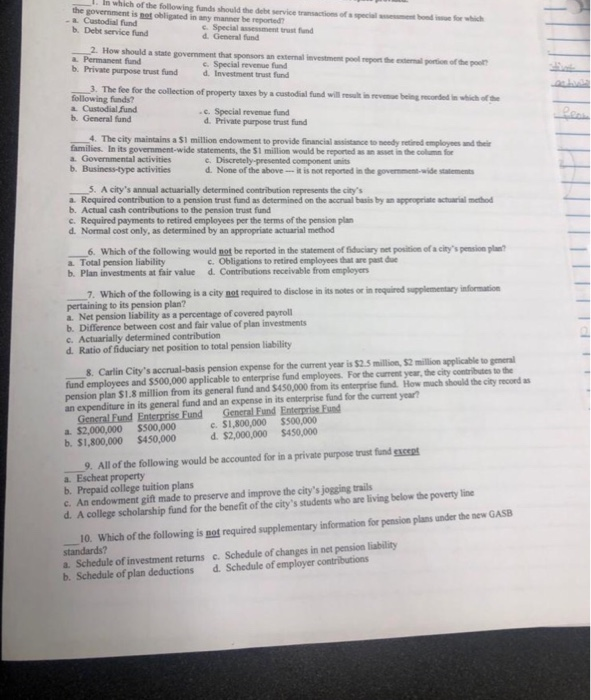

_1 . in which t ofthe following funds should the debt service transactions of #special the government is net obligated in any manner be reported et - a Custodial fund c. Special assessment trust fund d. General fund b. Debt service fund ,2 How should a state povernment hat sponsors an etmnal investment pool reporte eten mondhe me a Permanent fund b. Private purpose trust fund c. Special revenue fund d. Investment trust fund trust fund 3. The fee for the collection of property taxes by a custodial fund will result in revenue being reconded in which of th following funds? a Custodial fund b. General fund . c. Special revenue fund d. Private purpose trust fund 4. The city maintains a $1 million endowment to provide financial assistance to needy retired employees and thee In its govermment-wide statements, the 51 million would be reported as an asset in the column for a. Govermmental activities b. Business-type activities d. None of the above- it is not reported in the government-wide statements S. A city's annual actuarially determined contribution represents the city's a. Required contribution to a pension trust fund as determined on the accrual basis by an appropriate actuarial method b. Actual cash contributions to the pension trust fund c. Required payments to retired employees per the terms of the pension plan d. Normal cost only, as determined by an appropriate actuarial method 6. Which of the following would not be reported in the statement of Siduciary net position of a city's pension plae? a. Total pension liability b. Plan investments at fair value c. Obligations to retired employees that are past due d. Contributions receivable from employers 7. Which of the following is a city not required to disclose in its notes or in required supplementary information pertaining to its pension plan? a. Net pension liability as a percentage of covered payroll b. Difference between cost and fair value of plan investments c. Actuarially determined contribution d. Ratio of fiduciary net position to total pension liability 8. current year is $2.5 million $2 miltion applicable to general fund employees and $500,000 applicable to enterprise fund employees. For the current year, the city contributes to the pension plan $1.8 million from its general fund and $450,000 from its enterprise fund. How much should the city record as an expenditure in its general fund and an expense in its enterprise fund for the current year? Carlin Clity's accrual-basis pension expense for the General Fund Enterprise Fund General Fund Enterprise Fund a. $2,000,000 $500,000 c. $1,800,000 $500,000 b. $1,800,000 $450,000 d. $2,000,000 $450,000 9. All of the following would be accounted for in a private purpose trust fund exc a. Escheat property b. Prepaid college tuition plans c. An endowment gift made to preserve and improve the city's jogging trails d. A college scholarship fund for the benefit of the city's students who are living below the poverty line 10. Which of the following is not required supplementary information for pension plans under the new standards? a. Schedule of investment returns c. Schedule of changes in net pension liability b. Schedule of plan deductions d. Schedule of employer contributions _1 . in which t ofthe following funds should the debt service transactions of #special the government is net obligated in any manner be reported et - a Custodial fund c. Special assessment trust fund d. General fund b. Debt service fund ,2 How should a state povernment hat sponsors an etmnal investment pool reporte eten mondhe me a Permanent fund b. Private purpose trust fund c. Special revenue fund d. Investment trust fund trust fund 3. The fee for the collection of property taxes by a custodial fund will result in revenue being reconded in which of th following funds? a Custodial fund b. General fund . c. Special revenue fund d. Private purpose trust fund 4. The city maintains a $1 million endowment to provide financial assistance to needy retired employees and thee In its govermment-wide statements, the 51 million would be reported as an asset in the column for a. Govermmental activities b. Business-type activities d. None of the above- it is not reported in the government-wide statements S. A city's annual actuarially determined contribution represents the city's a. Required contribution to a pension trust fund as determined on the accrual basis by an appropriate actuarial method b. Actual cash contributions to the pension trust fund c. Required payments to retired employees per the terms of the pension plan d. Normal cost only, as determined by an appropriate actuarial method 6. Which of the following would not be reported in the statement of Siduciary net position of a city's pension plae? a. Total pension liability b. Plan investments at fair value c. Obligations to retired employees that are past due d. Contributions receivable from employers 7. Which of the following is a city not required to disclose in its notes or in required supplementary information pertaining to its pension plan? a. Net pension liability as a percentage of covered payroll b. Difference between cost and fair value of plan investments c. Actuarially determined contribution d. Ratio of fiduciary net position to total pension liability 8. current year is $2.5 million $2 miltion applicable to general fund employees and $500,000 applicable to enterprise fund employees. For the current year, the city contributes to the pension plan $1.8 million from its general fund and $450,000 from its enterprise fund. How much should the city record as an expenditure in its general fund and an expense in its enterprise fund for the current year? Carlin Clity's accrual-basis pension expense for the General Fund Enterprise Fund General Fund Enterprise Fund a. $2,000,000 $500,000 c. $1,800,000 $500,000 b. $1,800,000 $450,000 d. $2,000,000 $450,000 9. All of the following would be accounted for in a private purpose trust fund exc a. Escheat property b. Prepaid college tuition plans c. An endowment gift made to preserve and improve the city's jogging trails d. A college scholarship fund for the benefit of the city's students who are living below the poverty line 10. Which of the following is not required supplementary information for pension plans under the new standards? a. Schedule of investment returns c. Schedule of changes in net pension liability b. Schedule of plan deductions d. Schedule of employer contributions