Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In applied corporate finance, which of the following capital allocation strategies creates value? Why or why not (one or two sentences)? A. Capital Stock

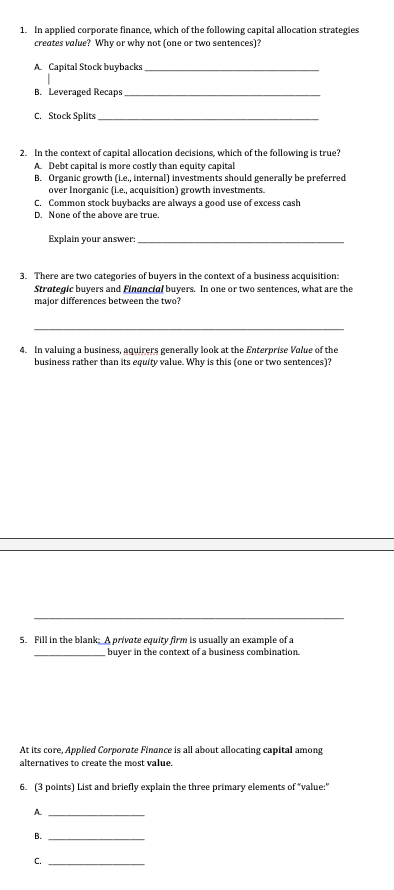

1. In applied corporate finance, which of the following capital allocation strategies creates value? Why or why not (one or two sentences)? A. Capital Stock buybacks B. Leveraged Recaps C. Stock Splits 2. In the context of capital allocation decisions, which of the following is true? A. Debt capital is more costly than equity capital B. Organic growth (L.e., internal) investments should generally be preferred over Inorganic (i.e., acquisition) growth investments. C. Common stock buybacks are always a good use of excess cash D. None of the above are true. Explain your answer: 3. There are two categories of buyers in the context of a business acquisition: Strategic buyers and Einancial buyers. In one or two sentences, what are the major differences between the two? 4. In valuing a business, aquirers generally look at the Enterprise Value of the business rather than its equity value. Why is this (one or two sentences)? 5. Fill in the blank: A private equity firm is usually an example of a buyer in the context of a business combination. At its core, Applied Corporate Finance is all about allocating capital among alternatives to create the most value. 6. (3 points) List and briefly explain the three primary elements of \"value:\" A. B. c

1. In applied corporate finance, which of the following capital allocation strategies creates value? Why or why not (one or two sentences)? A. Capital Stock buybacks B. Leveraged Recaps C. Stock Splits 2. In the context of capital allocation decisions, which of the following is true? A. Debt capital is more costly than equity capital B. Organic growth (L.e., internal) investments should generally be preferred over Inorganic (i.e., acquisition) growth investments. C. Common stock buybacks are always a good use of excess cash D. None of the above are true. Explain your answer: 3. There are two categories of buyers in the context of a business acquisition: Strategic buyers and Einancial buyers. In one or two sentences, what are the major differences between the two? 4. In valuing a business, aquirers generally look at the Enterprise Value of the business rather than its equity value. Why is this (one or two sentences)? 5. Fill in the blank: A private equity firm is usually an example of a buyer in the context of a business combination. At its core, Applied Corporate Finance is all about allocating capital among alternatives to create the most value. 6. (3 points) List and briefly explain the three primary elements of \"value:\" A. B. c Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started