Answered step by step

Verified Expert Solution

Question

1 Approved Answer

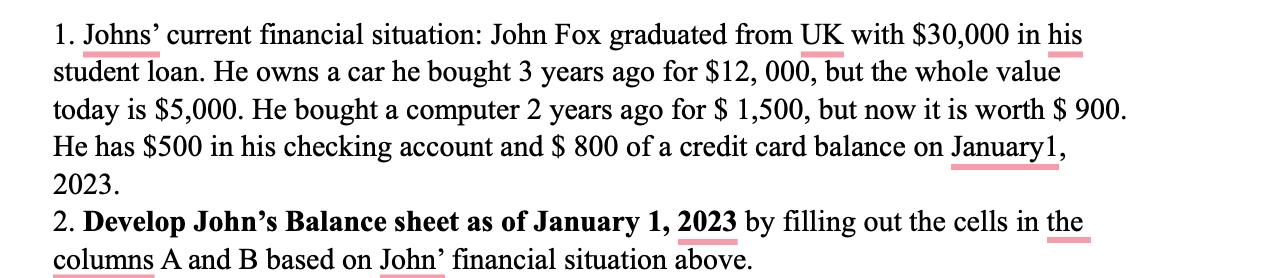

1. Johns' current financial situation: John Fox graduated from UK with $30,000 in his student loan. He owns a car he bought 3 years

