Question

1. Invested Capital. Provide the equation given in class and a description of what IC represents. 2. Wagner LLC has $10,000 in total assets, a

1. Invested Capital. Provide the equation given in class and a description of what IC represents.

2. Wagner LLC has $10,000 in total assets, a 5% net profit margin, and a ROE of 15%. The firm's total debt ratio is 20%. Compute Wagner's Sales.

3. Baker LLC has $10,000 in total assets. ROA is 8% and the firm's tax rate is 20%. The firm paid interest expense of $100. What is Baker's TIE ratio?

4. Thompson Trucking has 1,000 shares of common stock outstanding. Its market/book ratio is 4.0 and its P/E ratio equals 10. If the stock currently trades at $20 per share, what is the firm's EPS?

5. Which statement is TRUE? a. If expense control is a problem, one should look to the TAT ratio. b. A company that borrows a lot, relative to equity financing, would have a low EM ratio. c. One should not report both the inventory turnover ratio and the days sales inventory ratio- they measure the same thing. d. Liquidity ratios assess both the quantity and quality of current assets/liabilities. e. The goal of a financial manager should be to reduce all "stock" debt ratios - TD/TA, TD/TE, and TA/TE. After all, debt is bad.

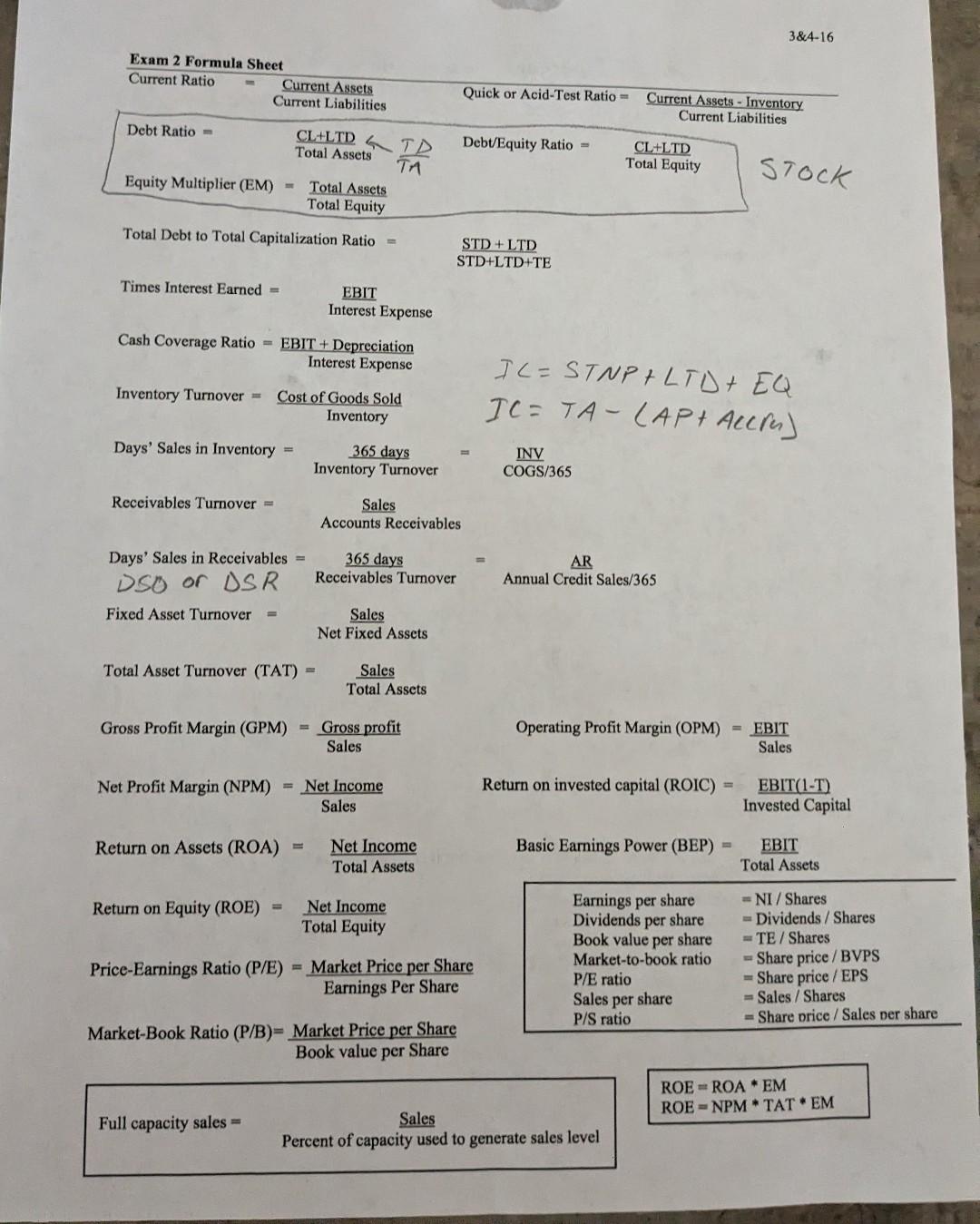

384-16 Exam2FormulaSheetCurrentRatio=CurrentLiabilitiesCurrentAssetsQuickorAcid-TestRatio=CurrentAssets-InventoryCurrentLiabilitiesDebtRatio=TotalAssetsCL+LTDTATDDebt/EquityRatio=TotalEquityCL+LTDEquityMultiplier(EM)=TotalAssetsTotalEquityTotalDebttoTotalCapitalizationRatio=STD+LTD+TESTD+LTDTimesInterestEarned=InterestExpenseEBITCashCoverageRatio=InterestExpenseEBIT+DepreciationInterestExpenseInventoryTurnover=CostofGoodsSoldInventoryDaysSalesinInventory=InventoryTurnover365days=COGS/365INVIC=STNP+LT+EQIC=TA[AP+ACCM)STOCKReceivablesTurnover=SalesAccountsReceivablesDaysSalesinReceivables=DSOorSRReceivablesTurnover=ARFixedAssetTurnover=SalesNetFixedAssetsAnnualCreditSales/365TotalAssetTurnover(TAT)=TotalAssetsSalesGrossProfitMargin(GPM)=SalesGrossprofitOperatingProfitMargin(OPM)=SalesEBITNetProfitMargin(NPM)=SalesNetIncomeReturnoninvestedcapital(ROIC)=InvestedCapitalEBIT(1-T)ReturnonAssets(ROA)=TotalAssetsNetIncomeBasicEarningsPower(BEP)=TotalAssetsEBIT ReturnonEquity(ROE)=TotalEquityNetIncome Price-EarningsRatio(P/E)=EarningsPerShareMarketPriceperShareMarket-BookRatio(P/B)=BookvalueperShareMarketPriceperShareFullcapacitysales= Sales Percent of capacity used to generate sales level ROE=ROAEMROE=NPMTATEM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started