Answered step by step

Verified Expert Solution

Question

1 Approved Answer

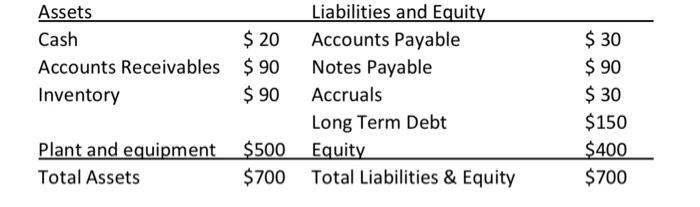

1. MNO, Inc., a publicly traded manufacturing firm in the United States, has provided the following financial information in its application for a loan. Also

1. MNO, Inc., a publicly traded manufacturing firm in the United States, has provided the following

financial information in its application for a loan.

Also assume sales = $500, cost of goods sold = $360, taxes = $56, interest payments = $40, net

income = $44, the dividend payout ratio is 50 percent, and the market value of equity is equal to

the book value.

a. What is the Altman discriminant function value for MNO, Inc.? Recall that:

Net working capital = current assets minus current liabilities.

Current assets = Cash + accounts receivable + inventories.

Current liabilities = Accounts payable + accruals + notes payable.

EBIT = Revenues - Cost of goods sold - depreciation.

Taxes = (EBIT - Interest)(tax rate).

Net income = EBIT - Interest - Taxes.

Retained earnings = Net income (1 - dividend payout ratio)

Altmans discriminant function is given by: Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5 where X1 =

Working capital/total assets (TA), X2 = Retained earnings/TA, X3 = EBIT/TA, X4 = Market value of

equity/long term debt, and X5 = Sales/TA. Assume prior retained earnings are zero.

b. Should you approve MNO, Inc.'s application to your bank for a $500,000 capital expansion

loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started