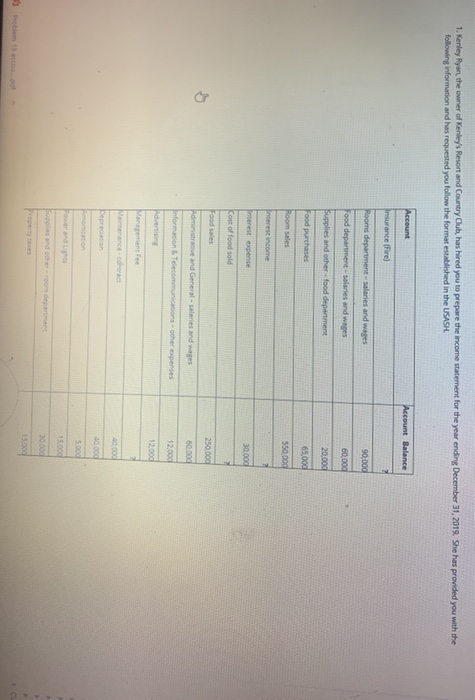

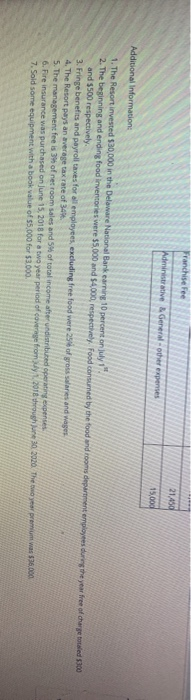

1. Kenley Ryan, the owner of Kenley's Resort and Country Club, has hired you to prepare the income statement for the year ending December 31, 2019. She has provides you with the following information and has requested you follow the format established in the USASH Account Account Balance Insurance (Fire) Rooms department - salaries and wages 90,000 Food department - salaries and wages 60,000 Supplies and other food department 20.000 Food purchases 65.000 Room sales 550,000 Interest income 30.000 Cost of food sold Food sales 250,000 Administrative and General - salaries and wages Informacion & Telecommunications - other expenses 60.000 12.000 12,000 Advertising Management Fee Maintenance contract peprecnon 40,000 40.000 500 15.000 30.000 15.00 Franchise Fee 21.450 Administrave General other expenses 15.000 Additional Information 1. The Resort invested 530,000 in the Delaware National Barkering 10 percent on 1 2. The beginning and ending food inventories were 55.000 and 54.000, respectively. Food consumed by the food and rooms are employees during the year free of charge totaled 300 and 5500 respectively 3. Fringe benefits and payroll taxes for all employees, excluding free food were 25 of grossanes and wages 4. The Resort pays an average tax rate of 34. 5. The management fee is hofre room sales and of cometer bred operates 6. Fire Insurance was purchased on June 15, 2018 for a two year period of coverage from 2016 ohne 30 2020. The two year premium was $36.000 7. Sold some equipment with a book value of $5,000 for $1.000. 1. Kenley Ryan, the owner of Kenley's Resort and Country Club, has hired you to prepare the income statement for the year ending December 31, 2019. She has provides you with the following information and has requested you follow the format established in the USASH Account Account Balance Insurance (Fire) Rooms department - salaries and wages 90,000 Food department - salaries and wages 60,000 Supplies and other food department 20.000 Food purchases 65.000 Room sales 550,000 Interest income 30.000 Cost of food sold Food sales 250,000 Administrative and General - salaries and wages Informacion & Telecommunications - other expenses 60.000 12.000 12,000 Advertising Management Fee Maintenance contract peprecnon 40,000 40.000 500 15.000 30.000 15.00 Franchise Fee 21.450 Administrave General other expenses 15.000 Additional Information 1. The Resort invested 530,000 in the Delaware National Barkering 10 percent on 1 2. The beginning and ending food inventories were 55.000 and 54.000, respectively. Food consumed by the food and rooms are employees during the year free of charge totaled 300 and 5500 respectively 3. Fringe benefits and payroll taxes for all employees, excluding free food were 25 of grossanes and wages 4. The Resort pays an average tax rate of 34. 5. The management fee is hofre room sales and of cometer bred operates 6. Fire Insurance was purchased on June 15, 2018 for a two year period of coverage from 2016 ohne 30 2020. The two year premium was $36.000 7. Sold some equipment with a book value of $5,000 for $1.000