Answered step by step

Verified Expert Solution

Question

1 Approved Answer

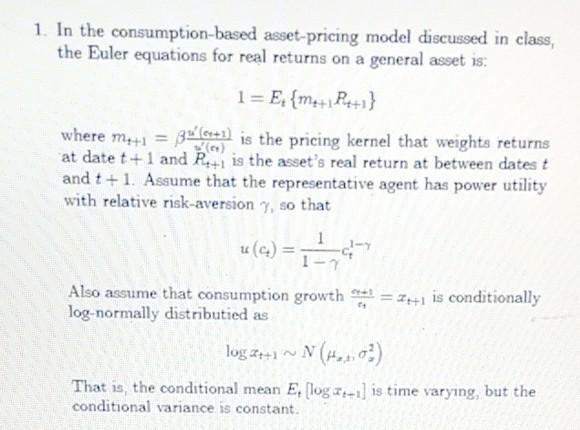

1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general asset is: 1 = E:{met Petr where

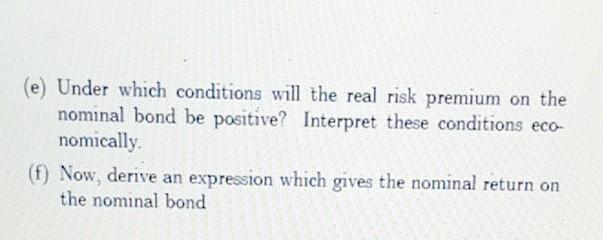

1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general asset is: 1 = E:{met Petr where mu+1 = 35 (6+1) is the pricing kernel that weights returns at date t +1 and Pet is the asset's real return at between datest and t + 1. Assume that the representative agent has power utility with relative risk-aversion, so that 1 Also assume that consumption growth = 2+1 is conditionally log-normally distributied as log t+1 ~ N(H2_, 03) That is the conditional mean Elog Tu-1) is time varying, but the conditional variance is constant. (e) Under which conditions will the real risk premium on the nominal bond be positive? Interpret these conditions eco- nomically (1) Now, derive an expression which gives the nominal return on the nominal bond 1. In the consumption-based asset-pricing model discussed in class, the Euler equations for real returns on a general asset is: 1 = E:{met Petr where mu+1 = 35 (6+1) is the pricing kernel that weights returns at date t +1 and Pet is the asset's real return at between datest and t + 1. Assume that the representative agent has power utility with relative risk-aversion, so that 1 Also assume that consumption growth = 2+1 is conditionally log-normally distributied as log t+1 ~ N(H2_, 03) That is the conditional mean Elog Tu-1) is time varying, but the conditional variance is constant. (e) Under which conditions will the real risk premium on the nominal bond be positive? Interpret these conditions eco- nomically (1) Now, derive an expression which gives the nominal return on the nominal bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started