1. If UA was to achieve an ACP of 40 days, 100 Inventory Days and 90 days of A/P, how much cash would it save in 2020 if Revenue and Cost of Goods Sold was expected to increase by 6%. Use 2019 as a base.

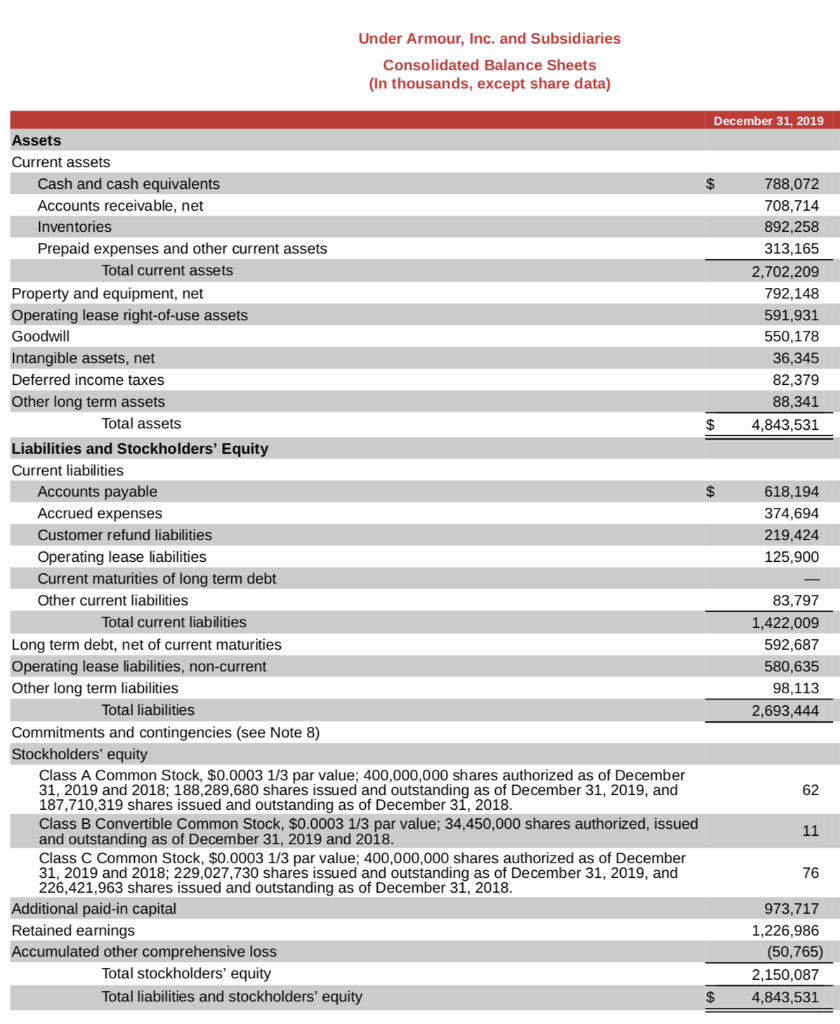

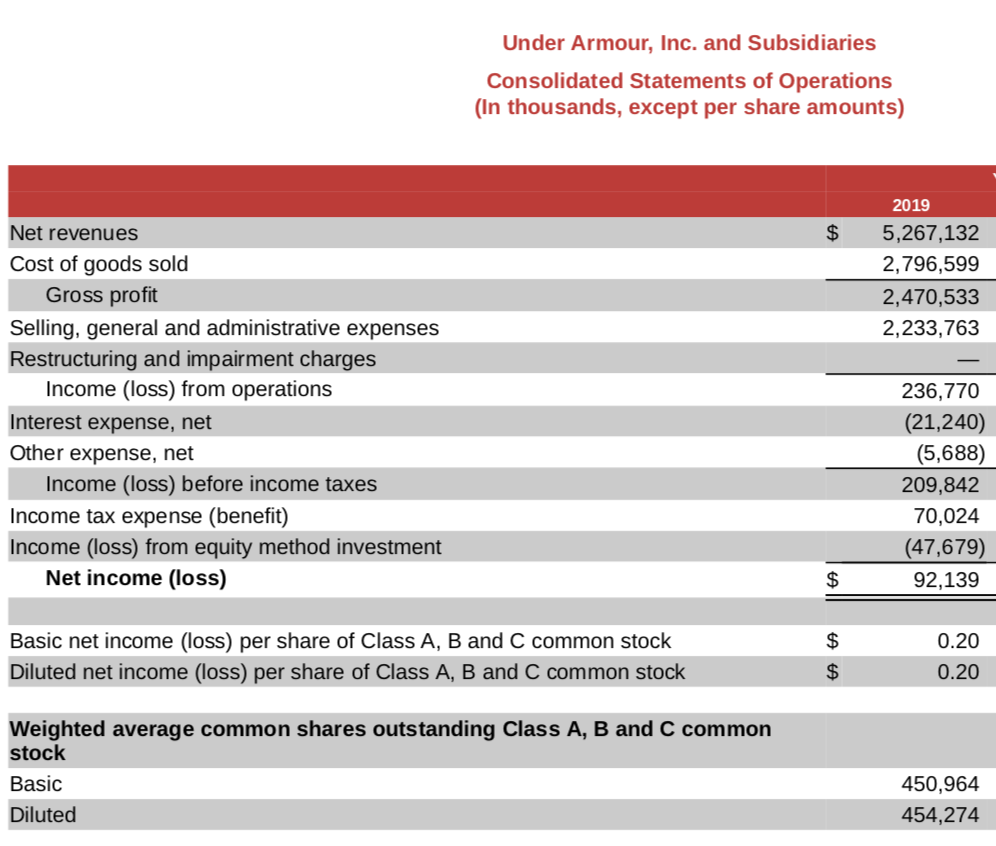

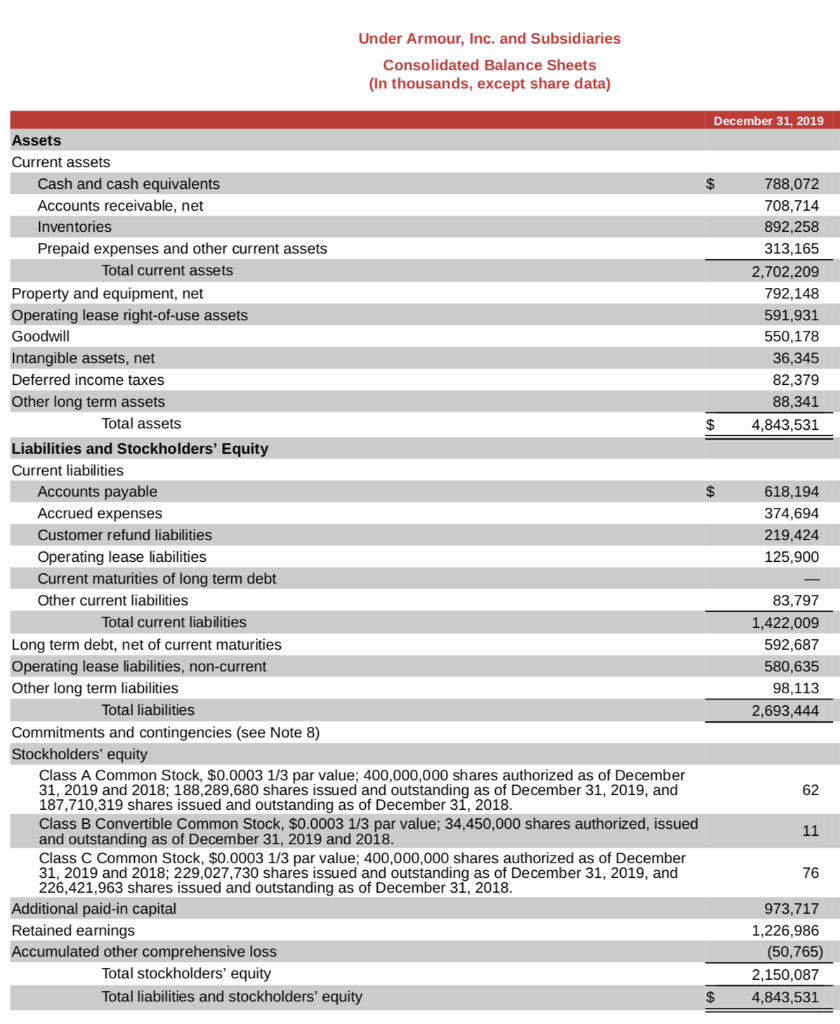

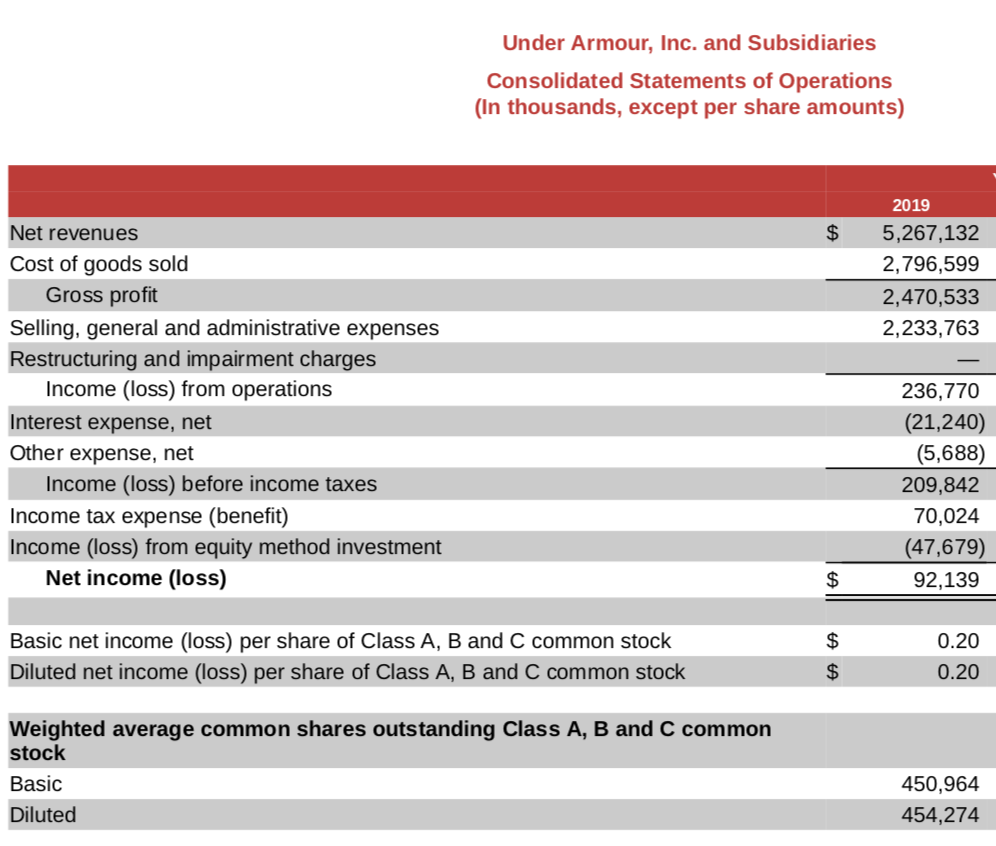

Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Commitments and contingencies (see Note 8) Stockholders' equity Class A Common Stock, $0.00031/3 par value; 400,000,000 shares authorized as of December 31,2019 and 2018;188,289,680 shares issued and outstanding as of December 31,2019 , and 187,710,319 shares issued and outstanding as of December 31,2018. Class B Convertible Common Stock, $0.00031/3 par value; 34,450,000 shares authorized, issued and outstanding as of