Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In 2020, Anderson, a Single person with taxable income of $38,000, has the following stock transactions: Stock Date Bought Basis Date Sold Proceed Amount

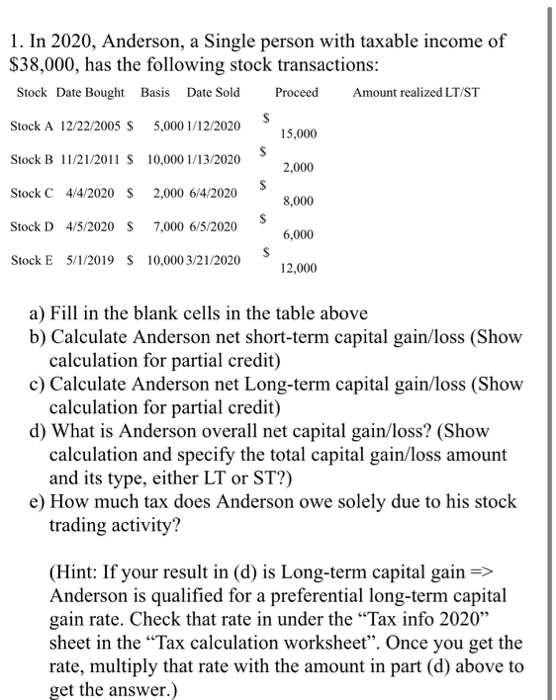

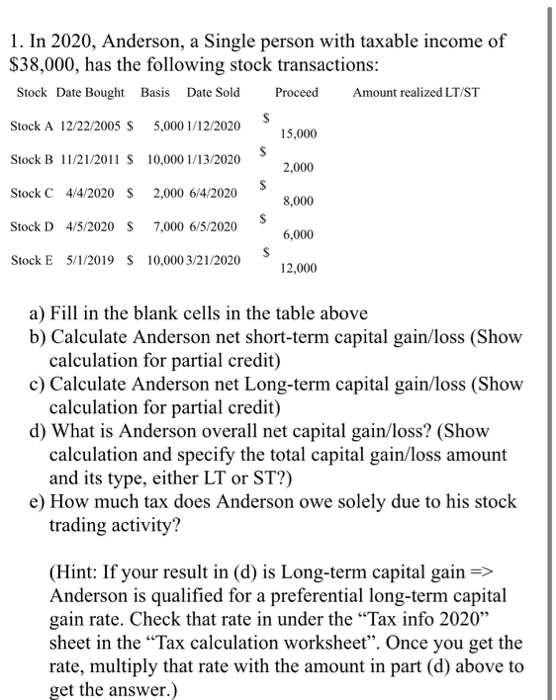

1. In 2020, Anderson, a Single person with taxable income of $38,000, has the following stock transactions: Stock Date Bought Basis Date Sold Proceed Amount realized LT/ST Stock A 12/22/2005 S 5,000 1/12/2020 s 15,000 Stock B 11/21/2011 $ 10,0001/13/2020 2,000 Stock C 4/4/2020 $ 2,000 6/4/2020 8,000 Stock D 4/5/2020 $ 7,000 6/5/2020 $ 6,000 Stock E 5/1/2019 $ 10,000 3/21/2020 12,000 $ $ $ a) Fill in the blank cells in the table above b) Calculate Anderson net short-term capital gain/loss (Show calculation for partial credit) c) Calculate Anderson net Long-term capital gain/loss (Show calculation for partial credit) d) What is Anderson overall net capital gain/loss? (Show calculation and specify the total capital gain/loss amount and its type, either LT or ST?) e) How much tax does Anderson owe solely due to his stock trading activity? (Hint: If your result in (d) is Long-term capital gain => Anderson is qualified for a preferential long-term capital gain rate. Check that rate in under the Tax info 2020 sheet in the Tax calculation worksheet. Once you get the rate, multiply that rate with the amount in part (d) above to get the answer.)

1. In 2020, Anderson, a Single person with taxable income of $38,000, has the following stock transactions: Stock Date Bought Basis Date Sold Proceed Amount realized LT/ST Stock A 12/22/2005 S 5,000 1/12/2020 s 15,000 Stock B 11/21/2011 $ 10,0001/13/2020 2,000 Stock C 4/4/2020 $ 2,000 6/4/2020 8,000 Stock D 4/5/2020 $ 7,000 6/5/2020 $ 6,000 Stock E 5/1/2019 $ 10,000 3/21/2020 12,000 $ $ $ a) Fill in the blank cells in the table above b) Calculate Anderson net short-term capital gain/loss (Show calculation for partial credit) c) Calculate Anderson net Long-term capital gain/loss (Show calculation for partial credit) d) What is Anderson overall net capital gain/loss? (Show calculation and specify the total capital gain/loss amount and its type, either LT or ST?) e) How much tax does Anderson owe solely due to his stock trading activity? (Hint: If your result in (d) is Long-term capital gain => Anderson is qualified for a preferential long-term capital gain rate. Check that rate in under the Tax info 2020 sheet in the Tax calculation worksheet. Once you get the rate, multiply that rate with the amount in part (d) above to get the answer.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started