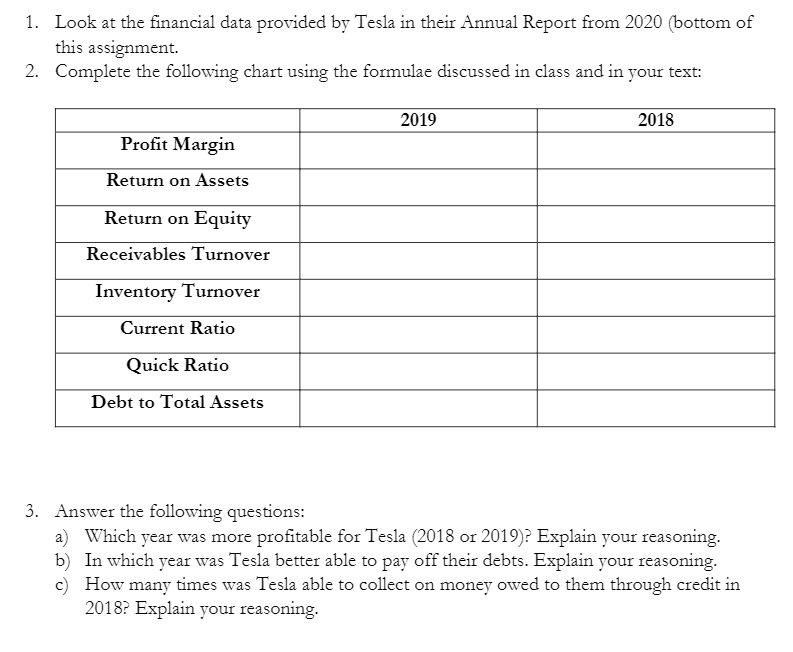

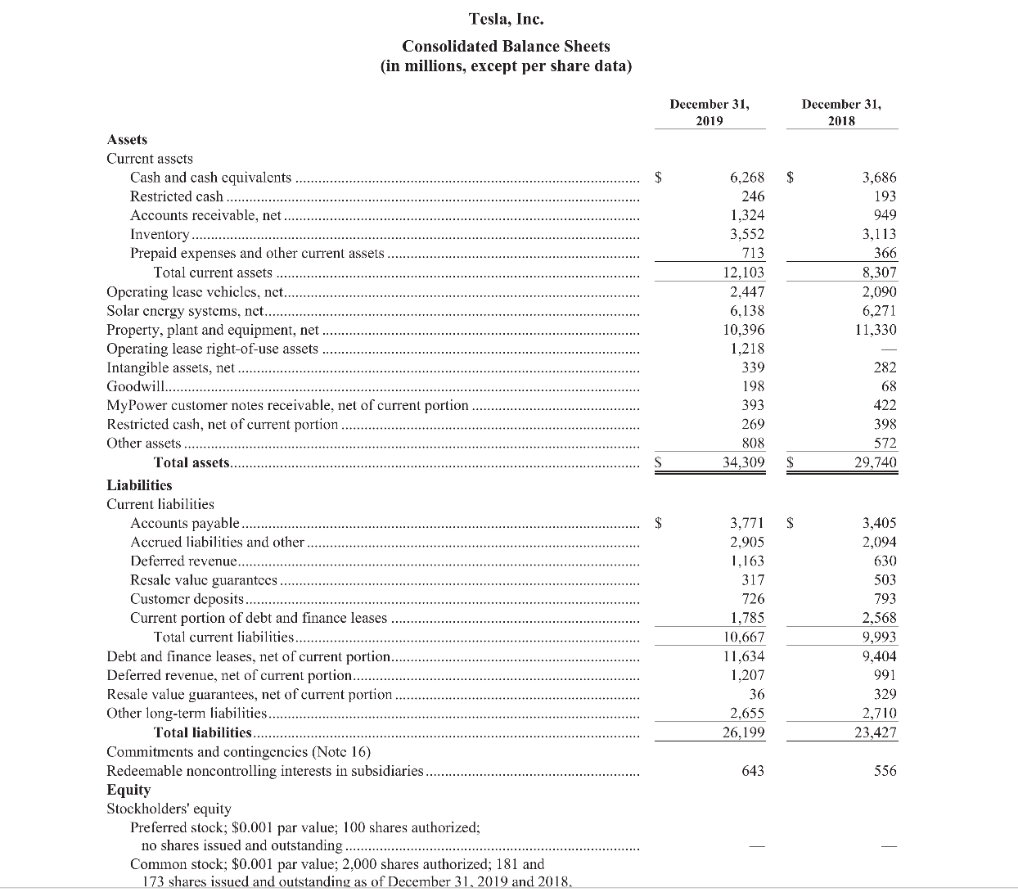

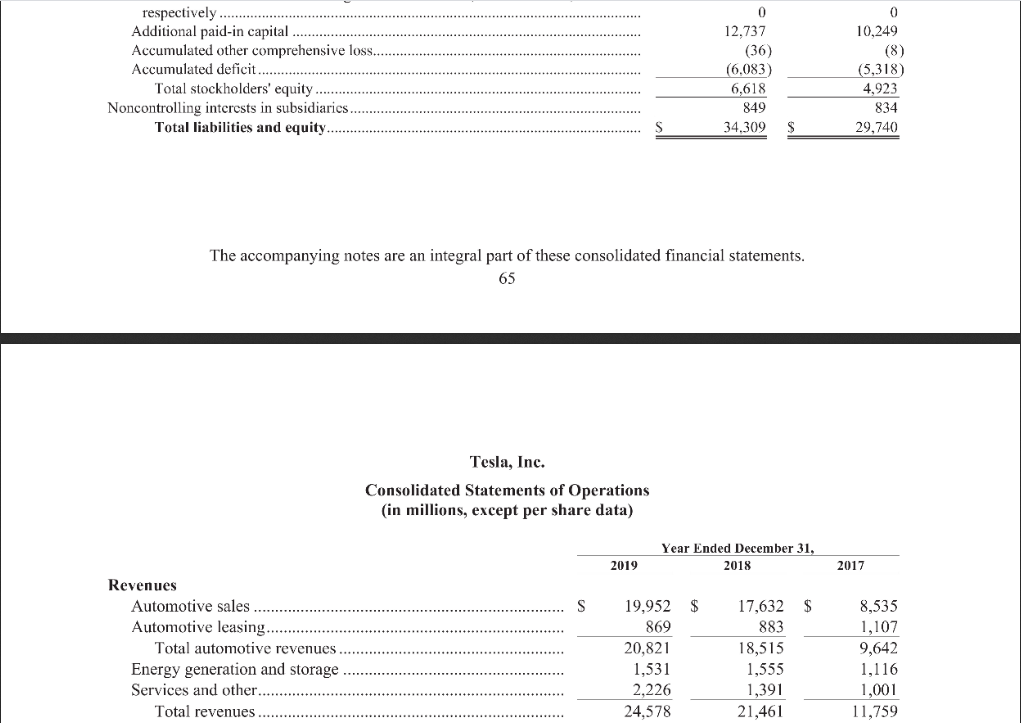

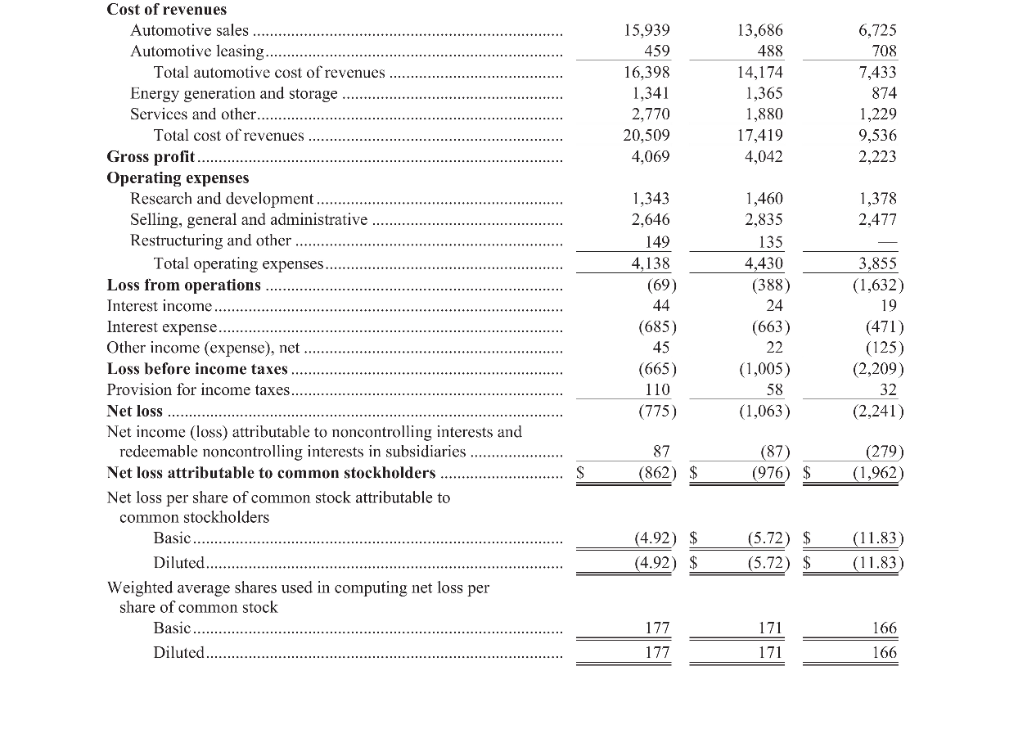

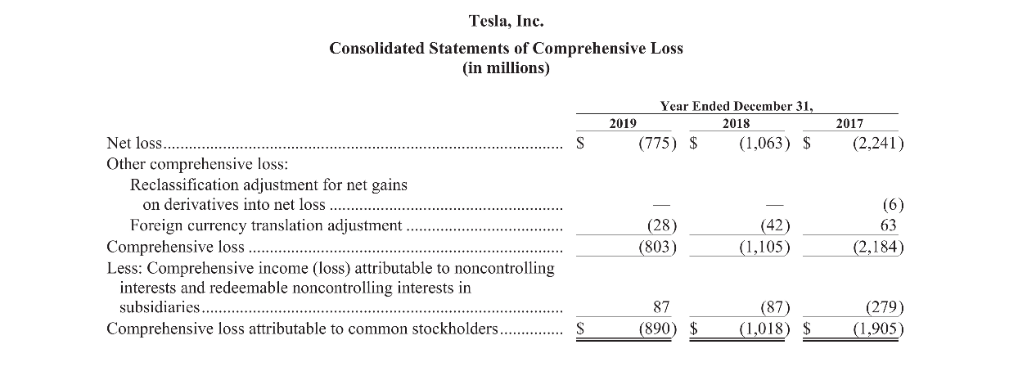

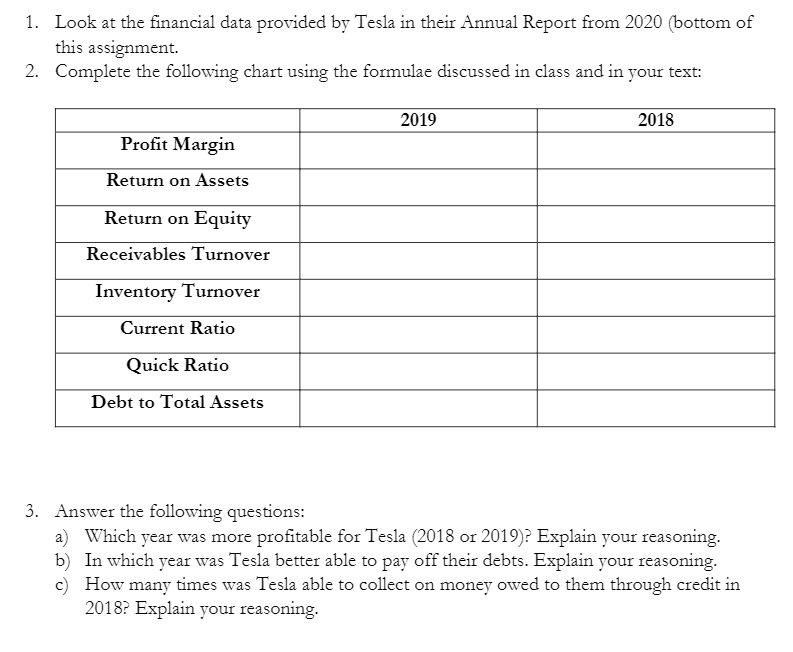

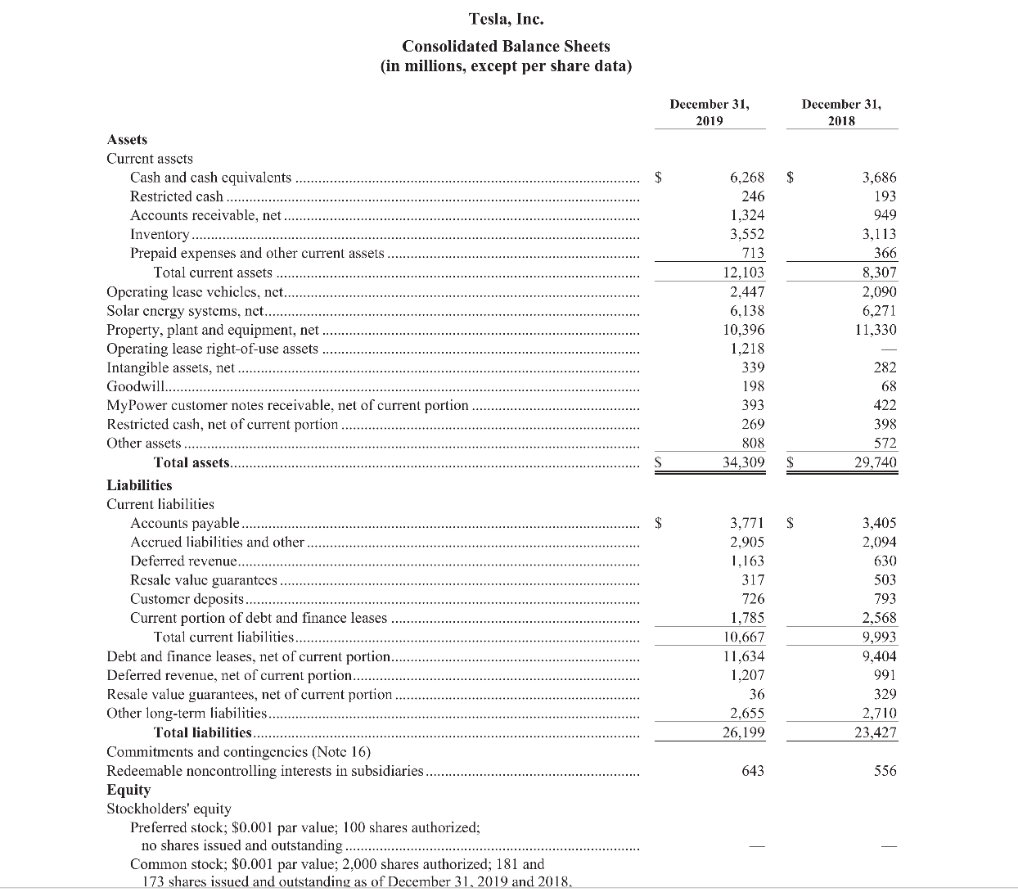

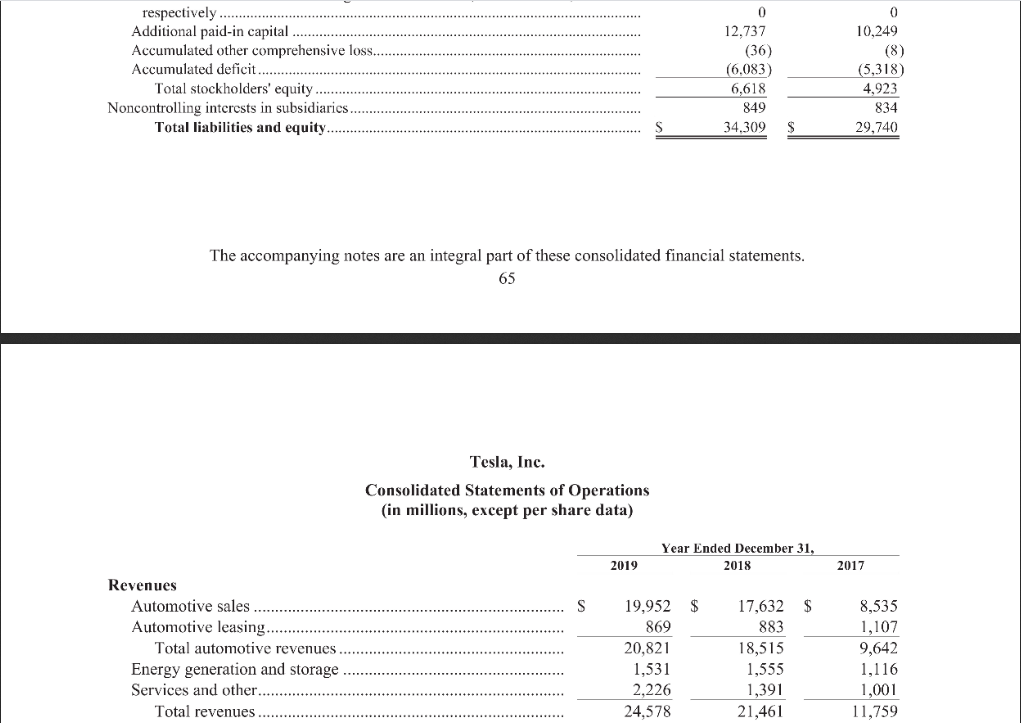

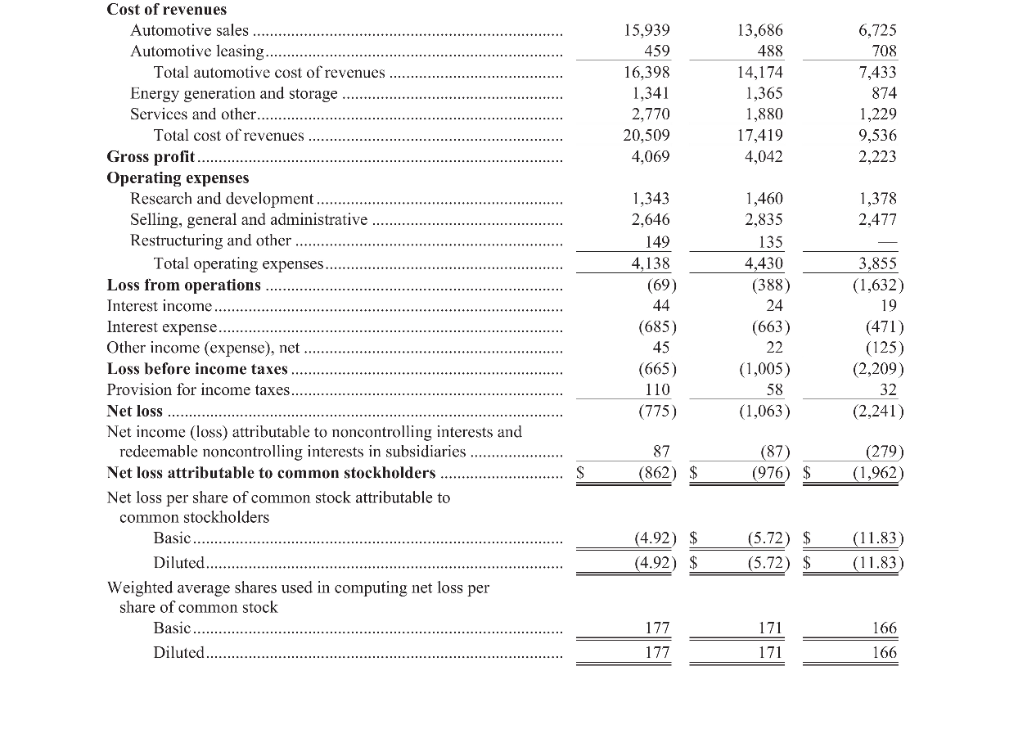

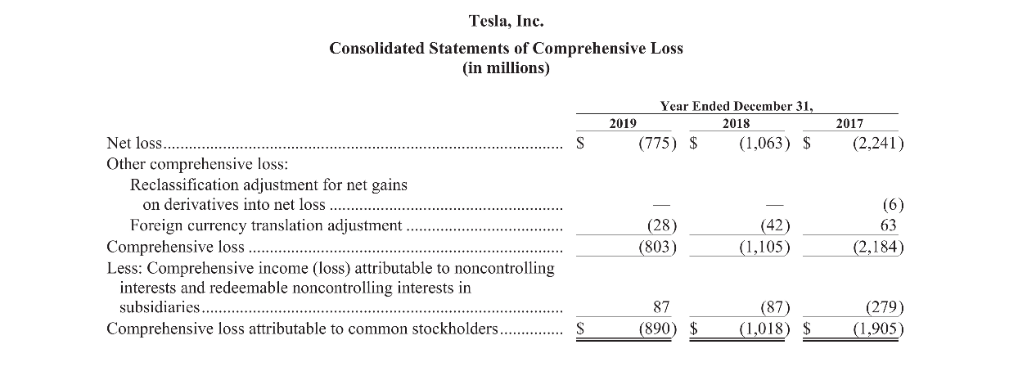

1. Look at the financial data provided by Tesla in their Annual Report from 2020 (bottom of this assignment. 2. Complete the following chart using the formulae discussed in class and in your text: 2019 2018 Profit Margin Return on Assets Return on Equity Receivables Turnover Inventory Turnover Current Ratio Quick Ratio Debt to Total Assets 3. Answer the following questions: a) Which year was more profitable for Tesla (2018 or 2019)? Explain your reasoning. b) In which year was Tesla better able to pay off their debts. Explain your reasoning. c) How many times was Tesla able to collect on money owed to them through credit in 2018? Explain your reasoning. Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31, 2019 December 31, 2018 6,268 $ 3,686 193 949 3,113 366 8,307 246 1.324 3.552 713 12,103 2.447 6,138 10.396 1.218 339 198 393 269 808 34,309 2,090 6,271 11,330 282 68 422 398 572 29,740 Assets Current