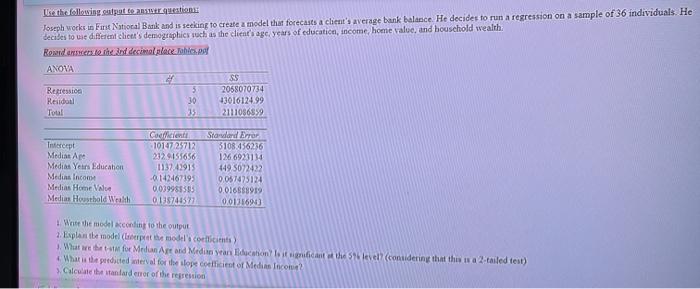

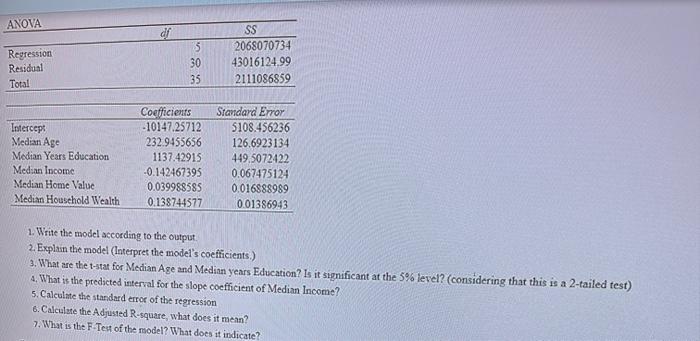

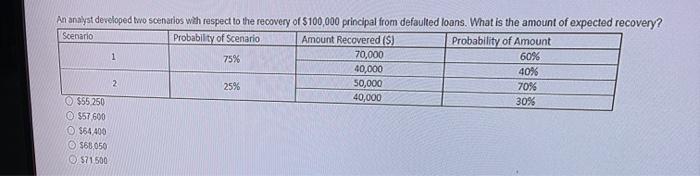

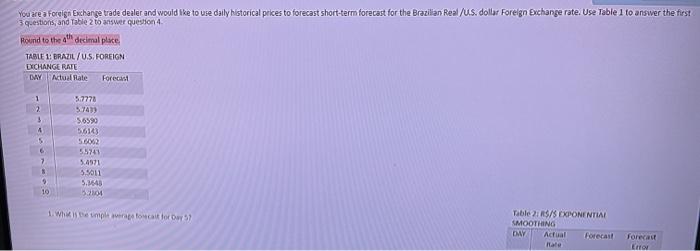

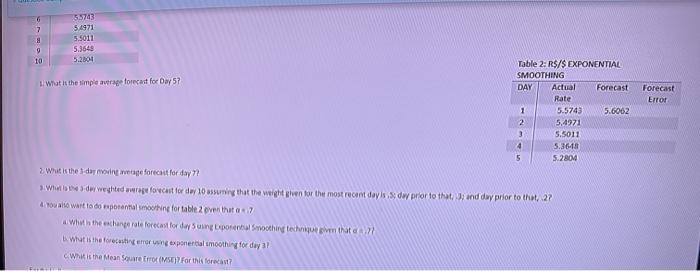

Le the following spot to answer questions Joseph works in First National Bank and is seeking to create a model that forecasts a client's average bank balance. He decides to run a regression on a sample of 36 individuals. He decides to use different clict's demographics such as the client's age years of education, income home value, and household wealth Rowards to the 3rd Decimal place Table of ANOVA SS Regression 3 2058070734 Resident 30 43016124.99 Tou! 35 2111086399 Intercept Median Are Media Years Educahon Media Income Medias Home Value Medis Housthold Wealth Coeficient 1012729712 2120155656 1132.43913 0142467193 0.019985555 0128748597 Standard Error 3108.456236 126 6923134 449 5022422 0.057475124 0.016888919 0.0121694) Write the model conding to the output 2. Explaibe model (pret the modelos corticis) Wars for Medan Art and Media Bohol level (considering that this is a 2-tailed test) What is the predicted serval foreslope corticist of Medus icon Calculate the standard error of the regreso ANOVA dr Regression Residual Total 5 30 35 SS 2068070734 43016124.99 2111086859 Intercept Median Age Median Years Education Median Income Median Home Value Median Household Wealth Coefficients -10147.25712 232.9455656 1137.42915 -0.142467395 0.039988585 0.138744577 Standard Error 5108.456236 126.6923134 449,5072422 0.067475124 0.016888989 0.01386943 1. Write the model according to the output 2. Explain the model (Interpret the model's coefficients.) 3. What are the t-stat for Median Age and Median years Education? Is it significant at the 5% level? (considering that this is a 2-tailed test) 4. What is the predicted interval for the slope coefficient of Median Income? 5. Calculate the standard error of the regression 6. Calculate the Adjusted R-square, what does it mean? 7. What is the F Test of the model? What does it indicate? An analyst developed two scenarios with respect to the recovery of $100,000 principal from defaulted loans. What is the amount of expected recovery? Scenario Probability of Scenario Amount Recovered (S) Probability of Amount 1 75% 70,000 60% 40,000 40% 2 25% 50,000 70% 40,000 $55 250 30% $57600 $64400 $68.050 571500 You are a Foreign Exchange trade dealer and would be to use daily historical prkes to forecast short-term forecast for the Brazilian Real /us. dollar Foreign Exchange rate. Use Table 1 to answer the first 3 questions and Table 2 to answer question 4 Round to the decimal place TABLE 1: BRAZIL/U.S. FOREIGN EXCHANGE RATE DAY Ntual Rate Forecast 3.7778 1 2 3 4 5 56990 546103 5602 55741 5.4971 5.5011 5.1543 53101 7 3 10 1 Whem to call for Table 2 S/S EXPONENTIAL SMOOTHING DWY Actual Forecast Forecast Error 7 21 9 55703 5.4971 5.5011 5.3548 5.2000 10 1 Wat the simple were forecast for Day 57 Forecast Error Table 2: R$/S EXPONENTIAL SMOOTHING DAY Actual Forecast Rate 1 5.5743 5.6062 2 5,4971 3 5.5011 4 5.363 5 5.2804 2 Whits the day vintage forecast for day? Wild Weyhted wage focus for day to assuming that the weight given for the most recent days. w prior to that and day prior to the 27 4 to wait to do portal mine for table even thou Whits the exchange rate forecast for daysuing porn Smoothing