Answered step by step

Verified Expert Solution

Question

1 Approved Answer

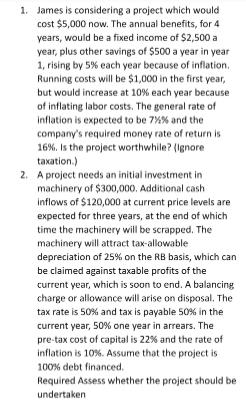

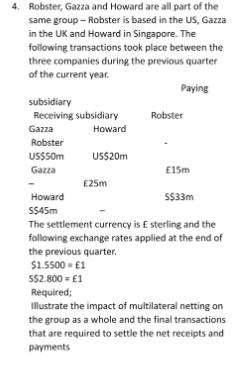

1. James is considering a project which would cost $5,000 now. The annual benefits, for 4 years, would be a fixed income of $2,500

1. James is considering a project which would cost $5,000 now. The annual benefits, for 4 years, would be a fixed income of $2,500 a year, plus other savings of $500 a year in year 1, rising by 5% each year because of inflation. Running costs will be $1,000 in the first year, but would increase at 10% each year because of inflating labor costs. The general rate of inflation is expected to be 7% % and the company's required money rate of return is 16%. Is the project worthwhile? (Ignore taxation.) 2. A project needs an initial investment in machinery of $300,000. Additional cash inflows of $120,000 at current price levels are expected for three years, at the end of which time the machinery will be scrapped. The machinery will attract tax-allowable - depreciation of 25% on the RB basis, which can be claimed against taxable profits of the current year, which is soon to end. A balancing charge or allowance will arise on disposal. The tax rate is 50% and tax is payable 50% in the current year, 50% one year in arrears. The pre-tax cost of capital is 22% and the rate of inflation is 10%. Assume that the project is 100% debt financed. Required Assess whether the project should be undertaken 4. Robster, Gazza and Howard are all part of the same group - Robster is based in the US, Gazza in the UK and Howard in Singapore. The following transactions took place between the three companies during the previous quarter of the current year. Paying subsidiary Receiving subsidiary Howard Gazza Robster US$50m Gazza US$20m 25m Robster 15m Howard S$45m The settlement currency is E sterling and the following exchange rates applied at the end of the previous quarter. $1.5500-1 552.800 = 1 Required; Illustrate the impact of multilateral netting on the group as a whole and the final transactions that are required to settle the net receipts and payments S$33m 1. James is considering a project which would cost $5,000 now. The annual benefits, for 4 years, would be a fixed income of $2,500 a year, plus other savings of $500 a year in year 1, rising by 5% each year because of inflation. Running costs will be $1,000 in the first year, but would increase at 10% each year because of inflating labor costs. The general rate of inflation is expected to be 7% % and the company's required money rate of return is 16%. Is the project worthwhile? (Ignore taxation.) 2. A project needs an initial investment in machinery of $300,000. Additional cash inflows of $120,000 at current price levels are expected for three years, at the end of which time the machinery will be scrapped. The machinery will attract tax-allowable - depreciation of 25% on the RB basis, which can be claimed against taxable profits of the current year, which is soon to end. A balancing charge or allowance will arise on disposal. The tax rate is 50% and tax is payable 50% in the current year, 50% one year in arrears. The pre-tax cost of capital is 22% and the rate of inflation is 10%. Assume that the project is 100% debt financed. Required Assess whether the project should be undertaken 4. Robster, Gazza and Howard are all part of the same group - Robster is based in the US, Gazza in the UK and Howard in Singapore. The following transactions took place between the three companies during the previous quarter of the current year. Paying subsidiary Receiving subsidiary Howard Gazza Robster US$50m Gazza US$20m 25m Robster 15m Howard S$45m The settlement currency is E sterling and the following exchange rates applied at the end of the previous quarter. $1.5500-1 552.800 = 1 Required; Illustrate the impact of multilateral netting on the group as a whole and the final transactions that are required to settle the net receipts and payments S$33m

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image includes text describing two different financial scenariosquestions The first one is about assessing the profitability of a project consider...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started