assets Cash and cash equivalents Restricted cash Accounts receivable, net Inventory ........... Prepaid expenses and other current assets. Total current assets Operating lease vehicles, nct. Solar energy systems, nct. Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net. Goodwill........ MyPower customer notes receivable, net of current portion Restricted cash, net of current portion Other assets Total assets. Liabilities Current liabilities Accounts payable. Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of debt and finance leases Total current liabilities........ Debt and finance leases, net of current portion.. Deferred revenue, net of current portion. Resale value guarantees, net of current portion Other long-term liabilities. Total liabilities. Commitments and contingencics (Note 16) Redeemable noncontrolling interests in subsidiaries Equity Stockholders' equity Preferred stock; $0.001 par value; 100 shares authorized; no shares issued and outstanding. Common stock; $0.001 par value; 2,000 shares authorized; 181 and 173 shares issued and outstanding as of December 31, 2019 and 2018 $ 3,771 $ 2.905 1,163 317 726 1,785 10.667 11.634 1.207 36 2.655 26,199 3,405 2,094 630 503 793 2,568 9,993 9,404 991 329 2,710 23,427 643 556 respectively Additional paid-in capital Accumulated other comprehensive loss. Accumulated deficit. Total stockholders' equity Noncontrolling interests in subsidiaries. Total liabilities and equity 0 12,737 (36) (6.083) 6,618 849 34.309 0 10,249 (8) (5,318) 4,923 834 29,740 S The accompanying notes are an integral part of these consolidated financial statements. 65 Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2018 2019 2017 Revenues Automotive sales Automotive leasing. Total automotive revenues Energy generation and storage Services and other. Total revenues 19,952 $ 869 20,821 1,531 2,226 24,578 17,632 $ 883 18,515 1,555 1,391 21,461 8,535 1,107 9,642 1,116 1,001 11,759 15,939 459 16,398 1,341 2,770 20,509 4,069 13,686 488 14,174 1,365 1,880 17,419 4,042 6,725 708 7,433 874 1,229 9,536 2,223 1,378 2,477 Cost of revenues Automotive sales Automotive leasing. Total automotive cost of revenues Energy generation and storage Services and other. Total cost of revenues Gross profit....... Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenses... Loss from operations Interest income Interest expense. Other income (expense), net Loss before income taxes Provision for income taxes Net loss..... Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net loss attributable to common stockholders Net loss per share of common stock attributable to common stockholders Basic Diluted. Weighted average shares used in computing net loss per share of common stock Basic Diluted. 