December 31,2019 and 2018. Class C Common Stock, $0.00031/3 par value; 400,000,000 shares authorized as of December 31,2019 and 2018;229,027,730 shares issued and outstanding as of December 31,2019 , and 226,421,963 shares issued and outstanding as of December 31,2018. \begin{tabular}{lr} Additional paid-in capital & \multicolumn{1}{r}{973,717} \\ \hline Retained earnings & 1,226,986 \\ \hline Accumulated other comprehensive loss & (50,765) \\ \hline Total stockholders' equity & 2,150,087 \\ \hline Total liabilities and stockholders' equity & $,843,531 \\ \hline \hline \end{tabular} Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Commitments and contingencies (see Note 8) Stockholders' equity Class A Common Stock, $0.00031/3 par value; 400,000,000 shares authorized as of December 31,2019 and 2018;188,289,680 shares issued and outstanding as of December 31,2019 , and 187,710,319 shares issued and outstanding as of December 31,2018. Class B Convertible Common Stock, $0.00031/3 par value; 34,450,000 shares authorized, issued and outstanding as of December 31,2019 and 2018. Class C Common Stock, $0.00031/3 par value; 400,000,000 shares authorized as of December 31,2019 and 2018;229,027,730 shares issued and outstanding as of December 31,2019 , and 226,421,963 shares issued and outstanding as of December 31,2018. \begin{tabular}{lr} Additional paid-in capital & \multicolumn{1}{r}{973,717} \\ \hline Retained earnings & 1,226,986 \\ \hline Accumulated other comprehensive loss & (50,765) \\ \hline Total stockholders' equity & 2,150,087 \\ \hline Total liabilities and stockholders' equity & $,843,531 \\ \hline \hline \end{tabular} Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts)