Answered step by step

Verified Expert Solution

Question

1 Approved Answer

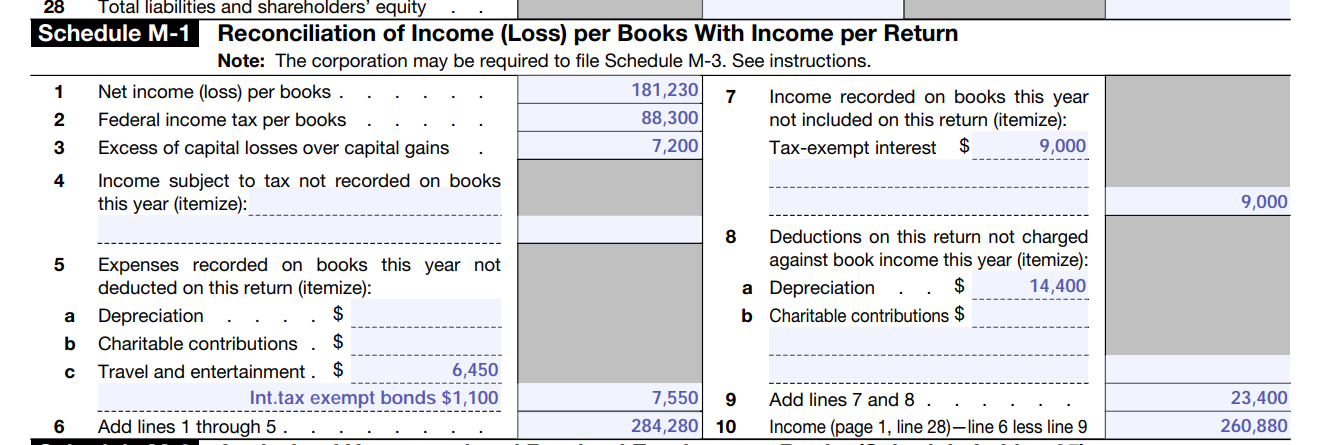

1. In this assignment, please help with Schedule M-1 of Form 1120 for Morado Corporation. Schedule M-1, is that look right? If not, please explain

1. In this assignment, please help with Schedule M-1 of Form 1120 for Morado Corporation. Schedule M-1, is that look right? If not, please explain what needs to be corrected.

Book income and need adjustments to book income to arrive at taxable income. Using the following data to complete Schedule M-1:

- Net income per books (after-tax): $181,230

- Federal income tax expense per books: $88,300

- Tax-exempt interest income: $9,000

- MACRS depreciation in excess of straight-line depreciation: $14,400

- Excess of capital loss over capital gains: $7,200

- Nondeductible meals and entertainment: $6,450

- Interest on loan to purchase tax-exempt bonds: $1,100

2. Please explain the book-tax income analysis, including an explanation of general concepts surrounding the calculation and information on their specific book-tax differences.

28 Total liabilities and shareholders' equity Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started