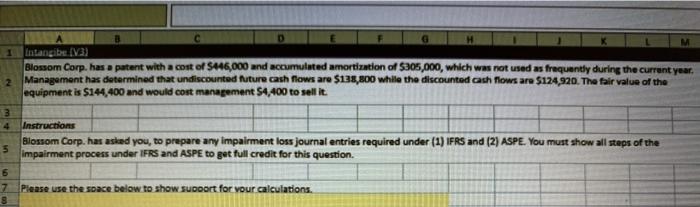

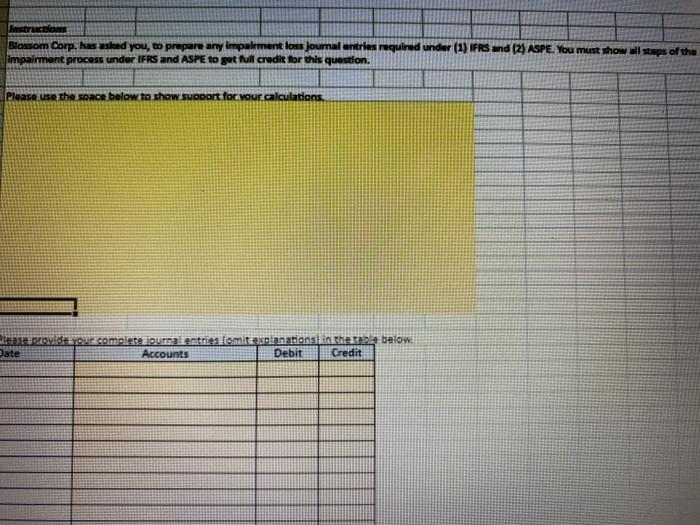

1 Intangibe (13) Blossom Corp. has a patent with a cost of S146,000 and accumulated amortization of $305,000, which was not used as frequently during the current year, 2 Management has determined that undiscounted future cash flows are $133,800 while the discounted cash flows are $124,920. The fair value of the equipment is $144,400 and would cost management 54,400 to sell it 3 Instructions Blossom Corp. has asked you, to prepare any impairment loss journal entries required under (1) IFRS and (2) ASPE. You must show all steps of the 5 impairment process under IFRS and ASPE to get full credit for this question. 6 7 Please use the space below to show support for your calculations. 4 restru Blossom Corp. has asked you, to prepare any impairment loss Journal entries required under (1) IFRS and (2) ASPE. You must show all steps of the impairment process under IFRS and ASPE to get full credit for this question. use the space below to show Support for your calculations. EPSE Provide our complete ourna entries tomit explanations in the table below. Accounts Debit Credit 1 Intangibe (13) Blossom Corp. has a patent with a cost of S146,000 and accumulated amortization of $305,000, which was not used as frequently during the current year, 2 Management has determined that undiscounted future cash flows are $133,800 while the discounted cash flows are $124,920. The fair value of the equipment is $144,400 and would cost management 54,400 to sell it 3 Instructions Blossom Corp. has asked you, to prepare any impairment loss journal entries required under (1) IFRS and (2) ASPE. You must show all steps of the 5 impairment process under IFRS and ASPE to get full credit for this question. 6 7 Please use the space below to show support for your calculations. 4 restru Blossom Corp. has asked you, to prepare any impairment loss Journal entries required under (1) IFRS and (2) ASPE. You must show all steps of the impairment process under IFRS and ASPE to get full credit for this question. use the space below to show Support for your calculations. EPSE Provide our complete ourna entries tomit explanations in the table below. Accounts Debit Credit