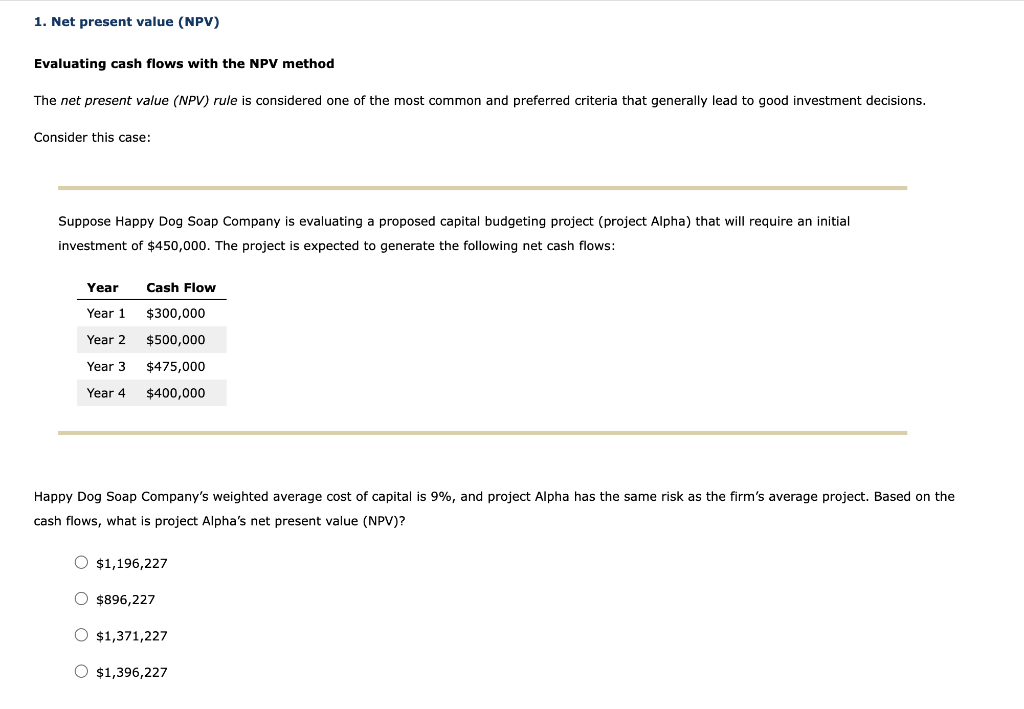

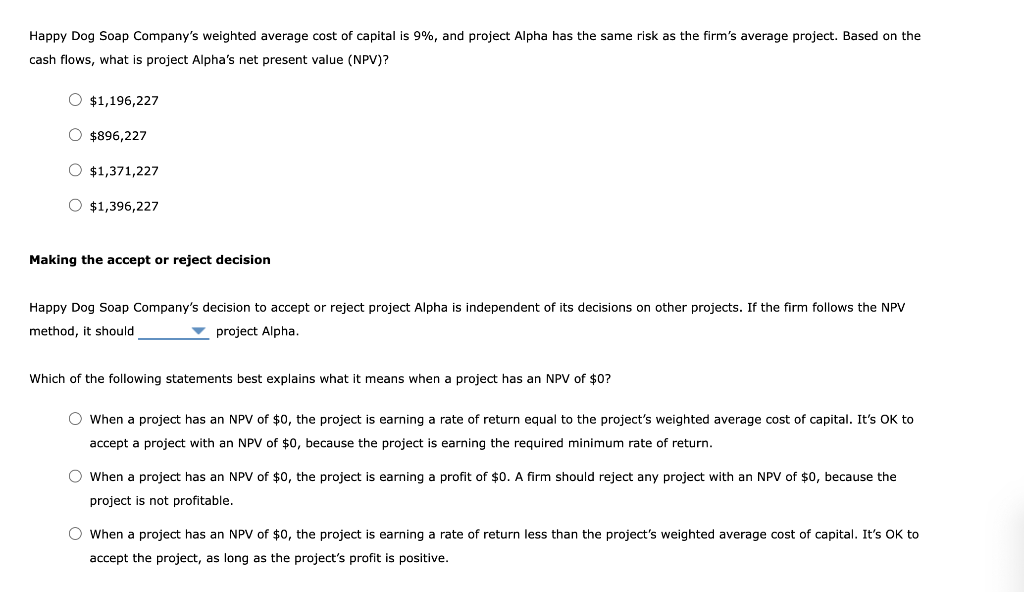

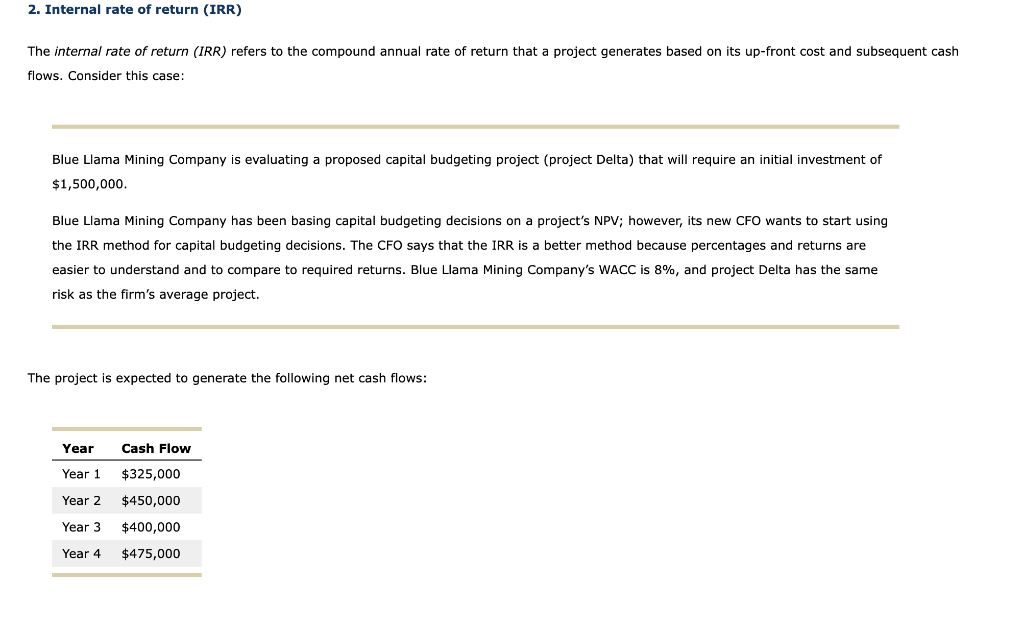

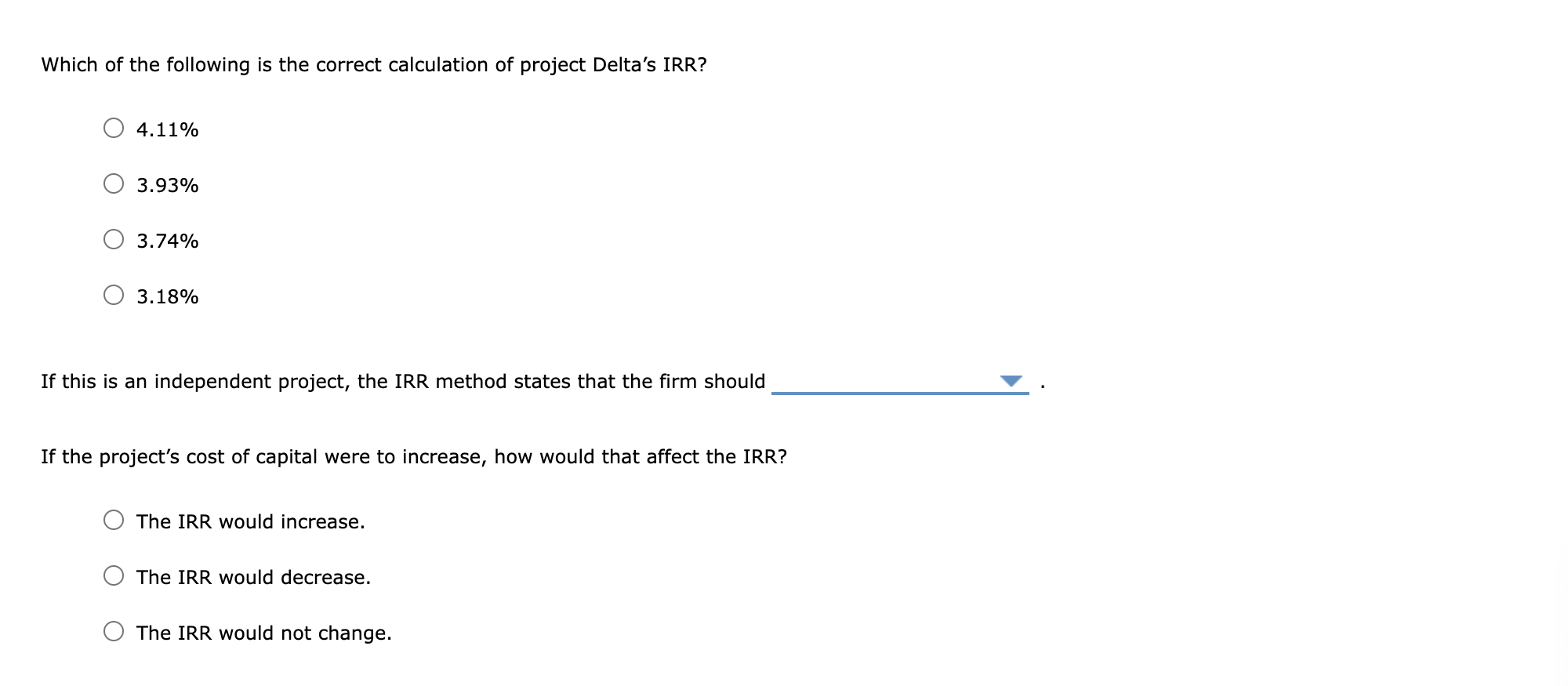

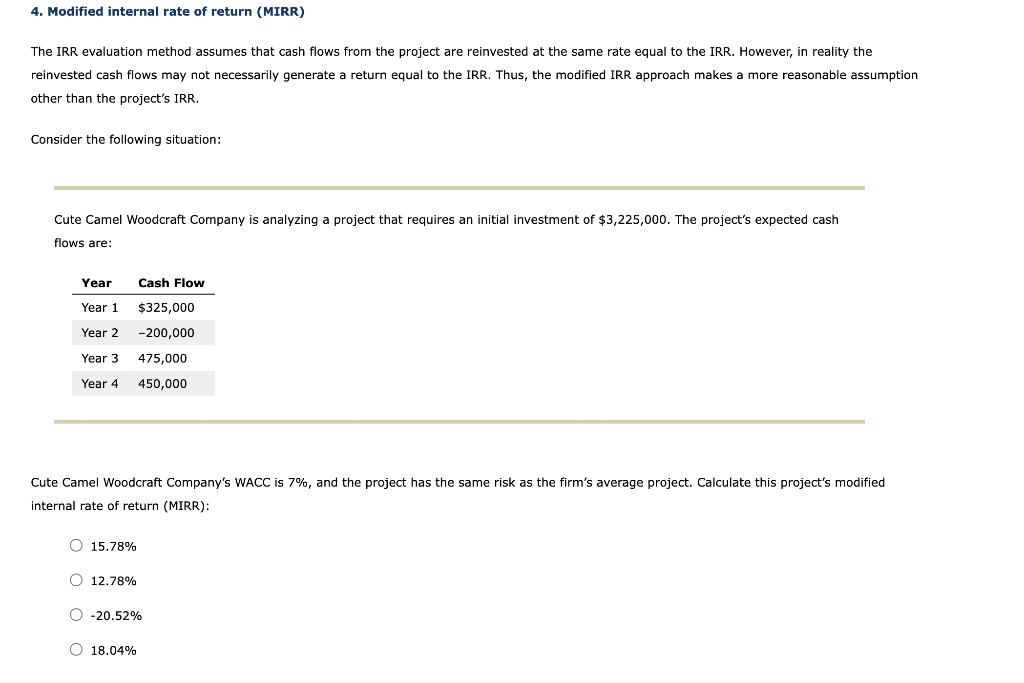

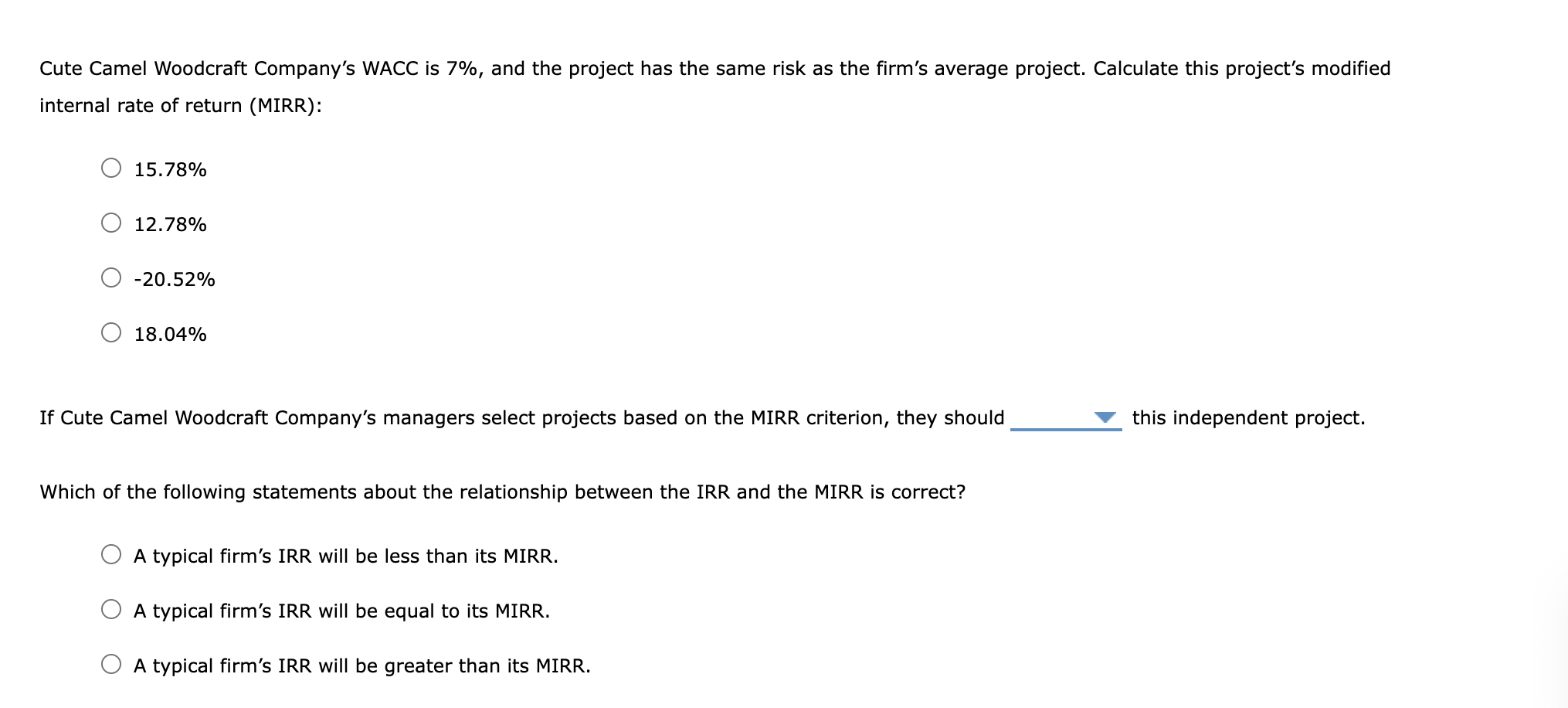

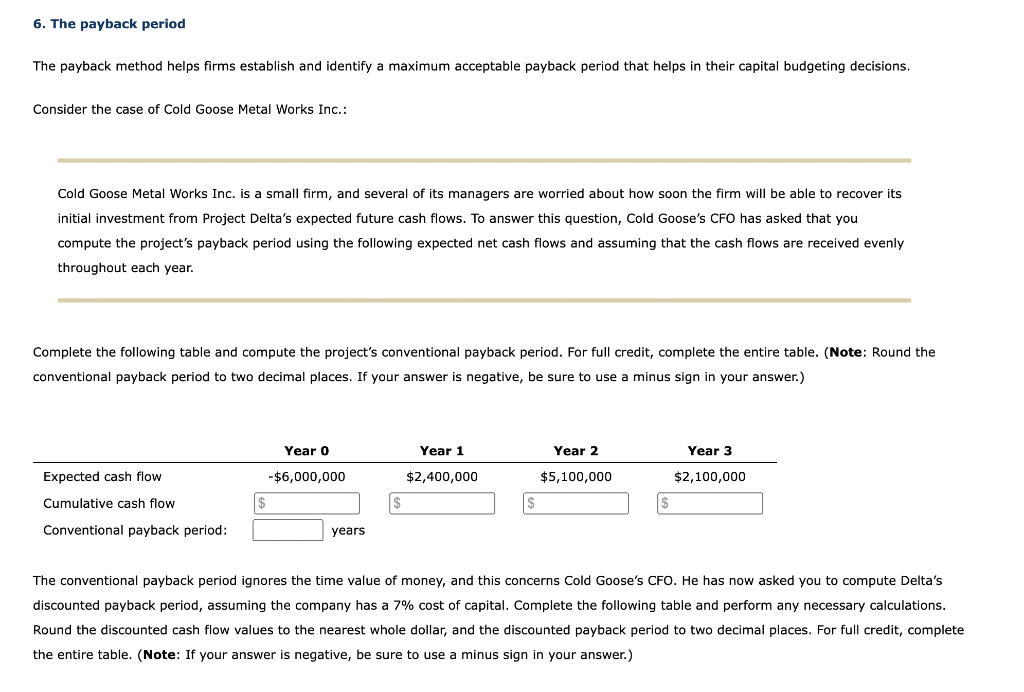

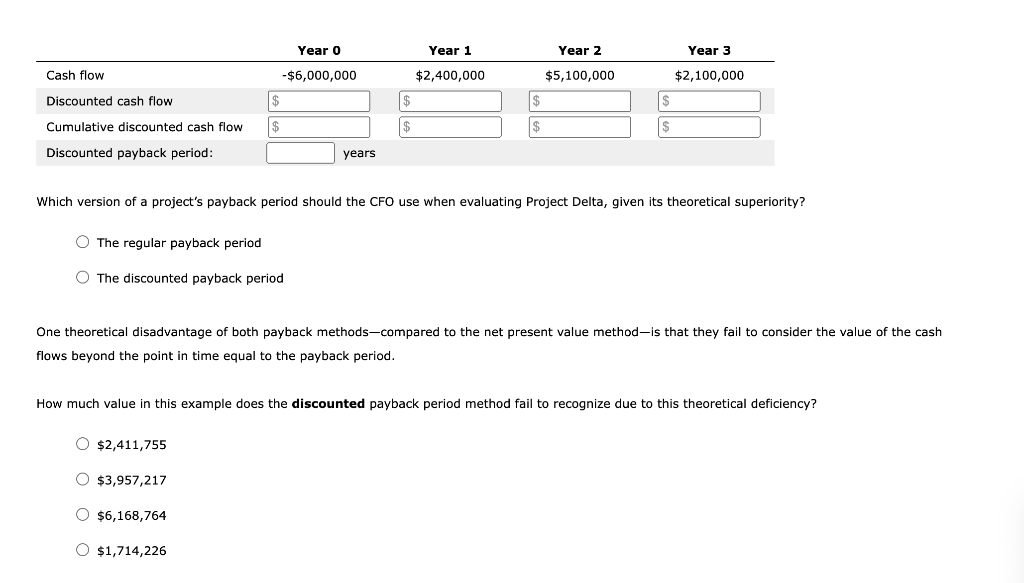

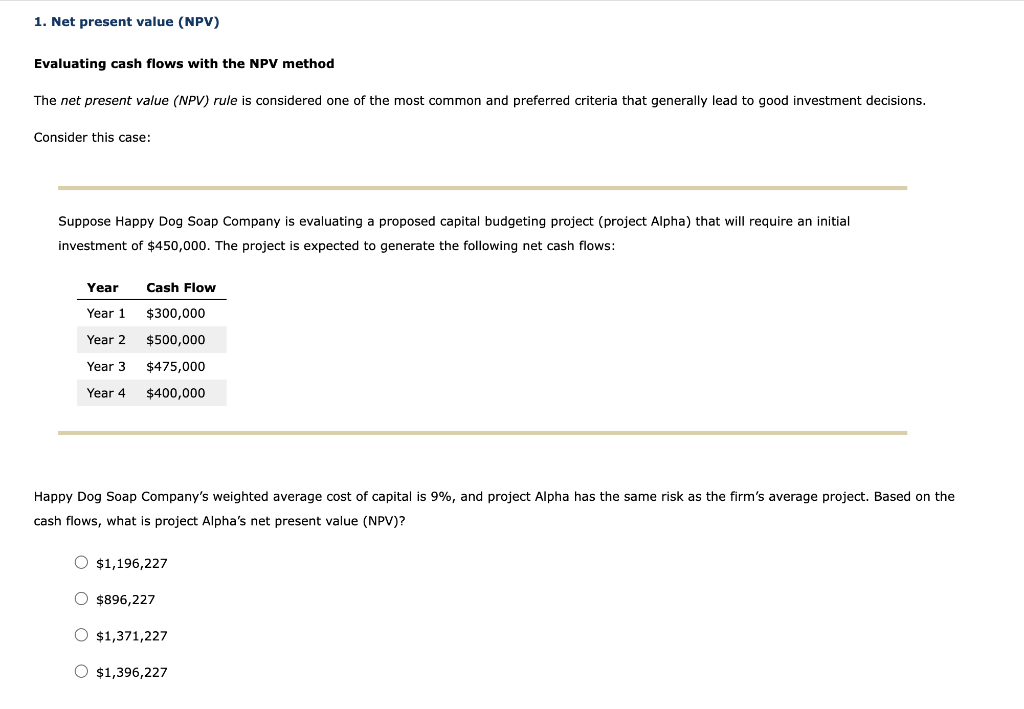

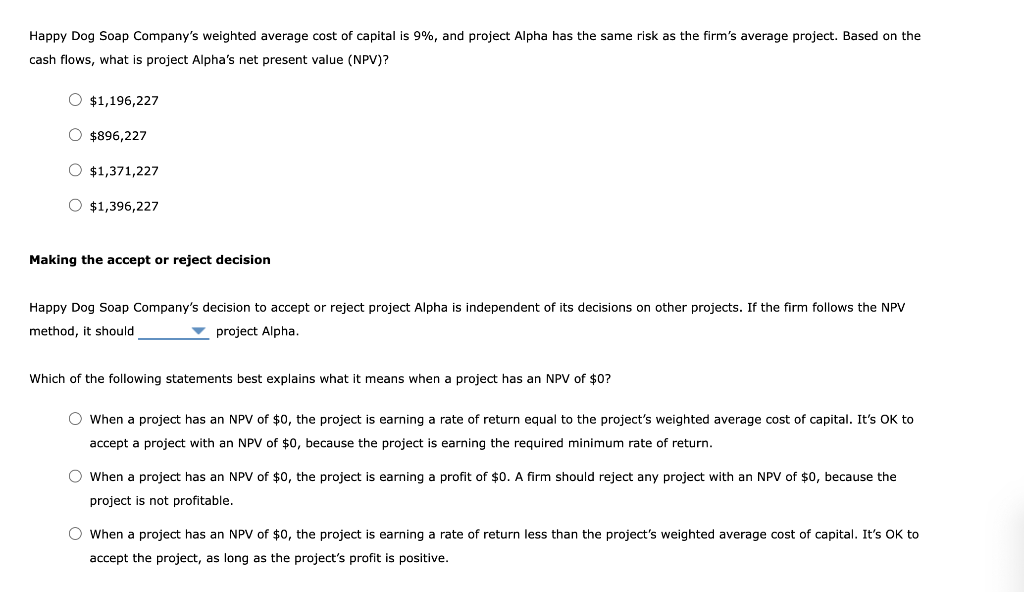

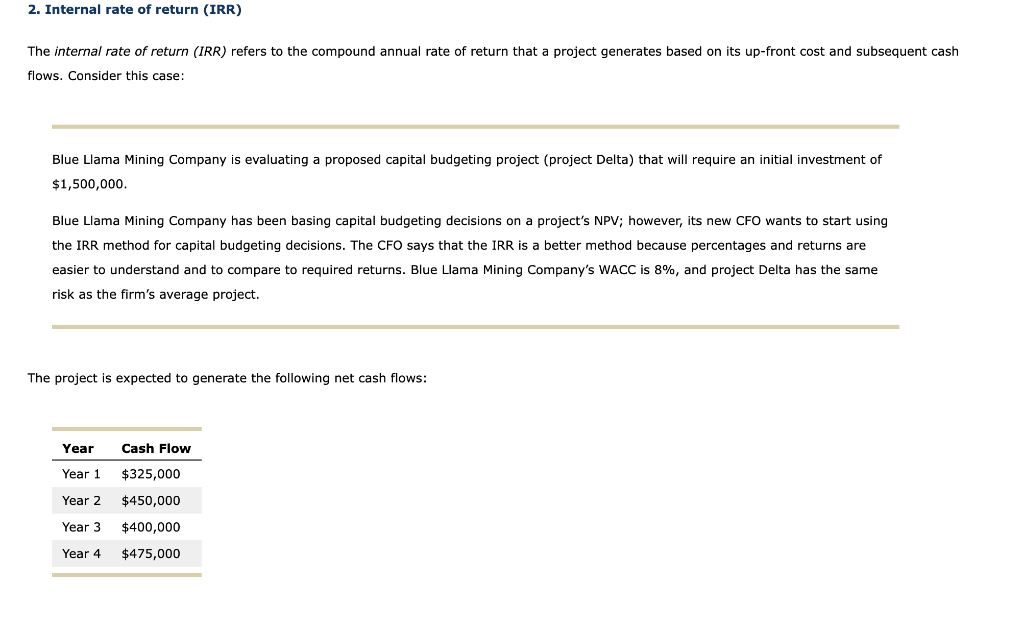

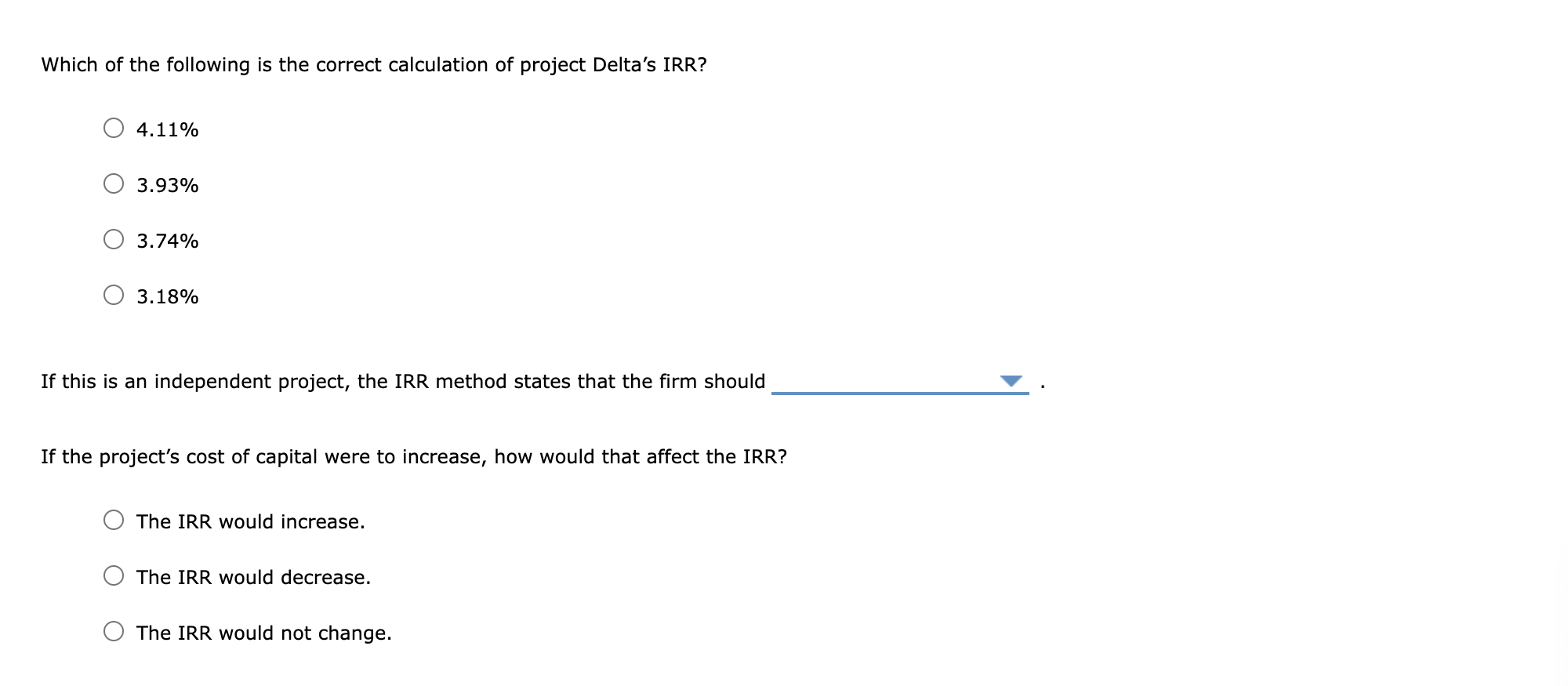

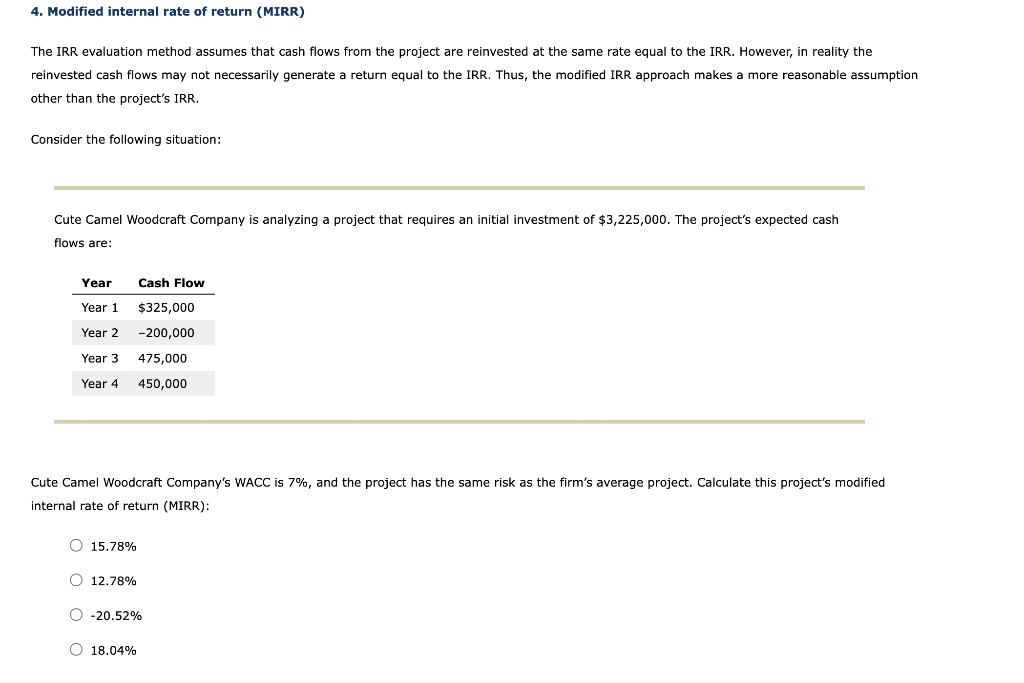

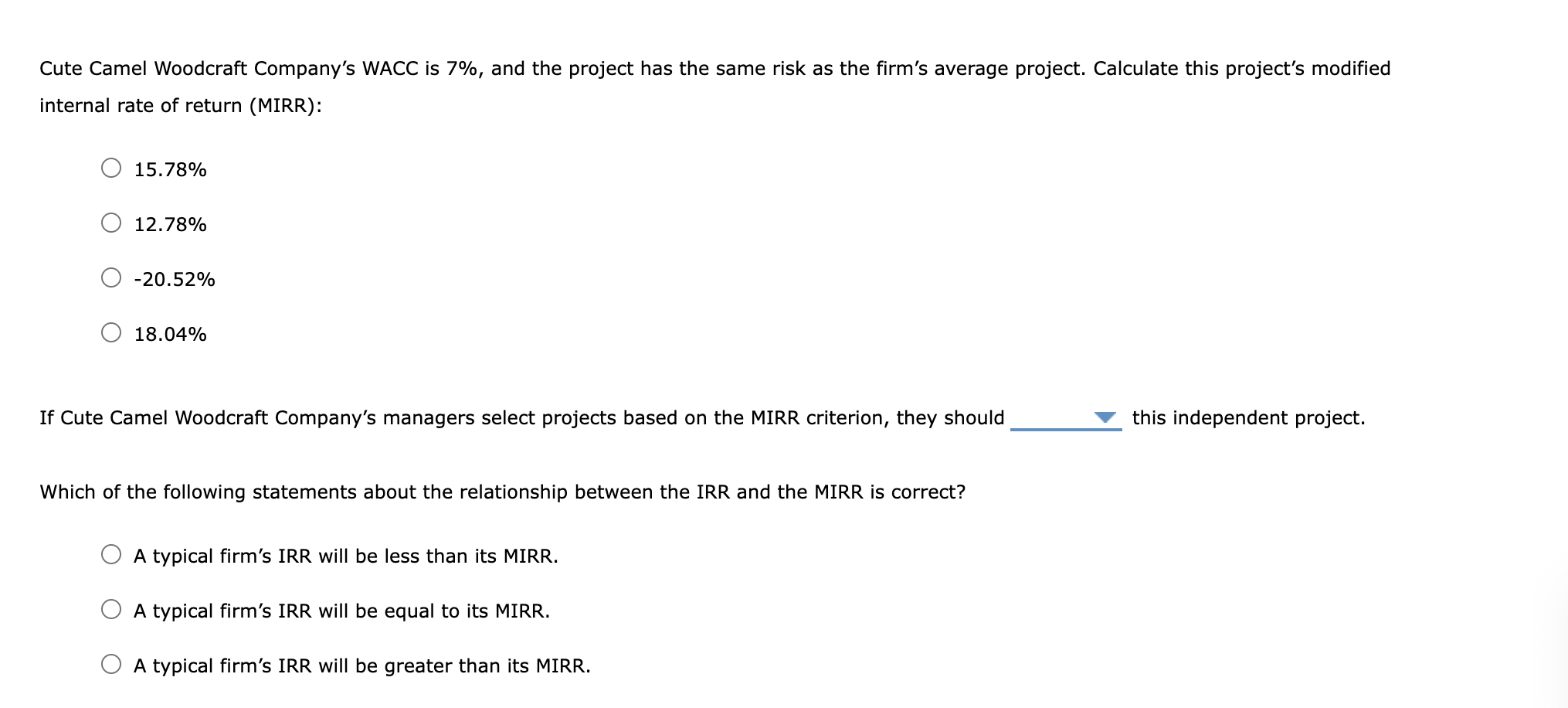

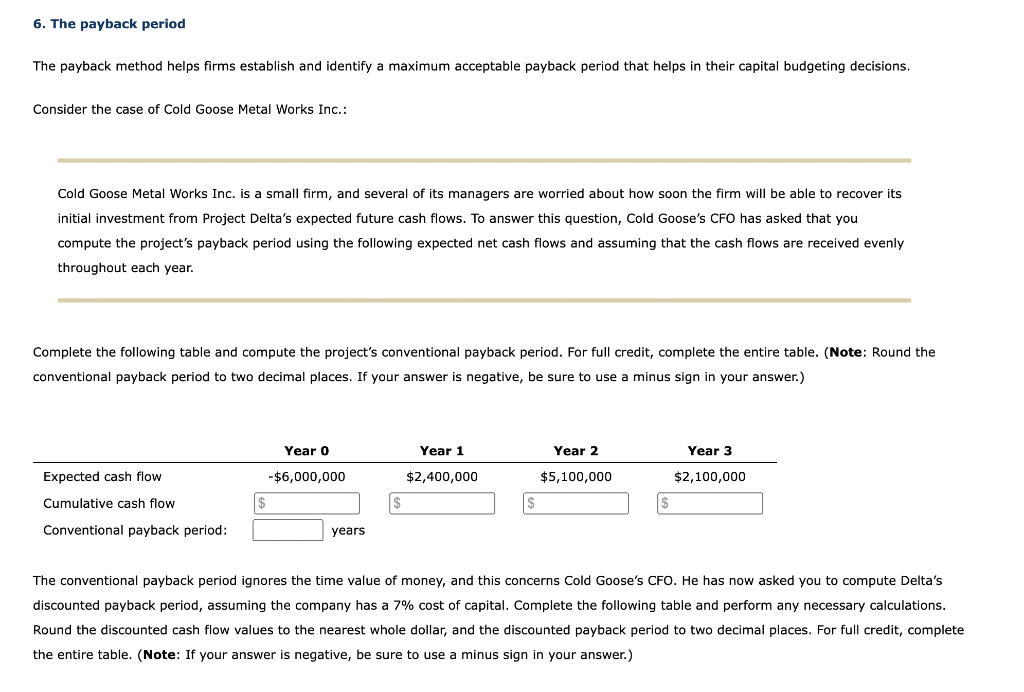

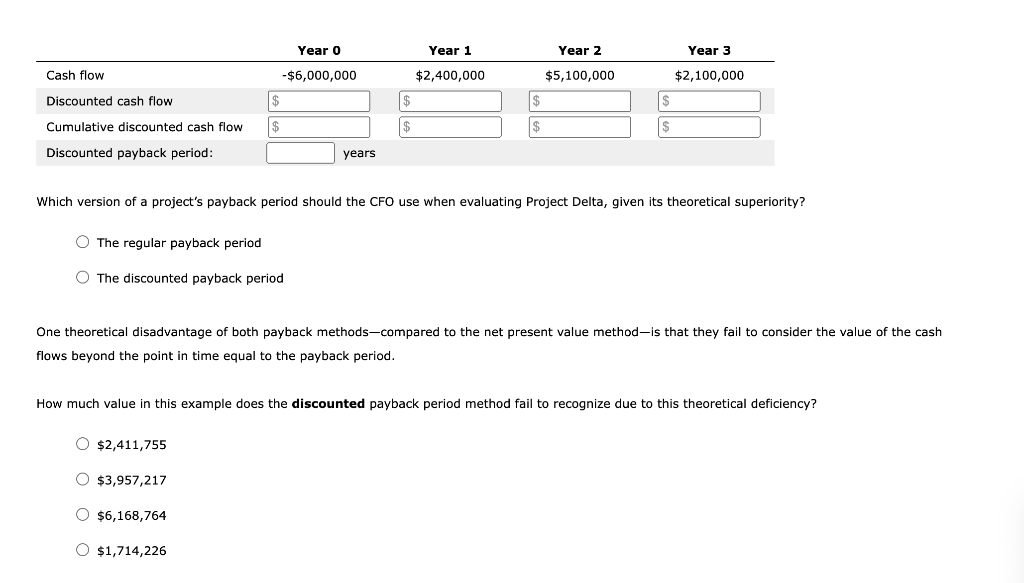

