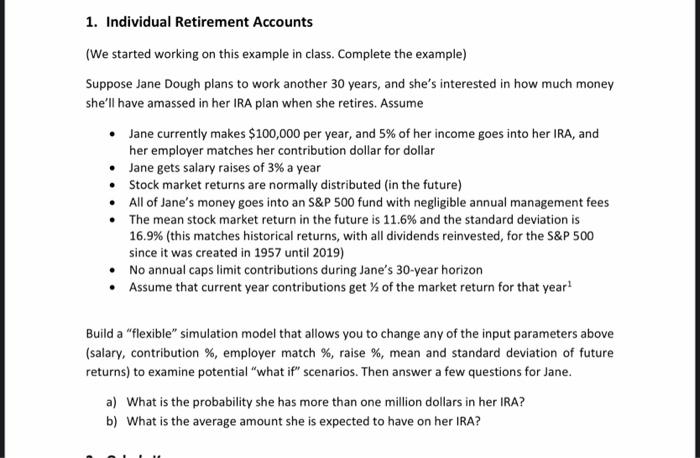

1. Individual Retirement Accounts (We started working on this example in class. Complete the example) Suppose Jane Dough plans to work another 30 years, and she's interested in how much money she'll have amassed in her IRA plan when she retires. Assume Jane currently makes $100,000 per year, and 5% of her income goes into her IRA, and her employer matches her contribution dollar for dollar Jane gets salary raises of 3% a year Stock market returns are normally distributed in the future) All of Jane's money goes into an S&P 500 fund with negligible annual management fees The mean stock market return in the future is 11.6% and the standard deviation is 16.9% (this matches historical returns, with all dividends reinvested, for the S&P 500 since it was created in 1957 until 2019) No annual caps limit contributions during Jane's 30-year horizon Assume that current year contributions get 1 of the market return for that year! Build a "flexible" simulation model that allows you to change any of the input parameters above (salary, contribution %, employer match %, raise %, mean and standard deviation of future returns) to examine potential "what if" scenarios. Then answer a few questions for Jane. a) What is the probability she has more than one million dollars in her IRA? b) What is the average amount she is expected to have on her IRA? 1. Individual Retirement Accounts (We started working on this example in class. Complete the example) Suppose Jane Dough plans to work another 30 years, and she's interested in how much money she'll have amassed in her IRA plan when she retires. Assume Jane currently makes $100,000 per year, and 5% of her income goes into her IRA, and her employer matches her contribution dollar for dollar Jane gets salary raises of 3% a year Stock market returns are normally distributed in the future) All of Jane's money goes into an S&P 500 fund with negligible annual management fees The mean stock market return in the future is 11.6% and the standard deviation is 16.9% (this matches historical returns, with all dividends reinvested, for the S&P 500 since it was created in 1957 until 2019) No annual caps limit contributions during Jane's 30-year horizon Assume that current year contributions get 1 of the market return for that year! Build a "flexible" simulation model that allows you to change any of the input parameters above (salary, contribution %, employer match %, raise %, mean and standard deviation of future returns) to examine potential "what if" scenarios. Then answer a few questions for Jane. a) What is the probability she has more than one million dollars in her IRA? b) What is the average amount she is expected to have on her IRA