them to What is the forecasting mo ng poneral smoothing for day 3! What is the Mean Sore (MS? For forect? Le the following spot to answer questions Joseph works in First National Bank and is seeking to create a model that forecasts a client's average bank balance. He decides to run a regression on a sample of 36 individuals. He decides to use different clict's demographics such as the client's age years of education, income home value, and household wealth Rowards to the 3rd Decimal place Table of ANOVA SS Regression 3 2058070734 Resident 30 43016124.99 Tou! 35 2111086399 Intercept Median Are Media Years Educahon Media Income Medias Home Value Medis Housthold Wealth Coeficient 1012729712 2120155656 1132.43913 0142467193 0.019985555 0128748597 Standard Error 3108.456236 126 6923134 449 5022422 0.057475124 0.016888919 0.0121694) Write the model conding to the output 2. Explaibe model (pret the modelos corticis) Wars for Medan Art and Media Bohol level (considering that this is a 2-tailed test) What is the predicted serval foreslope corticist of Medus icon Calculate the standard error of the regreso ANOVA dr Regression Residual Total 5 30 35 SS 2068070734 43016124.99 2111086859 Intercept Median Age Median Years Education Median Income Median Home Value Median Household Wealth Coefficients -10147.25712 232.9455656 1137.42915 -0.142467395 0.039988585 0.138744577 Standard Error 5108.456236 126.6923134 449,5072422 0.067475124 0.016888989 0.01386943 1. Write the model according to the output 2. Explain the model (Interpret the model's coefficients.) 3. What are the t-stat for Median Age and Median years Education? Is it significant at the 5% level? (considering that this is a 2-tailed test) 4. What is the predicted interval for the slope coefficient of Median Income? 5. Calculate the standard error of the regression 6. Calculate the Adjusted R-square, what does it mean? 7. What is the F Test of the model? What does it indicate? An analyst developed two scenarios with respect to the recovery of $100,000 principal from defaulted loans. What is the amount of expected recovery? Scenario Probability of Scenario Amount Recovered (S) Probability of Amount 1 75% 70,000 60% 40,000 40% 2 25% 50,000 70% 40,000 $55 250 30% $57600 $64400 $68.050 571500 You are a Foreign Exchange trade dealer and would be to use daily historical prkes to forecast short-term forecast for the Brazilian Real /us. dollar Foreign Exchange rate. Use Table 1 to answer the first 3 questions and Table 2 to answer question 4 Round to the decimal place TABLE 1: BRAZIL/U.S. FOREIGN EXCHANGE RATE DAY Ntual Rate Forecast 3.7778 1 2 3 4 5 56990 546103 5602 55741 5.4971 5.5011 5.1543 53101 7 3 10 1 Whem to call for Table 2 S/S EXPONENTIAL SMOOTHING DWY Actual Forecast Forecast Error 7 21 9 55703 5.4971 5.5011 5.3548 5.2000 10 1 Wat the simple were forecast for Day 57 Forecast Error Table 2: R$/S EXPONENTIAL SMOOTHING DAY Actual Forecast Rate 1 5.5743 5.6062 2 5,4971 3 5.5011 4 5.363 5 5.2804 2 Whits the day vintage forecast for day? Wild Weyhted wage focus for day to assuming that the weight given for the most recent days. w prior to that and day prior to the 27 4 to wait to do portal mine for table even thou Whits the exchange rate forecast for daysuing porn Smoothing them to What is the forecasting mo ng poneral smoothing for day 3! What is the Mean Sore (MS? For forect