Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. JONES COMPANY AN ACCRUAL BASIS TAXPAYER SOLD PARTS TO SMITH ON ACCOUNT IN 2019 THE AMOUNT OF $5,000. DURING 2020 JONES WRITES OFF

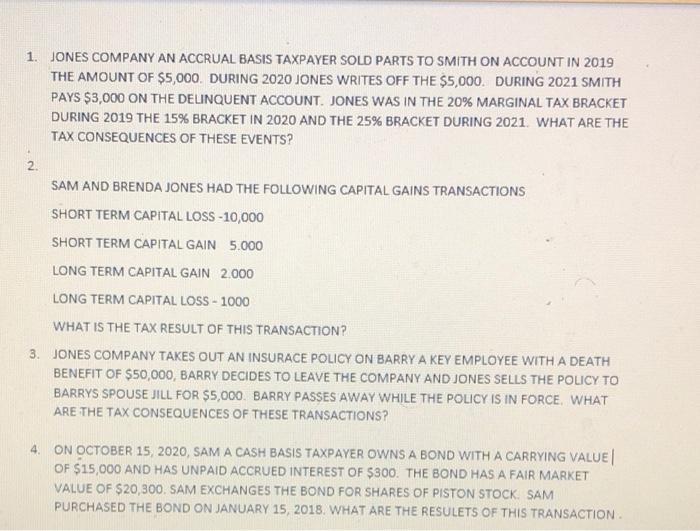

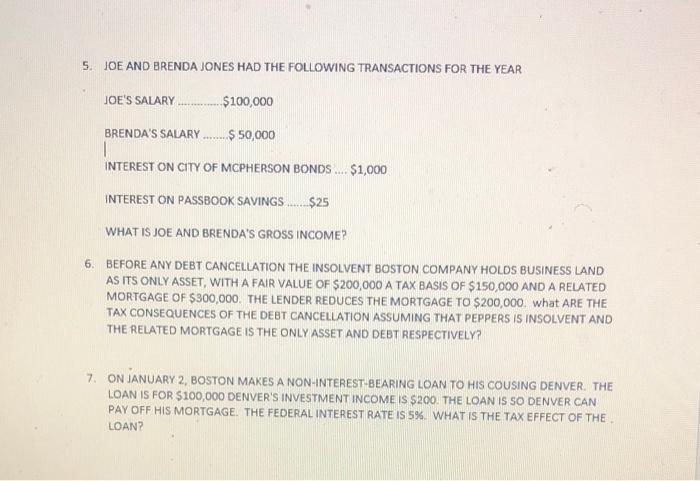

1. JONES COMPANY AN ACCRUAL BASIS TAXPAYER SOLD PARTS TO SMITH ON ACCOUNT IN 2019 THE AMOUNT OF $5,000. DURING 2020 JONES WRITES OFF THE $5,000. DURING 2021 SMITH PAYS $3,000 ON THE DELINQUENT ACCOUNT. JONES WAS IN THE 20% MARGINAL TAX BRACKET DURING 2019 THE 15% BRACKET IN 2020 AND THE 25% BRACKET DURING 2021. WHAT ARE THE TAX CONSEQUENCES OF THESE EVENTS? 2. SAM AND BRENDA JONES HAD THE FOLLOWING CAPITAL GAINS TRANSACTIONS SHORT TERM CAPITAL LOSS -10,000 SHORT TERM CAPITAL GAIN 5.000 LONG TERM CAPITAL GAIN 2.000 LONG TERM CAPITAL LOSS - 1000 WHAT IS THE TAX RESULT OF THIS TRANSACTION? 3. JONES COMPANY TAKES OUT AN INSURACE POLICY ON BARRY A KEY EMPLOYEE WITH A DEATH BENEFIT OF $50,000, BARRY DECIDES TO LEAVE THE COMPANY AND JONES SELLS THE POLICY TO BARRYS SPOUSE JILL FOR $5,000. BARRY PASSES AWAY WHILE THE POLICY IS IN FORCE. WHAT ARE THE TAX CONSEQUENCES OF THESE TRANSACTIONS? 4. ON OCTOBER 15, 2020, SAM A CASH BASIS TAXPAYER OWNS A BOND WITH A CARRYING VALUE OF $15,000 AND HAS UNPAID ACCRUED INTEREST OF $300. THE BOND HAS A FAIR MARKET VALUE OF $20,300. SAM EXCHANGES THE BOND FOR SHARES OF PISTON STOCK. SAM PURCHASED THE BOND ON JANUARY 15, 2018. WHAT ARE THE RESULETS OF THIS TRANSACTION. 5. JOE AND BRENDA JONES HAD THE FOLLOWING TRANSACTIONS FOR THE YEAR $100,000 $ 50,000 INTEREST ON CITY OF MCPHERSON BONDS.... $1,000 INTEREST ON PASSBOOK SAVINGS $25 WHAT IS JOE AND BRENDA'S GROSS INCOME? 6. BEFORE ANY DEBT CANCELLATION THE INSOLVENT BOSTON COMPANY HOLDS BUSINESS LAND AS ITS ONLY ASSET, WITH A FAIR VALUE OF $200,000 A TAX BASIS OF $150,000 AND A RELATED MORTGAGE OF $300,000. THE LENDER REDUCES THE MORTGAGE TO $200,000, what ARE THE TAX CONSEQUENCES OF THE DEBT CANCELLATION ASSUMING THAT PEPPERS IS INSOLVENT AND THE RELATED MORTGAGE IS THE ONLY ASSET AND DEBT RESPECTIVELY? JOE'S SALARY BRENDA'S SALARY. 7. ON JANUARY 2, BOSTON MAKES A NON-INTEREST-BEARING LOAN TO HIS COUSING DENVER. THE LOAN IS FOR $100,000 DENVER'S INVESTMENT INCOME IS $200. THE LOAN IS SO DENVER CAN PAY OFF HIS MORTGAGE. THE FEDERAL INTEREST RATE IS 5%. WHAT IS THE TAX EFFECT OF THE LOAN?

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Jones company will report the 5000 as income in 2019 and will be taxed at the 20 marginal tax rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started