Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In recent testimony before Congress Federal Reserve Chair Jerome Powell indicated that the Fed might move to raise interest rates earlier than anticipated. A.

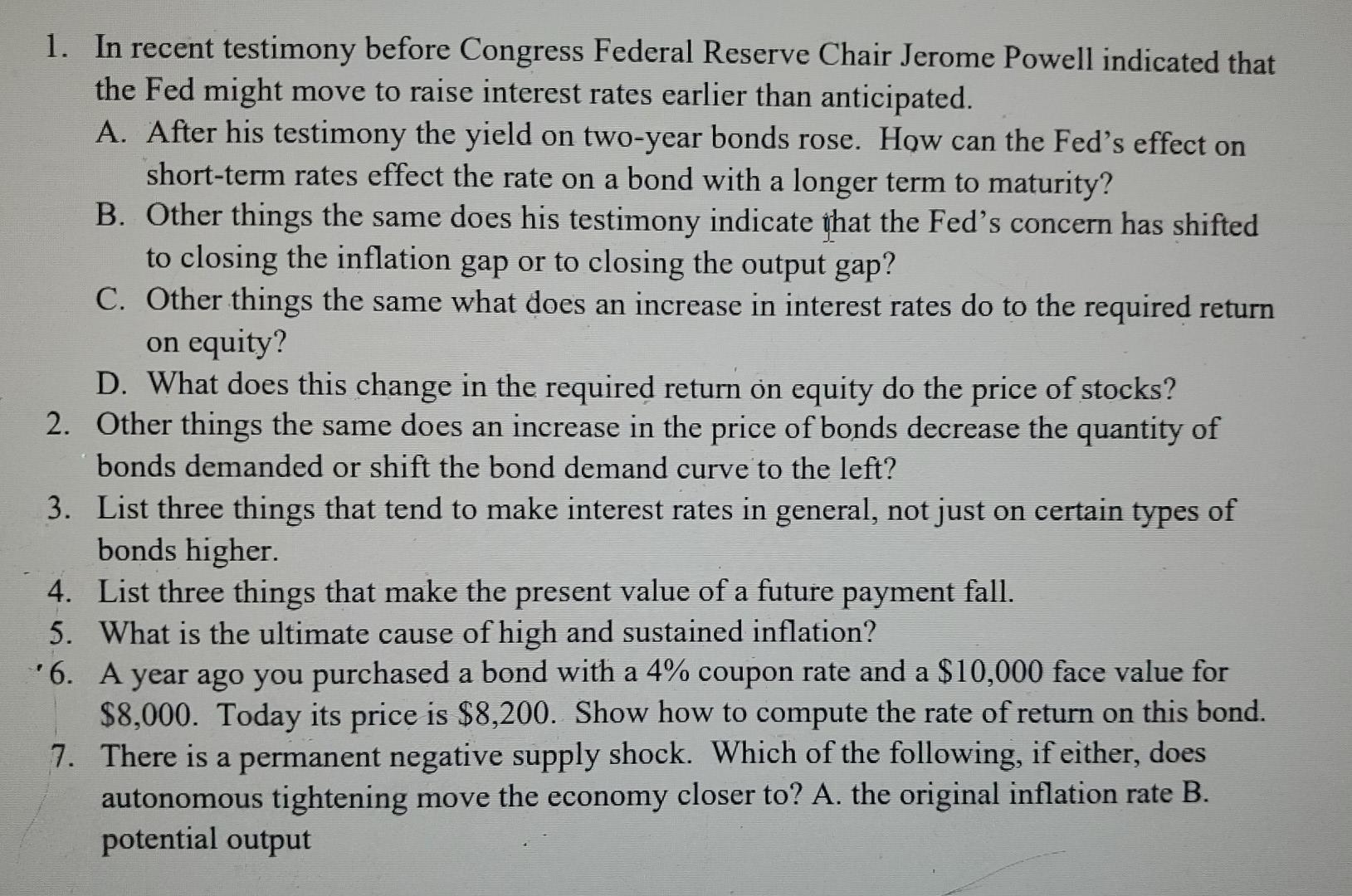

1. In recent testimony before Congress Federal Reserve Chair Jerome Powell indicated that the Fed might move to raise interest rates earlier than anticipated. A. After his testimony the yield on two-year bonds rose. How can the Fed's effect on short-term rates effect the rate on a bond with a longer term to maturity? B. Other things the same does his testimony indicate that the Fed's concern has shifted to closing the inflation gap or to closing the output gap? C. Other things the same what does an increase in interest rates do to the required return on equity? D. What does this change in the required return on equity do the price of stocks? 2. Other things the same does an increase in the price of bonds decrease the quantity of bonds demanded or shift the bond demand curve to the left? 3. List three things that tend to make interest rates in general, not just on certain types of bonds higher. 4. List three things that make the present value of a future payment fall. 5. What is the ultimate cause of high and sustained inflation? 6. A year ago you purchased a bond with a 4% coupon rate and a $10,000 face value for $8,000. Today its price is $8,200. Show how to compute the rate of return on this bond. 7. There is a permanent negative supply shock. Which of the following, if either, does autonomous tightening move the economy closer to? A. the original inflation rate B. potential output a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started