Answered step by step

Verified Expert Solution

Question

1 Approved Answer

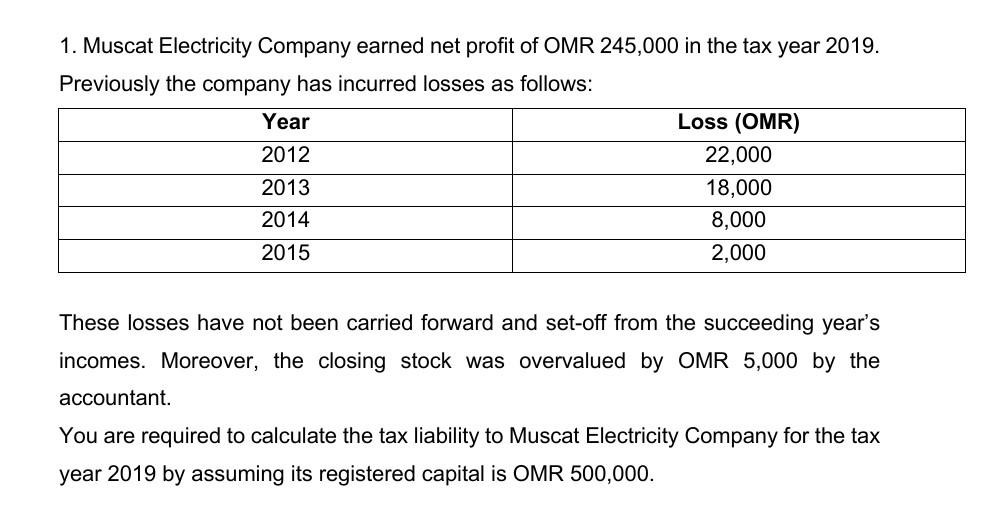

1. Muscat Electricity Company earned net profit of OMR 245,000 in the tax year 2019. Previously the company has incurred losses as follows: Year Loss

1. Muscat Electricity Company earned net profit of OMR 245,000 in the tax year 2019. Previously the company has incurred losses as follows: Year Loss (OMR) 2012 22,000 2013 18,000 2014 8,000 2015 2,000 These losses have not been carried forward and set-off from the succeeding year's incomes. Moreover, the closing stock was overvalued by OMR 5,000 by the accountant. You are required to calculate the tax liability to Muscat Electricity Company for the tax year 2019 by assuming its registered capital is OMR 500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started