Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In comparing futures contracts with options contracts, we can say that A) in a futures contract, the buyer and seller have asymmetric rights, whereas

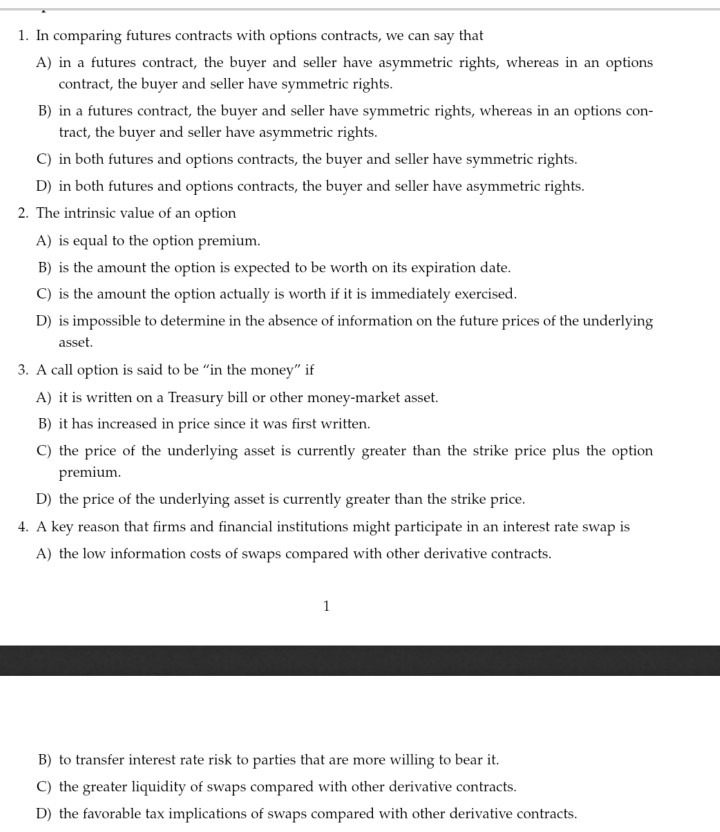

1. In comparing futures contracts with options contracts, we can say that A) in a futures contract, the buyer and seller have asymmetric rights, whereas in an options contract, the buyer and seller have symmetric rights B) in a futures contract, the buyer and seller have symmetric rights, whereas in an options con- tract, the buyer and seller have asymmetric rights. C) in both futures and options contracts, the buyer and seller have symmetric rights. D) in both futures and options contracts, the buyer and seller have asymmetric rights. 2. Th e intrinsic value of an option A) is equal to the option premium. B) is the amount the option is expected to be worth on its expiration date C) is the amount the option actually is worth if it is immediately exercised D) is impossible to determine in the absence of information on the future prices of the underlying asset. 3. A call option is said to be "in the money" if A) it is written on a Treasury bill or other money-market asset. B) it has increased in price since it was first written. C) the price of the underlying asset is currently greater than the strike price plus the option premium. D) the price of the underlying asset is currently greater than the strike price 4. A key reason that firms and financial institutions might participate in an interest rate swap is A) the low information costs of swaps compared with other derivative contracts B) to transfer interest rate risk to parties that are more willing to bear it. C) the greater liquidity of swaps compared with other derivative contracts. D) the favorable tax implications of swaps compared with other derivative contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started