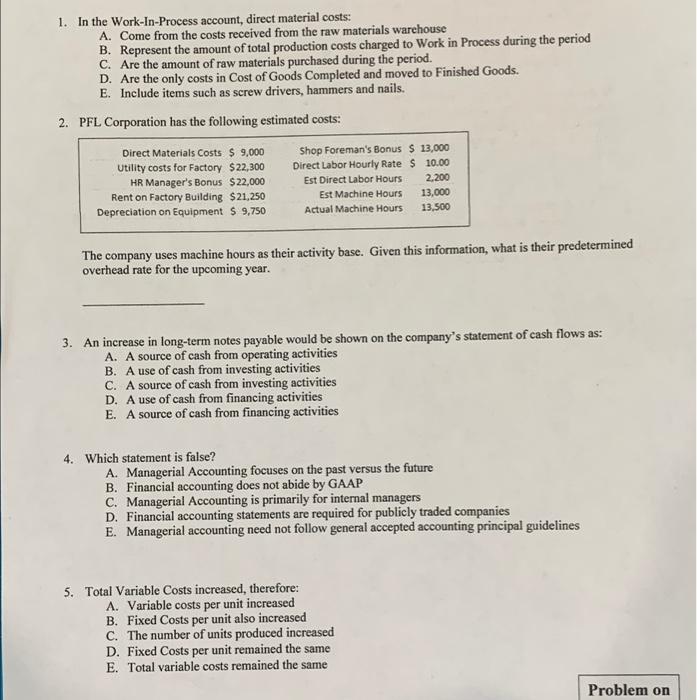

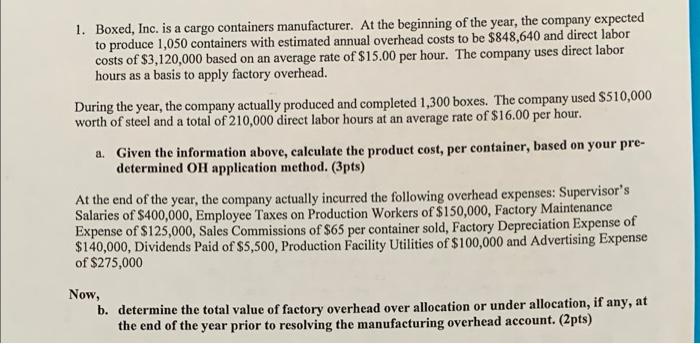

1. In the Work-In-Process account, direct material costs: A. Come from the costs received from the raw materials warehouse B. Represent the amount of total production costs charged to Work in Process during the period c. Are the amount of raw materials purchased during the period. D. Are the only costs in Cost of Goods Completed and moved to Finished Goods. E. Include items such as screw drivers, hammers and nails. 2. PFL Corporation has the following estimated costs: Direct Materials Costs $ 9,000 Shop Foreman's Bonus $ 13,000 Utility costs for Factory $22,300 Direct Labor Hourly Rate $ 10.00 HR Manager's Bonus $ 22,000 Est Direct Labor Hours 2,200 Rent on Factory Building $21,250 Est Machine Hours 13,000 Depreciation on Equipment S 9,750 Actual Machine Hours 13,500 The company uses machine hours as their activity base. Given this information, what is their predetermined overhead rate for the upcoming year. 3. An increase in long-term notes payable would be shown on the company's statement of cash flows as: A. A source of cash from operating activities B. A use of cash from investing activities C. A source of cash from investing activities D. A use of cash from financing activities E. A source of cash from financing activities 4. Which statement is false? A. Managerial Accounting focuses on the past versus the future B. Financial accounting does not abide by GAAP C. Managerial Accounting is primarily for internal managers D. Financial accounting statements are required for publicly traded companies E. Managerial accounting need not follow general accepted accounting principal guidelines 5. Total Variable Costs increased, therefore: A. Variable costs per unit increased B. Fixed Costs per unit also increased C. The number of units produced increased D. Fixed Costs per unit remained the same E. Total variable costs remained the same Problem on 1. Boxed, Inc. is a cargo containers manufacturer. At the beginning of the year, the company expected to produce 1,050 containers with estimated annual overhead costs to be $848,640 and direct labor costs of $3,120,000 based on an average rate of $15.00 per hour. The company uses direct labor hours as a basis to apply factory overhead. During the year, the company actually produced and completed 1,300 boxes. The company used $510,000 worth of steel and a total of 210,000 direct labor hours at an average rate of $16.00 per hour. a. Given the information above, calculate the product cost, per container, based on your pre- determined OH application method. (3pts) At the end of the year, the company actually incurred the following overhead expenses: Supervisor's Salaries of $400,000, Employee Taxes on Production Workers of $150,000, Factory Maintenance Expense of $125,000, Sales Commissions of $65 per container sold, Factory Depreciation Expense of $140,000, Dividends Paid of $5,500, Production Facility Utilities of $100,000 and Advertising Expense of $275,000 Now, b. determine the total value of factory overhead over allocation or under allocation, if any, at the end of the year prior to resolving the manufacturing overhead account. (2pts)