1,343 2,646 149 4.138 (69) 44 (685) 45 (665) 110 (775) 1,460 2,835 135 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) 3,855 (1,632) 19 (471) (125) (2,209) 32 (2,241) 87 (862) $ (87) (976) $ (279) (1,962) (4.92) $ (4.92) $ (5.72) $ (5.72) $ (11.83) (11.83 166 177 177 171 171 166 Tesla, Inc. Consolidated Statements of Comprehensive Loss (in millions) Year Ended December 31, 2019 2018 (775) $ (1,063) $ 2017 (2,241) Net loss. Other comprehensive loss: Reclassification adjustment for net gains on derivatives into net loss Foreign currency translation adjustment Comprehensive loss Less: Comprehensive income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries...... Comprehensive loss attributable to common stockholders... (28) (803) (42) (1,105) (6) 63 (2,184) 87 (890) $ (87) (1,018) $ (279) (1,905) 1. Look at the financial data provided by Tesla in their Annual Report from 2020 (bottom of this assignment. 2. Complete the following chart using the formulae discussed in class and in your text: 2019 2018 Profit Margin Return on Assets Return on Equity Receivables Turnover Inventory Turnover Current Ratio Quick Ratio Debt to Total Assets 3. Answer the following questions: a) Which year was more profitable for Tesla (2018 or 2019)? Explain your