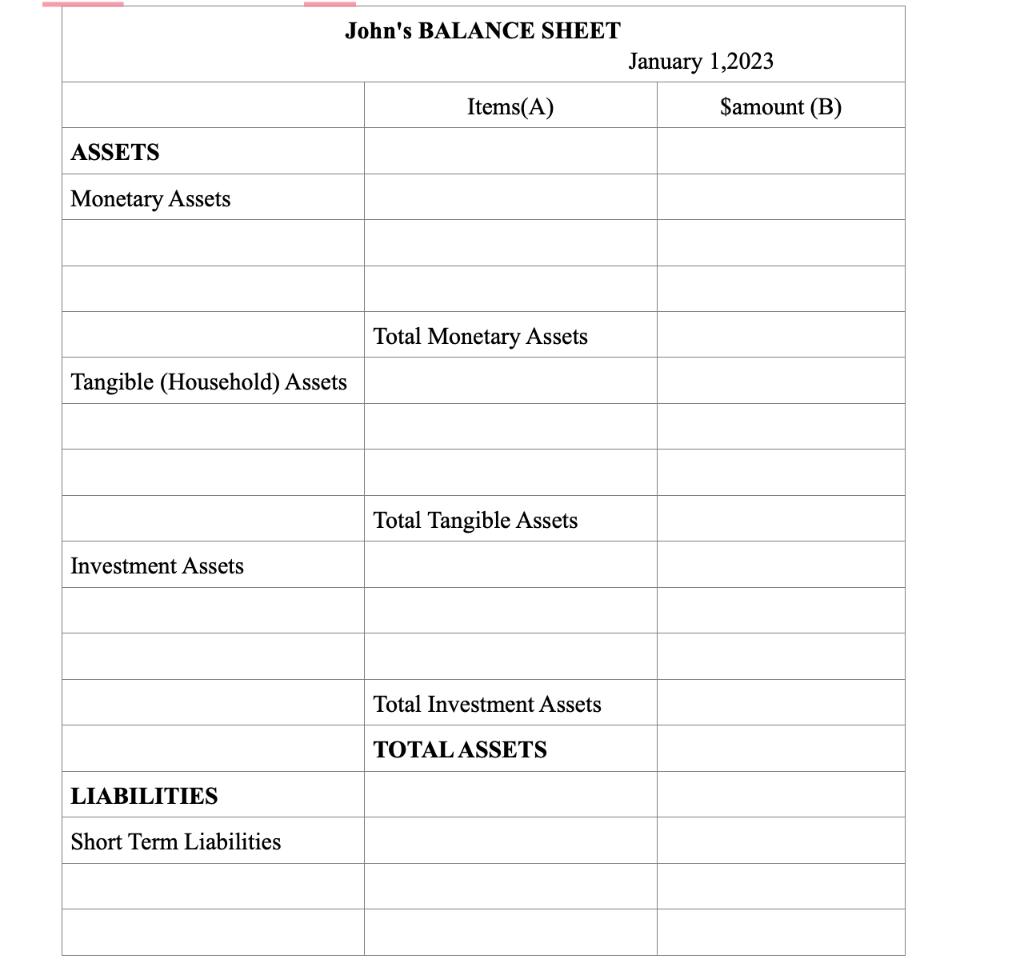

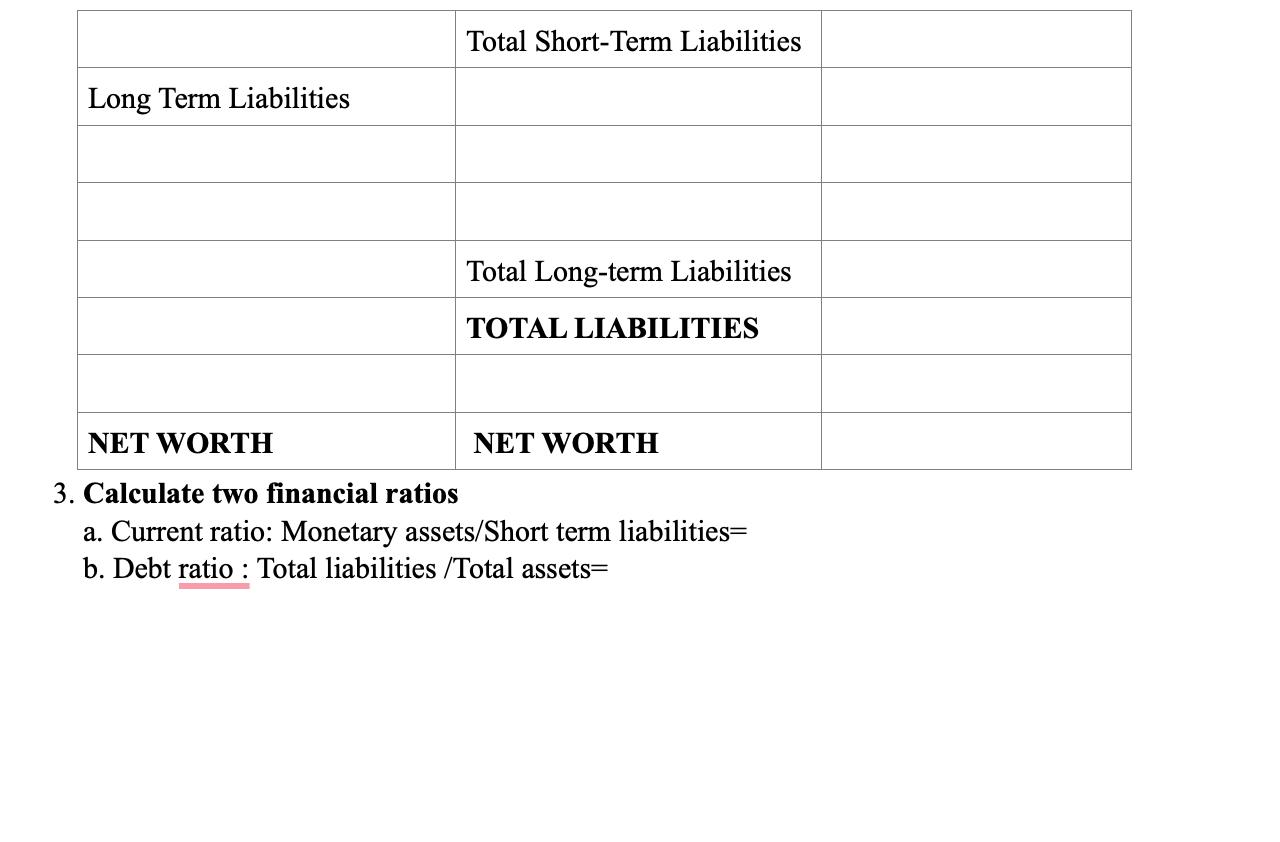

1. Johns' current financial situation: John Fox graduated from UK with $30,000 in his student loan. He owns a car he bought 3 years ago for $12, 000, but the whole value today is $5,000. He bought a computer 2 years ago for $ 1,500, but now it is worth $ 900. He has $500 in his checking account and $ 800 of a credit card balance on January 1, 2023. 2. Develop John's Balance sheet as of January 1, 2023 by filling out the cells in the columns A and B based on John' financial situation above. ASSETS Monetary Assets Tangible (Household) Assets Investment Assets John's BALANCE SHEET LIABILITIES Short Term Liabilities Items(A) Total Monetary Assets Total Tangible Assets Total Investment Assets TOTAL ASSETS January 1,2023 $amount (B) Long Term Liabilities Total Short-Term Liabilities Total Long-term Liabilities TOTAL LIABILITIES NET WORTH 3. Calculate two financial ratios a. Current ratio: Monetary assets/Short term liabilities= b. Debt ratio : Total liabilities/Total assets= NET WORTH

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Balance sheet Monetary Assets Checking Account 500 Tangible Household Assets Car 5000 current value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started