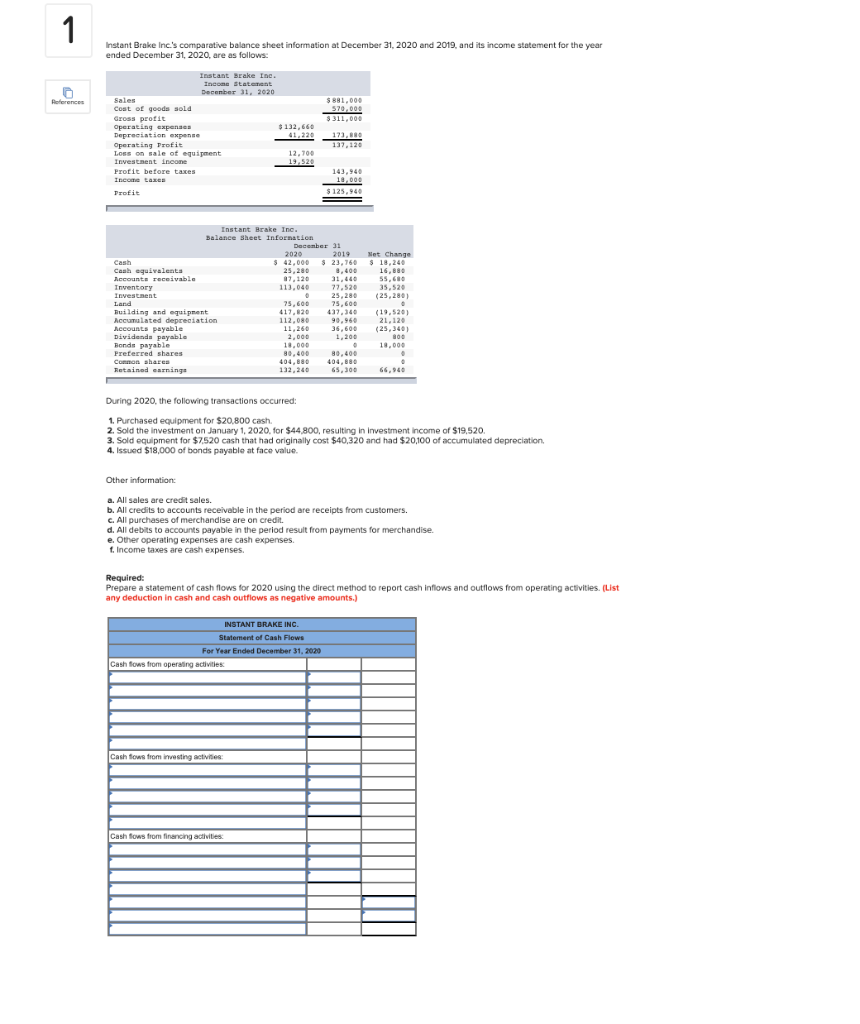

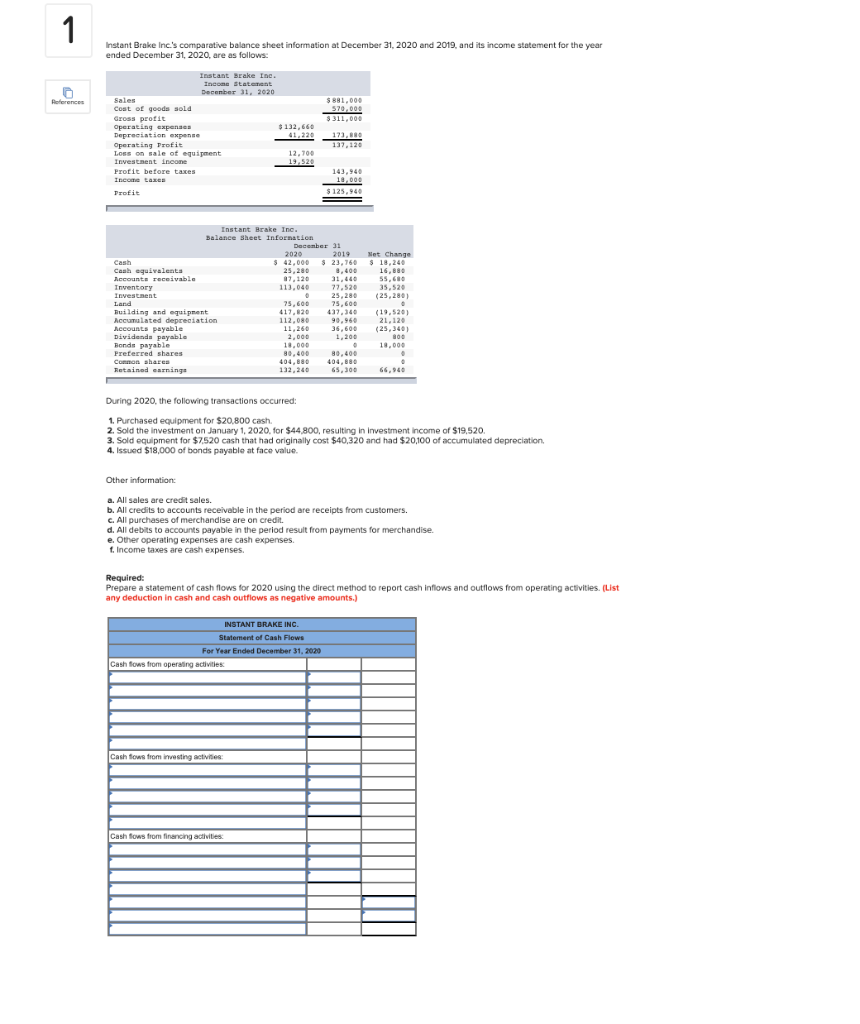

1 Instant Brake Inc.'s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020, are as follows: References $881.000 $ 570,000 $311.000 Instant Brake Ine. Income statement December 31, 2020 Sales Coat of goods sold Cross profit Operating expenses $ 132,660 Depreciation opene 41.220 Operating Profit Loss on sale of equipment 12,700 Investment Income 19.520 Protit before taxes Income taxes Profit 173.880 143,940 18.00 $ 125,94 77.520 Instant Brake Inc. Balance Sheet Information December 31 2020 2019 Net Change Cash $ 42,000 $ 23,760 18,240 Coah equivalenta 25,280 16,880 Accounts receivable 55,600 Inventory 111.040 35.520 Investment 25,280 (25,280) Land 75,600 75,600 Building and equipment 110 417.820 (19,5201 Accumulated depreciation 112,080 90.960 21.120 Accounts payable 11,260 36,600 (25,340) Dividende payable 2,000 1,200 . Bonds payable 18.000 18.000 Preferred shares 80,400 80,400 Common shares 404,080 404,830 Retained camnings 65,300 66,90 ( During 2020, the following transactions occurred: 1. Purchased equipment for $20,800 cash. 2. Sold the investment on January 1, 2020, for $44,800, resulting in Investment Income of $19,520. 3. Sold equipment for $7.520 cash that had originally cost $40,320 and had $20,100 of accumulated depreciation 4. Issued $18,000 of bonds payable at face value Other information: a. All sales are credit sales. b. All credits to accounts receivable in the period are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to accounts payable in the period result from payments for merchandise e. Other operating expenses are cash expenses. f. Income taxes are cash expenses. Required: Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. (List any deduction in cash and cash outflows as negative amounts.) INSTANT BRAKE INC. Statement of Cash Flows For Year Ended December 31, 2020 Cash fows from operating activities Cash flows from investing Cash flows from financing activities