1. Net present value (NPV) Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Happy Dog Soap Company is evaluating a proposed capital budgeting project (project Alpha) that will require an initial investment of $450,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $500,000 Year 3 $475,000 Year 4 $400,000 Happy Dog Soap Company's weighted average cost of capital is 9%, and project Alpha has the same risk as the firm's average project. Based on the cash flows, what is project Alpha's net present value (NPV)? O $1,196,227 O $896,227 O $1,371,227 O $1,396,227 Happy Dog Soap Company's weighted average cost of capital is 9%, and project Alpha has the same risk as the firm's average project. Based on the cash flows, what is project Alpha's net present value (NPV)? $1,196,227 $896,227 O $1,371,227 O $1,396,227 Making the accept or reject decision Happy Dog Soap Company's decision to accept or reject project Alpha is independent of its decisions on other projects. If the firm follows the NPV method, it should project Alpha Which of the following statements best explains what it means when a project has an NPV of $0? When a project has an NPV of $0, the project is earning a rate of return equal to the project's weighted average cost of capital. It's OK to accept a project with an NPV of $0, because the project is earning the required minimum rate of return. O When a project has an NPV of $0, the project is earning a profit of $0. A firm should reject any project with an NPV of $0, because the project is not profitable. When a project has an NPV of $0, the project is earning a rate of return less than the project's weighted average cost of capital. It's OK to accept the project, as long as the project's profit is positive. 