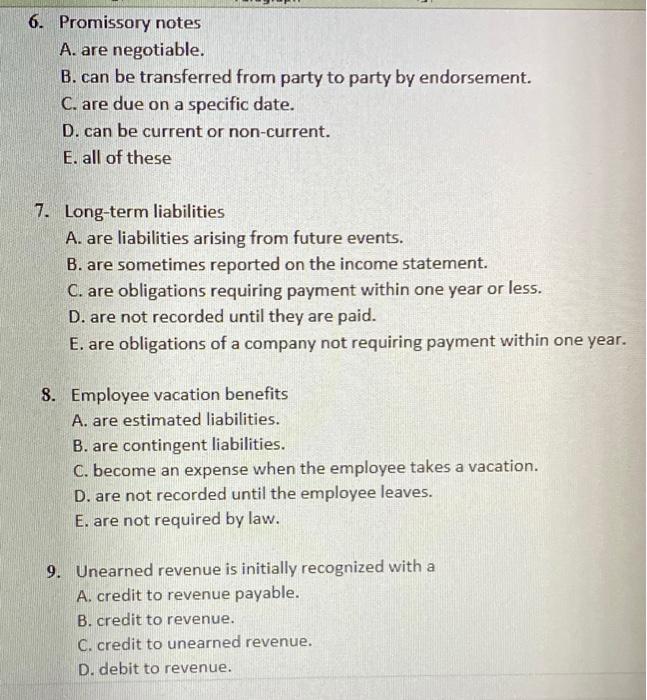

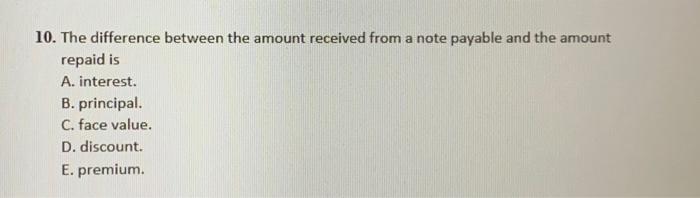

1. If the book value (or carrying amount) of a PPE item is greater than the amount to be recovered through the asset's use or sale, the asset is said to be: A. Exchanged. B. Declined. C. Accumulated. D. Improved. E. Impaired. 2. Once the estimated depreciation for an asset is calculated: A. It cannot be changed due to the historical cost principle. B. It may be revised based on new information. C. Any changes are accumulated and recognized when the asset is sold. D. The estimate itself cannot be changed, however, new information should be disclosed in financial statement footnotes. E. It may be revised based on new information and any changes are accumulated and recognized when the asset is sold. 3. Property, plant and equipment include: A. Land B. Land improvements. C. Buildings. D. Machinery and equipment. E. All of these answers are correct. 4. Ordinary repairs: A. Are expenditures to keep an asset in normal operating condition. B. Do not extend an asset's useful life. C. Do not materially increase the asset's life or productive capabilities. D. Maintain an asset. E. All of these answers are correct 5. Legal permissions for the extraction of oil and gas from the earth are known as: A. Trademarks. B. Patents. C. Drilling rights. D. Copyrights. E. Leaseholds. 6. Promissory notes A. are negotiable. B. can be transferred from party to party by endorsement. C. are due on a specific date. D. can be current or non-current. E. all of these 7. Long-term liabilities A. are liabilities arising from future events. B. are sometimes reported on the income statement. C. are obligations requiring payment within one year or less. D. are not recorded until they are paid. E. are obligations of a company not requiring payment within one year. 8. Employee vacation benefits A. are estimated liabilities. B. are contingent liabilities. C. become an expense when the employee takes a vacation. D. are not recorded until the employee leaves. E. are not required by law. 9. Unearned revenue is initially recognized with a A. credit to revenue payable. B. credit to revenue. C. credit to unearned revenue. D. debit to revenue. 10. The difference between the amount received from a note payable and the amount repaid is A. interest. B. principal. C. face value. D. discount. E. premium