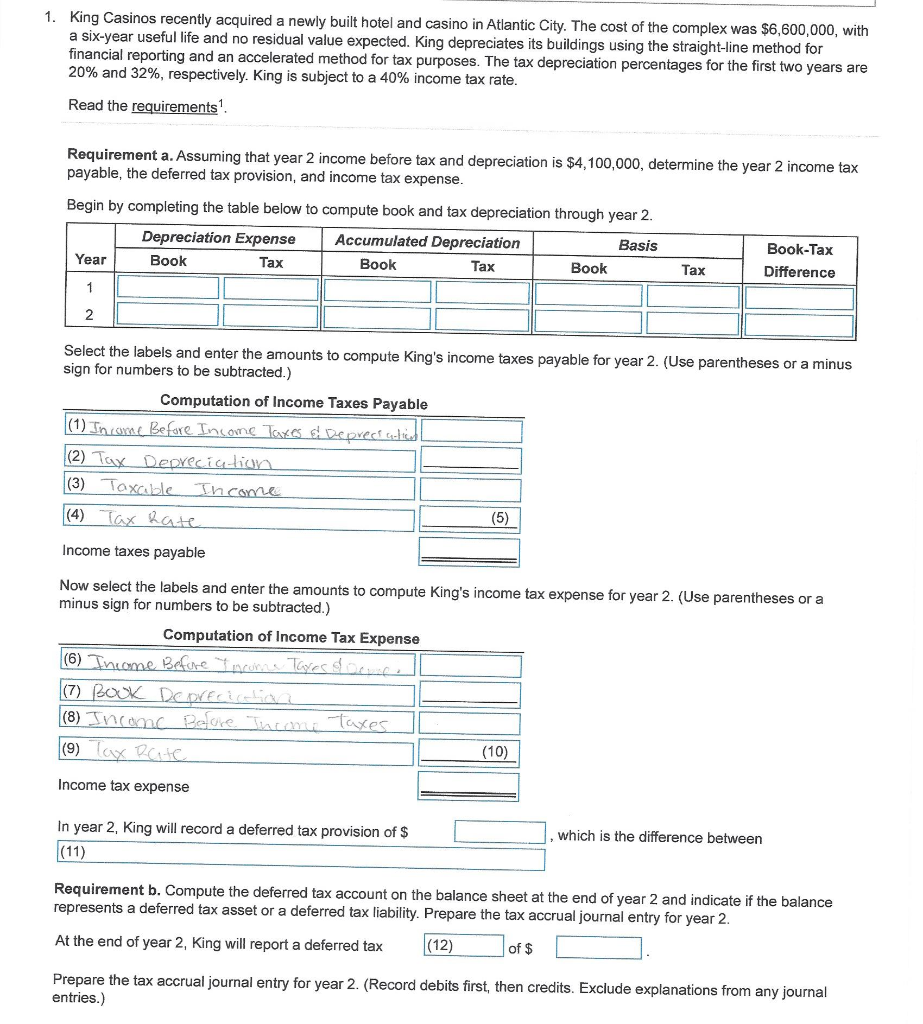

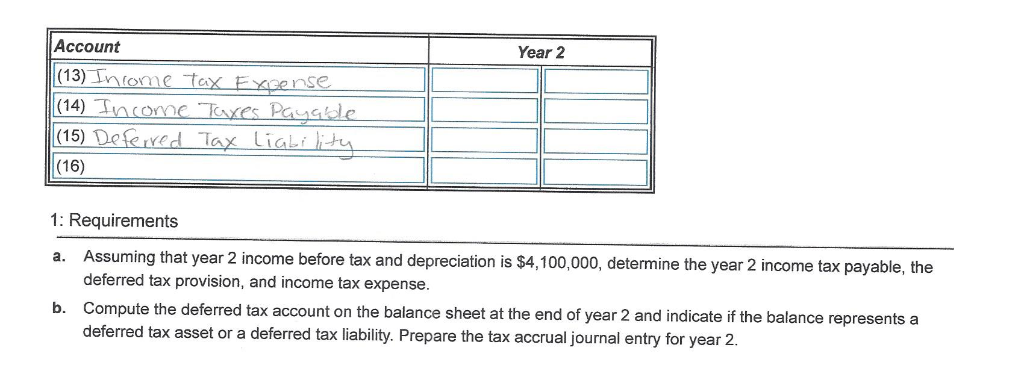

1. King Casinos recently acquired a newly built hotel and casino in Atlantic City. The cost of the complex was $6,600,000, with a six-year useful life and no residual value expected. King depreciates its buildings using the straight-line method for financial reporting and an accelerated method for tax purposes. The tax depreciation percentages for the first two years are 20% and 32%, respectively. King is subject to a 40% income tax rate. Read the requirements Requirement a. Assuming that year 2 income before tax and depreciation is $4,100,000, determine the year 2 income tax payable, the deferred tax provision, and income tax expense. Begin by completing the table below to compute book and tax depreciation through year 2. Depreciation Expense Accumulated Depreciation Basis Year Book Tax Book Tax Book Tax Book-Tax Difference Select the labels and enter the amounts to compute King's income taxes payable for year 2. (Use parentheses or a minus sign for numbers to be subtracted.) Computation of Income Taxes Payable (1) Income Before Income Taxes e Depress codice |(2) Tax Depreciation |(3) Taxable Income (4) Tax Rate Income taxes payable Now select the labels and enter the amounts to compute King's income tax expense for year 2. (Use parentheses or a minus sign for numbers to be subtracted.) Computation of Income Tax Expense |(6) Income Before Income Tapes & Deme (7) BOOK Depreciation |(8) Income Beure Thcome taxes. |(9) Tax Rate Income tax expense , which is the difference between In year 2, King will record a deferred tax provision of $ (11) Requirement b. Compute the deferred tax account on the balance sheet at the end of year 2 and indicate if the balance represents a deferred tax asset or a deferred tax liability. Prepare the tax accrual journal entry for year 2. At the end of year 2, King will report a deferred tax (12) of $ Prepare the tax accrual journal entry for year 2. (Record debits first, then credits. Exclude explanations from any journal entries.) Year 2 Account (13) Income Tax Excense (14) Income Taxes Payalde (15) Deferred Tax liability (16) 1: Requirements a. Assuming that year 2 income before tax and depreciation is $4,100,000, determine the year 2 income tax payable, the deferred tax provision, and income tax expense. b. Compute the deferred tax account on the balance sheet at the end of year 2 and indicate if the balance represents a deferred tax asset or a deferred tax liability. Prepare the tax accrual journal entry for year 2