Question

1.. If you invested one dollar at the beginning of the period in the S&P500, how much would it be worth ten years later? 2.

1.. If you invested one dollar at the beginning of the period in the S&P500, how much would it be worth ten years later?

2. What was the geometric mean return for the 10-year period?

3.What was the arithmetic average return of the S&P500 for the 10-year period?

4.What was the standard deviation of returns for the 10-year period?

5.What was the variance of returns for the 10-year period?

6.Using this data, and assuming that returns are normally distributed, what range of stock returns would you expect 68% of the time for a given year?

i need all calculation

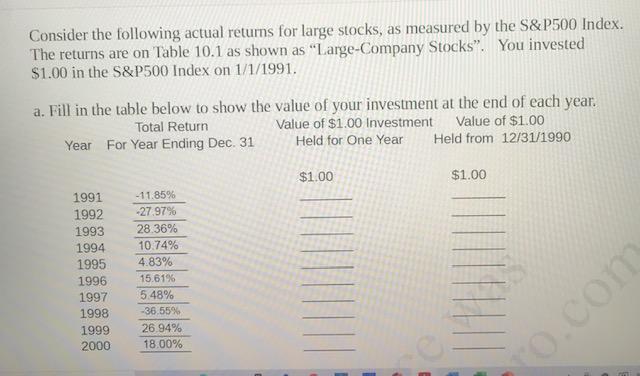

Consider the following actual returns for large stocks, as measured by the S&P500 Index. The returns are on Table 10.1 as shown as "Large-Company Stocks. You invested $1.00 in the S&P500 Index on 1/1/1991. a. Fill in the table below to show the value of your investment at the end of each year. Total Return Value of $1.00 Investment Value of $1.00 Year For Year Ending Dec. 31 Held for One Year Held from 12/31/1990 $1.00 $1.00 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 - 11.85% -27.97% 28.36% 10.74% 4.83% 15.61% 5.48% -36.55% 26.94% 18.00% Consider the following actual returns for large stocks, as measured by the S&P500 Index. The returns are on Table 10.1 as shown as "Large-Company Stocks. You invested $1.00 in the S&P500 Index on 1/1/1991. a. Fill in the table below to show the value of your investment at the end of each year. Total Return Value of $1.00 Investment Value of $1.00 Year For Year Ending Dec. 31 Held for One Year Held from 12/31/1990 $1.00 $1.00 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 - 11.85% -27.97% 28.36% 10.74% 4.83% 15.61% 5.48% -36.55% 26.94% 18.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started