2. Internal rate of return (IRR) The internal rate of return (IRR) refers to the compound annual rate of return that a project generates based on its up-front cost and subsequent cash flows. Consider this case: Blue Llama Mining Company is evaluating a proposed capital budgeting project (project Delta) that will require an initial investment of $1,500,000. Blue Llama Mining Company has been basing capital budgeting decisions on a project's NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because percentages and returns are easier to understand and to compare to required returns. Blue Llama Mining Company's WACC is 8%, and project Delta has the same risk as the firm's average project. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $325,000 Year 2 $450,000 Year 3 $400,000 Year 4 $475,000 Which of the following is the correct calculation of project Delta's IRR? 4.11% 3.93% 3.74% 3.18% If this is an independent project, the IRR method states that the firm should If the project's cost of capital were to increase, how would that affect the IRR? The IRR would increase. The IRR would decrease. The IRR would not change. 4. Modified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Cute Camel Woodcraft Company is analyzing a project that requires an initial investment of $3,225,000. The project's expected cash flows are: Year Cash Flow Year 1 $325,000 Year 2 -200,000 Year 3 475,000 Year 4 450,000 Cute Camel Woodcraft Company's WACC is 7%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): O 15.78% O 12.78% 0 -20.52% O 18.04% Cute Camel Woodcraft Company's WACC is 7%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 15.78% 12.78% -20.52% 18.04% If Cute Camel Woodcraft Company's managers select projects based on the MIRR criterion, they should this independent project. Which of the following statements about the relationship between the IRR and the MIRR is correct? A typical firm's IRR will be less than its MIRR. A typical firm's IRR will be equal to its MIRR. A typical firm's IRR will be greater than its MIRR. 6. The payback period The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta's expected future cash flows. To answer this question, Cold Goose's CFO has asked that you compute the project's payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project's conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year o Year 1 Year 2 Year 3 Expected cash flow -$6,000,000 $2,400,000 $5,100,000 $2,100,000 Cumulative cash flow $ Conventional payback period: years The conventional payback period ignores the time value of money, and this concerns Cold Goose's CFO. He has now asked you to compute Delta's discounted payback period, assuming the company has a 7% cost of capital. Complete the following table and perform any necessary calculations. Round the discounted cash flow values to the nearest whole dollar, and the discounted payback period to two decimal places. For full credit, complete the entire table. (Note: If your answer is negative, be sure to use a minus sign in your answer.) Year o Year 1 Year 2 Year 3 Cash flow - $6,000,000 $2,400,000 $5,100,000 $2,100,000 Discounted cash flow $ $ $ Cumulative discounted cash flow $ $ $ Discounted payback period: years Which version of a project's payback period should the CFO use when evaluating Project Delta, given its theoretical superiority? The regular payback period O The discounted payback period One theoretical disadvantage of both payback methods-compared to the net present value method is that they fail to consider the value of the cash flows beyond the point in time equal to the payback period. How much value in this example does the discounted payback period method fail to recognize due to this theoretical deficiency? O $2,411,755 O $3,957,217 O $6,168,764 O $1,714,226