reasoning. b) In which year was Tesla better able to pay off their debts. Explain your reasoning. c) How many times was Tesla able to collect on money owed to them through credit in 2018? Explain your reasoning. Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31, 2019 December 31, 2018 6,268 $ 3,686 193 949 3,113 366 8,307 246 1.324 3.552 713 12,103 2.447 6,138 10.396 1.218 339 198 393 269 808 34,309 2,090 6,271 11,330 282 68 422 398 572 29,740 Assets Current assets Cash and cash equivalents Restricted cash Accounts receivable, net Inventory ........... Prepaid expenses and other current assets. Total current assets Operating lease vehicles, nct. Solar energy systems, nct. Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net. Goodwill........ MyPower customer notes receivable, net of current portion Restricted cash, net of current portion Other assets Total assets. Liabilities Current liabilities Accounts payable. Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of debt and finance leases Total current liabilities........ Debt and finance leases, net of current portion.. Deferred revenue, net of current portion. Resale value guarantees, net of current portion Other long-term liabilities. Total liabilities. Commitments and contingencics (Note 16) Redeemable noncontrolling interests in subsidiaries Equity Stockholders' equity Preferred stock; $0.001 par value; 100 shares authorized; no shares issued and outstanding. Common stock; $0.001 par value; 2,000 shares authorized; 181 and 173 shares issued and outstanding as of December 31, 2019 and 2018 $ 3,771 $ 2.905 1,163 317 726 1,785 10.667 11.634 1.207 36 2.655 26,199 3,405 2,094 630 503 793 2,568 9,993 9,404 991 329 2,710 23,427 643 556 respectively Additional paid-in capital Accumulated other comprehensive loss. Accumulated deficit. Total stockholders' equity Noncontrolling interests in subsidiaries. Total liabilities and equity 0 12,737 (36) (6.083) 6,618 849 34.309 0 10,249 (8) (5,318) 4,923 834 29,740 S The accompanying notes are an integral part of these consolidated financial statements. 65 Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2018 2019 2017 Revenues Automotive sales Automotive leasing. Total automotive revenues Energy generation and storage Services and other. Total revenues 19,952 $ 869 20,821 1,531 2,226 24,578 17,632 $ 883 18,515 1,555 1,391 21,461 8,535 1,107 9,642 1,116 1,001 11,759 15,939 459 16,398 1,341 2,770 20,509 4,069 13,686 488 14,174 1,365 1,880 17,419 4,042 6,725 708 7,433 874 1,229 9,536 2,223 1,378 2,477 Cost of revenues Automotive sales Automotive leasing. Total automotive cost of revenues Energy generation and storage Services and other. Total cost of revenues Gross profit....... Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenses... Loss from operations Interest income Interest expense. Other income (expense), net Loss before income taxes Provision for income taxes Net loss..... Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net loss attributable to common stockholders Net loss per share of common stock attributable to common stockholders Basic Diluted. Weighted average shares used in computing net loss per share of common stock Basic Diluted. 1,343 2,646 149 4.138 (69) 44 (685) 45 (665) 110 (775) 1,460 2,835 135 4,430 (388) 24 (663) 22 (1,005) 58 (1,063) 3,855 (1,632) 19 (471) (125) (2,209) 32 (2,241) 87 (862) $ (87) (976) $ (279) (1,962) (4.92) $ (4.92) $ (5.72) $ (5.72) $ (11.83) (11.83 166 177 177 171 171 166 Tesla, Inc. Consolidated Statements of Comprehensive Loss (in millions) Year Ended December 31, 2019 2018 (775) $ (1,063) $ 2017 (2,241) Net loss. Other comprehensive loss: Reclassification adjustment for net gains on derivatives into net loss Foreign currency translation adjustment Comprehensive loss Less: Comprehensive income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries...... Comprehensive loss attributable to common stockholders... (28) (803) (42) (1,105) (6) 63 (2,184) 87 (890) $ (87) (1,018) $ (279) (1,905)